Last Updated:

Welcome to the latest episode of “Where is the General Theory of the 21st Century?”(WITGT21). WITGT21 interview series explores the evolution of macroeconomics academia since the Great Recession. Do we have some revolutionary changes in the macroeconomics after 2008, just like we have had the “Keynesian Revolution” after the Great Recession? Why haven’t economists come up with a new General Theory after the Great Recession? We ask influential economists for their answers on these questions.

We are honored to have Professor Roger Farmer to be the guest of this episode. Prof. Farmer is Professor of Economics at the University of Warwick and Research Director at the National Institute of Economic and Social Research.

His body of work has advanced the view that the beliefs of stock market participants are fundamental determinants of economic activity. He proposes a paradigm shift in macroeconomics and policymaking that could raise employment rates, keep inflation at bay, and stimulate growth. He detailed the proposal in his 2016 book, Prosperity for All. Prof. Farmer also runs a popular blog, Roger Farmer’s Economic Window.

In this interview, Prof. Farmer explains to us the following. Why are multiple equilibria modeling better compared to the standard unique equilibrium model? Why should “belief” be an important component to macroeconomic modeling? Why should central banks consider stock market intervention in stabilizing the employment markets?

Q: EconReporter F: Roger Farmer

(The interview is edited for clarity. All mistakes are ours.)

Q: Do you think that there have been “revolutionary” changes in macroeconomics since the Great Recession?

F: Yes and no. In my own work, I have made some major changes to macroeconomics. I will leave it to others to decide if they are revolutionary. But in my view, most macroeconomists are carrying on with business as usual. And that is discouraging because macroeconomics needs to change.

The dominant paradigm before the Great Recession was New-Keynesian economics. That paradigm is widely perceived to have failed in two key dimensions. It didn’t include a financial sector and it had no role for unemployment. New Keynesian economists have tried to fix the NK model by adding in these features and there have been some notable contributions. But for the most part, attempts to fix the NK model are akin to rearranging the deckchairs on the Titanic.

Economics is not an experimental science. As a consequence, frequently, people pursue avenues of research that are simply wrong or mistaken.

In my view, economics took a wrong path in the 1950s. Back in 1928, there was a book published by Pigou called “Industrial Fluctuations.” It is a very rich verbal theory about the causes of business cycles. According to Pigou, there are six different causes of business cycles. Those include what we would now call productivity shocks, monetary disturbances, sunspot shocks, that is, shocks to business confidence; agricultural disturbances, changes in tastes and news shocks.

Then in 1929, there was the stock market crash, and in 1936, Keynes wrote the General Theory. The General Theory was a revolutionary change in the way we think about the world. It was revolutionary because, instead of thinking of the economic system in a capitalist economy as self-stabilizing, Keynes’s vision was of a dysfunctional world in which high unemployment can persist for a very long time.

A few years ago, I wrote a book called “How the Economy Works”. In it, I described two metaphors. The first was that of Pigou’s book in which the economy is like a rocking horse hit repeatedly and randomly by a kid with a club. The movement of the rocking horse is partly caused by the shocks of the club and partly caused by the internal dynamics of the rocker. We’ve modeled this system for decades using linear stochastic difference equations.

In my book, I provide a different metaphor to capture Keynes’ insight that the economy can get stuck in an equilibrium with high unemployment. I call that metaphor the “windy-boat model”. The economy is not like a rocking horse; it is like a sailboat on the ocean with a broken rudder. When the wind blows the boat, instead of always returning to the same point, the boat can become stranded a long way from a safe harbor.

In the language of equilibrium theory, the rocking horse analogy leads to a model with a unique steady-state equilibrium: the rocking horse always comes to rest at the same point. In the windy-boat model, which is, I think, the essence of the General Theory, the economy can get stuck with high unemployment for an extended period.

In the immediate aftermath of the Great Depression in the 1940s and 1950s, the economic model we were using was based on ideas from the General Theory. Then in 1955, Samuelson wrote the third edition of his introductory textbook, in which he introduced the concept of the neo-classical synthesis.

In Samuelson’s view, a view that has dominated the discipline since 1955, the economy is classical in the long run but Keynesian in the short run. Samuelson defined the short-run as the period over which prices don’t adjust. He defined the long-run as the period over which the economy has had enough time to return to a classical full-employment equilibrium. According to the neo-classical synthesis, the economy is temporarily away from the “social planning optimum”, but only temporarily.

In 1982, with the birth of Real Business Cycle Theory (RBC), economists gave up on Keynesian economics and we returned to the ideas of Pigou. Real Business Cycle theory formalized Pigou’s model of the economy, but instead of the rich verbal theory of Industrial Fluctuations, RBC theorists constructed complicated mathematical models. And because the mathematics was complicated, the models were very simple and, initially, driven by a single productivity shock. In the period from 1982 up through 2008, most macroeconomists were engaged in a research program that was, essentially, adding the shocks back to Pigou’s vision of the rocking horse model.

What happened in 2008 and in the aftermath of the Great Recession has, or should, cause us to rethink the entire enterprise of macroeconomics. In my work, I have formalized the main ideas in Keynes’ General Theory. These ideas are vastly different to those that preceded Keynes and they are very different from the ideas that have guided macroeconomics since the 1980s. Keynes argued that there are multiple steady-state equilibria and that the economy can get stuck in an equilibrium with high persistent involuntary unemployment. In my work, I have formalized that idea.

Q: Why, in your view, did economists, in the 1980s, give up on Keynesian economics?

F: The General Theory was incomplete. It was incomplete because it eliminated the idea of the labor supply curve but didn’t replace it with any convincing alternative.

Keynes argued that the economy is on the labor demand curve, but he threw away the labor supply curve and replaced it with the idea of involuntary unemployment. That was always somewhat unsatisfactory theoretically. Involuntary unemployment is open to a number of criticisms. For example, why don’t firms offer to employ unemployed workers for lower wages when those workers would willingly accept a lower wage if they are involuntarily unemployed? This is a theoretical problem that was left hanging in the General Theory.

Then the other issue in the General Theory is that there was never a theory of what determines the price level. Hicks and Hansen, who interpreted the General Theory, considered it to be a short-term theory in which prices are temporarily fixed. Around the time that Samuelson was writing the third edition of his textbook, a New Zealander, William Phillips, published the article “The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957“. This empirical article demonstrated that there had been a stable relationship between wage inflation and unemployment in nearly a century of UK data. This has been known ever since as the Phillips curve.

Samuelson used the Phillips curve to bring together the short run and the long run. He saw it as a wage adjustment equation which explained how excess demand pressure would cause wages to rise. As wages and prices changed, the economy would return to its long-run steady state. The problem with that explanation is that as soon as Phillips had written the article, the Phillips Curve disappeared. There hasn’t been a stable Phillips Curve in data anywhere in any advanced economy that I know of since the mid-1960s.

So now we have two strikes against Keynes. There was no theoretical explanation of why workers don’t offer to work for less and we have the empirical refutation of the Phillips Curve. Those two failures caused Lucas, Prescott and other RBC theorists to go back to the principles of classical economics expounded by Pigou.

Q: What is your view on the role of the rational expectations approach in macroeconomics?

F: The classical reformulation of macroeconomics developed by Lucas and Prescott required a radical reformulation of expectations. In the Keynesian model of the 1950s, expectations were determined with a separate equation called adaptive expectations. In the Keynesian model beliefs about future prices might be different from the realization of the future prices. Because of that, those models needed another equation to explain how beliefs or expectations were determined.

Lucas, writing in 1972, removed the adaptive expectations equation and he argued that beliefs are not independent; they are endogenous and must be explained within the model. He argued the world is random. As a consequence of randomness, prices aren’t always equal to what people expect them to be and he introduced the idea of rational expectations into macroeconomics. Instead of adding an equation, adaptive expectations, to determine beliefs, Lucas closed his model by arguing that beliefs should be right on average. He argued that people wouldn’t be expected to be fooled in the long run, and that we can model beliefs or expectations as probability distributions that coincide with the distribution of the actual realizations.

That all sounds very sensible, but it only makes sense in models where there is a unique equilibrium. Even in the model that Lucas wrote down in 1972, there were multiple equilibria. For me, the existence of multiple equilibria is not a problem. It is an opportunity.

Q: What is the “Keynesian search model” that you are advocating in your book “Prosperity for All”? How is it different from the mainstream search model that you refer to as classical search theory?

The Keynesian search model is a variant of what I call classical search models. By classical, I mean the work that evolved from Peter Diamond, Dale Mortensen, and Chris Pissarides. In the classical search model, there is a unique equilibrium in the labor market pinned down by the bargaining power of workers relative to firms. In the Keynesian search model, there is a continuum of equilibria and the equilibrium that occurs is selected by aggregate demand, just as in the Keynesian models of the 1950s.

The Keynesian Search Model maintains Keynes’ idea, which I think is important, that beliefs are fundamental. Animal spirits, confidence, and self-fulfilling beliefs can influence outcomes. In every single equilibrium of the Keynesian search model, there is no incentive for either firms or workers to change their behaviors. The reason has nothing to do with sticky prices; it has to do with the fact that there are incomplete factor markets.

The search model has a search technology, separate from the production technology, that moves people from home to jobs. That technology has two inputs; the searching time of workers and the searching time of the recruiting department of a firm. Because there are two inputs, for the market to function well, there must be two prices. One price for the searching time for workers and another for the searching time for recruiters.

You could imagine a recruiting firm which would offer to purchase the right to find an unemployed worker and offer to buy the right to fill the vacancy of the company. This market would operate a little bit like a dating website, where the firm would take the two searching parties, match them and sell the match back to the worker-firm pair.

We do not see the market working in that way, largely because there are moral hazard issues. If I am unemployed and you are paying me to be unemployed, I do not see why I would ever accept a job. As a consequence of the failure of that market, there are equilibria with search externalities that can support equilibria with any level of unemployment.

My Keynesian search model solves the problem of understanding Keynes’s General Theory in a way that is different from the sticky price approach that Samuelson initiated and that continues to be perpetuated by New Keynesian economists today.

Q: Do you think it is right for mainstream macroeconomists to “reject” the idea of involuntary unemployment?

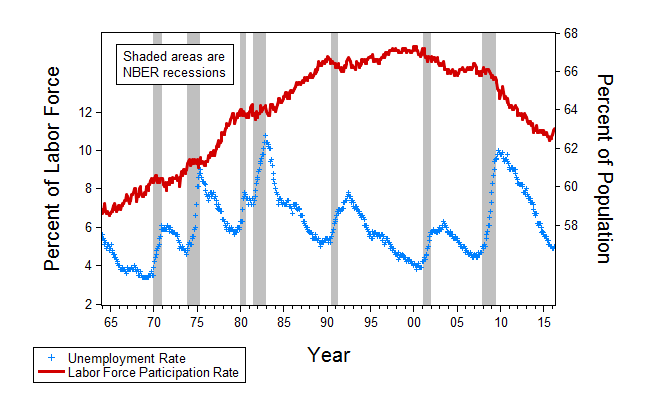

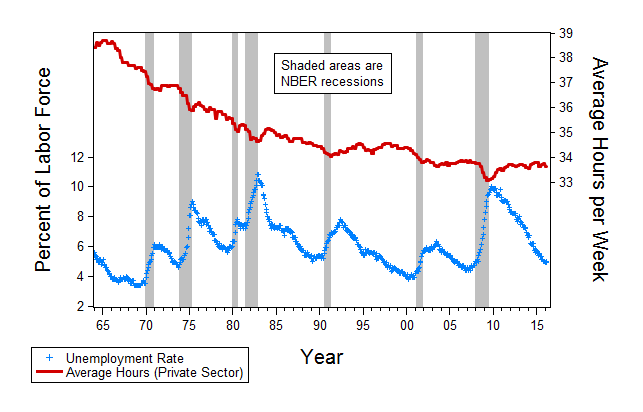

F: I think language is very important. We have been told that the only thing that matters is the number of hours supplied to the market by the representative household. In data, you can break that down into three components. One is the number of hours per week of an employed person; another is the participation rate, i.e., the number of people who are actively working or looking for a job; the third component is the unemployment rate.

During recessions, there is almost no movement in participation. The participation rate is a smooth curve in the US data that can be explained by demographics or female labour force participation, which I would attribute to sociological factors. [See Figure 1].

Hours per week vary a little bit in recessions, but not much. Almost the entire fluctuation of business cycles is caused by variations in the unemployment rate. Is that voluntary or involuntary? I don’t know. I mean, people are looking for jobs and they can’t find jobs and it often takes a long while to find jobs. [See Figure 2].

Calling that involuntary unemployment is nevertheless important because it brings home the notion that unemployment over the business cycle is not the solution to a social planning problem. I prefer the word “involuntary” because it carries that suggestion. I think we made a huge mistake by accepting the Lucas and Prescott version of business cycles. By accepting their view, we came to believe that fluctuations in the unemployment rate are not a big deal. In my view, fluctuations in the unemployment rate are a very big deal.

We were told that the cost of business cycles is minimal compared with growth. While there may be an element of truth to that, the cost is certainly not as trivial as a fraction of a percentage of steady-state consumption, as Lucas tried to persuade us. Movements in the unemployment rate are not minor fluctuations around a social planning optimum. There are often persistent significant movements in the unemployment rate that cause it to differ from the social planning optimum for a very long period of time.

Q: How can we capture the changes in peoples’ beliefs and make predictions accordingly in your model?

F: In my view, we should give beliefs the same methodological status as preferences and endowments.

I am married to a sociologist. When we first met, she said to me, “Are you saying that economists believe that human beings are born into the world at the age of twenty with the ability to distinguish whether or not they would like a glass of wine or a glass of beer with their dinner?” And I said, “Economists don’t quite believe that. They think that preferences are learned, but they are learned slowly. By the time you get to the age of twenty, your preferences are pretty much fixed.”

I think the same is true of beliefs. We have to predict the future and we do it by looking at the past. We use rules of thumb to predict what we think will happen. After a period, we learn to use the same rules of thumb.

To implement the idea that beliefs are fundamental, in my published work I have advocated the use of what I call the belief function. This a mapping from things that we observe today and in the past to probability measures over things that we think will happen in the future.

When you write down a macroeconomic model, you write down the utility functions for each of the people in your model. You write down the production functions of how you produce goods. You should also write down a belief function for each of the future variables that appear in the model. A belief function has parameters that can be estimated in the same way you would estimate the parameters of the utility function. If your model is a good model, you would hope that the parameters of the belief function will remain stable over long periods of time. That is how I propose to model beliefs.

The important point is that although beliefs are fundamental, they can be rational at the same time. The reason for this apparent paradox is the existence of multiplicity that allows the belief function to select which of the many possible rational expectations equilibria is the one that occurs in practice.

Q: If there is no unique natural rate of unemployment, does it also mean that there is no single natural rate of interest?

F: In a representative agent model, if you are at the natural rate of unemployment, you are also at the natural rate of interest. There is a one-to-one correspondence between the two concepts. In my models, there is not. The natural rate of interest and the natural rate of unemployment are quite distinct. There is an interesting set of questions that I think is still open. Is the world closer to a representative agent model, where the real interest rate is a natural constant, determined by the rate of time preference? Or is the real rate of interest influenced by fiscal and monetary policy?

I tend to think that the answer is “Yes” to the second question. I can conceive of a world where there is a unique natural rate of interest, and yet there are many equilibrium unemployment rates. The concepts of the natural rate of interest and the natural rate of unemployment are not necessarily connected to each other.

The interest rate, it is essentially a ratio of the price you are willing to pay for an asset, to the dividend stream that you can get back from that asset. There is a one to one connection between interest rate and price-dividend ratio.

A constant 5% real interest rate could be associated with a very high asset price, a very high level of economic activity and very high dividends. Alternatively, it could be associated with a very low asset price, a very low level of economic activity and very low dividends. Because the interest rate is associated with a ratio, there are many possible unemployment rates and many possible asset values, associated with the same constant rate.

There is another question: “Is the world like that?” The answer to me seems to be “No” because we have seen some fairly big changes in the real rate of interest, at least on treasury bills during the past couple of decades.

Q: Why is incomplete participation in the asset markets important in your model?

F: It’s important because if you want to make a case that there is a role for the government to intervene in the market, it is incumbent on you to explain why private individuals transacting with each other can’t achieve the first best. Why should government intervene in transactions between private individuals? I believe that the reason is related to the observation of Robert Shiller that there is excessive volatility in asset markets.

The reason why asset markets are so volatile is that when we trade in them, we are not just trading with other people who are alive today. We are also trading with people who are not yet born. Because of the persistence in asset price movements, there are people who won’t be born for twenty years who will be affected by significant asset market movements today. If those people could trade in the asset markets that open before they were born, it is those trades that would eliminate the inefficient fluctuations that we see in the asset markets.

In my view, the central challenge for macroeconomic policy is the stabilization of asset prices. Why? Because there is a sense in which asset markets are inefficient. When people talk about efficient markets, they are typically referring to a concept defined by Gene Fama of the University of Chicago. The Chicago School’s definition of “efficient markets”, is not the same as the definition of efficiency used by microeconomists. When Fama talks about efficient markets, he means informational efficiency. Informational efficiency means that it is not possible to make money by trading in the asset market unless you have insider information.

The more usual concept of efficiency in microeconomics is Pareto Efficiency. That is something completely different. Pareto Efficiency means that there is no intervention that government could make that would improve the life or the utilities of people in the economy.

Informational Efficiency is a good characterization of the financial markets. Pareto Efficiency is not. And Pareto efficiency fails because of the inability of people to participate in the markets that open before they are born.

Q: What is the policy anchor/target of the stock market intervention you’ve suggested in your book “Prosperity for All”? When should policymakers intervene in the stock exchange?

F: I advocate that we maintain something like a monetary policy committee with the goal of stabilizing inflation and finance. The MPC would do exactly what it does now, by moving around the money interest rate. Then I would have a second policy, maybe implemented by the same committee or maybe by a different committee, and their goal would be to maintain full employment.

The way they would do that is, first, to define an index fund of a broad variety of assets. The broader, the better. If unemployment went too high, they would announce that they would be willing to buy that fund at a higher price than it is selling in the market. The index fund would appreciate at a relatively rapid rate for a period. If the level of unemployment is judged to be too low, they would do the opposite. They would sell that asset and lower the rate of return.

These policy proposals are feasible because the universe which I am working with is one where there are multiple equilibrium unemployment rates. Friedman convinced us that the only role of monetary policy is to stabilize prices. I disagree. I believe we are paying the price for accepting Friedman’s view right now.

Q: There is an interesting case I would like to mention. The Hong Kong government intervened in the stock market during the Asian Financial Crisis. Is that an example of what you have suggested?

F: Yes, and they’ve made a lot of money out of it. If you take what happened with the intervention in 2008, every single intervention in the asset markets by central banks proved profitable. The Royal Bank of Scotland is an exception and the British Government sold it off at a loss. However, it was sold off for political reasons before the market had the chance to recover.

Q: In your model, does the size of the central bank’s balance sheet still matter?

F: There are three significant changes since 2008. Central banks’ balance sheets got much bigger. The Federal Reserve, or more accurately the Federal Open Market Committee, is now paying interest on excess reserves; they have also changed the risk composition of their balance sheet.

The first two changes are related to each other. Does the size of the balance sheet matter? The answer to that question depends, in part, on whether or not the central bank pays interest on the excess reserves held by private banks as deposits with the central bank. When the central bank pays interest on reserves, as the Fed and the Bank of England now do, bonds and money become perfect substitutes. In that world, a larger central bank balance sheet is not transmitted into higher prices. This is essentially the policy advocated by Friedman in his work on the optimum quantity of money. Because there is a zero social-cost of creating money, Friedman argued it should be created up to the point at which its marginal benefit becomes zero.

The third change in central bank policy is that central bank balance sheets became much riskier. That was a positive change in my view. I have advocated, in my book Prosperity for All, that central banks should maintain large enough balance sheets going forward to be able to credibly intervene in asset markets. By stabilizing asset price movements, central banks can influence the unemployment rate, and to stabilize asset prices, they must be able to alter the risk composition of their balance sheets.

When they started intervening in the MBS market, the stock market began to rise. When they stopped intervening in the MBS market, the stock market slowed down again. A policy of this kind can and should be pursued in the future. There is more than one way to intervene and I am not sure which is the best way. I have advocated intervention in the equity markets, but others, Scott Sumner and Bob Shiller, for example, have advocated instead that we create a market for GDP futures. That market doesn’t exist yet. If it did exist, it would be a good substitute for operating in the stock market.

Q: Do you think that the central banks buying and selling NGDP futures would be a better policy, compared to interventions in the stock market?

F: If you could create a thick enough market for NGDP futures, then yes. There is a lot of skepticism over whether that would be feasible.

The reason for both kinds of interventions is related to the connection between the asset markets and consumption. Traditional Keynesians think, or thought, that consumption depends on income. In the 1950s and the 1960s, with the work of Milton Friedman on the Permanent Income Hypothesis and Franco Modigliani on the Life Cycle Hypothesis, we learned instead that consumption does not depend on income, it depends primarily on wealth.

The asset markets are highly developed in western economies, and those people who would be buying and selling NGDP futures will also be buying and selling stocks. Arbitrage opportunities would cause interventions in one of those markets to spill over to all of them.

When wealth fluctuates and stays up or down persistently, those wealth changes feed into consumption, and consumption feeds into employment. Asset price fluctuations, caused by animal spirits, become self-fulfilling. In my view, intervention in the asset markets operates through wealth effects. I remain eclectic as to the best way to intervene in these markets to stabilize asset price movements.

Q: My last question is, to what extent do you think the DSGE framework is still useful in macroeconomics?

F: DSGE is just a language. The world is clearly dynamic, clearly stochastic and my view of what constitutes a valid equilibrium concept is incredibly broad.

As an example, Hicks talked about fixed price and flexible price markets. In the 1970s, there was a version of general equilibrium theory, called Temporary Equilibrium Theory, in which there is disequilibrium in each period. However, if your definition of an equilibrium concept is broad enough, the disequilibrium that occurs in temporary equilibrium theory is simply a different kind of equilibrium. I would interpret temporary equilibrium models and DSGE models in the same way. The difference is semantic.

My biggest objection to the DSGE agenda is with the obsessive reliance on models with a unique equilibrium where the equilibrium is always at, or close to, the social planning optimum. Equilibrium has a bad name in the eyes of its critics, for example, the Post-Keynesians, because of the focus on models in which equilibrium is identified with optimality.

The notion of an equilibrium is simply a way of imposing discipline on yourself when you are writing down a model. Once we give up the idea that equilibria are optimal, I have no problem calling all models “equilibrium models.”

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡