Tag: US Inflation

September FOMC Meeting: The Potential Dissenters

The Federal Reserve is expected to cut its benchmark interest rate by 25 basis points this week. This has been the baseline market assumption since Chairman Jerome Powell's speech at Jackson Hole, in which he proclaimed, “the shifting balance of risks may warrant adjusting our policy stance."

The question is, how many dissenting votes will Powell face in this meeting?

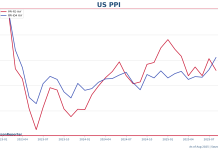

US PPI drops to 2.6% in August— a tale of two service prices

The Producer Price Index for Final Demand (PPI-FD) declined 0.1% MoM in Aug, bring the annual increase down to 2.6% from 3.1% in the previous month.

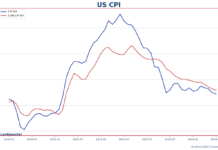

US CPI down to 2.9% in July as disinflation continues

US headline CPI down to 2.9% in July, lowest since March 2021

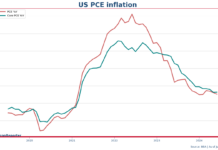

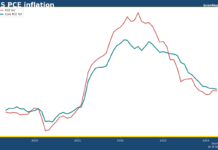

US PCE inflation drops to 2.5% as disinflationary trend continues

Inflation in the US cooled off further to 2.5% over the year to the end of June, according to the latest reading of US Bureau of Economic Analysis's PCE price index.

US PCE price index shows zero monthly inflation in May

US PCE price index showed 0% monthly inflation in May, bolstering market narrative that consumption sentiment has weakened in Q2 and helped easing inflationary pressure in the US economy.

US PCE inflation holds at 2.7% in April as market expected

US PCE inflation held at 2.7% YoY in April 2024 while core inflation maintained its pace at 2.8% for the third months,

US core CPI rises 3.6% as expected

US CPI rose 3.35% in the year to April, as expected by analysts. Meanwhile, core CPI, which strips out prices of food and energy, increased 3.61%, also as market expected.

US Core CPI rises 3.9% in January

Core CPI: 3.86% YoY (Dec: 3.93%) | 0.39% MoM (0.28%)

US CPI inflation rebounds in Dec to 3.4%

Core CPI inflation continues to decelerate to 3.93%

Early signs of inflation expectation de-anchoring back in 2021

Ricardo Reis, economics professor at the London School of Economics, explained that there were telling signs that the increase in cost of living started ealry-2021 was not a "transitory" phenomenon.