Home 2016

Yearly Archives: 2016

What is Hysteresis?

Hysteresis is referred to the hypothesis that recessions may have permanent effects on the level of output relative to trend.

What is New Keynesian DSGE Models?

DSGE is a methodology for a wide range of macroeconomics models. One of the most common formulations is the so-called New Keynesian model. New Keynesian economics can be interpreted as an effort to combine the methodological tools developed by real business cycle theory with some of the central tenets of Keynesian economics tracing back to Keynes’ own General Theory.

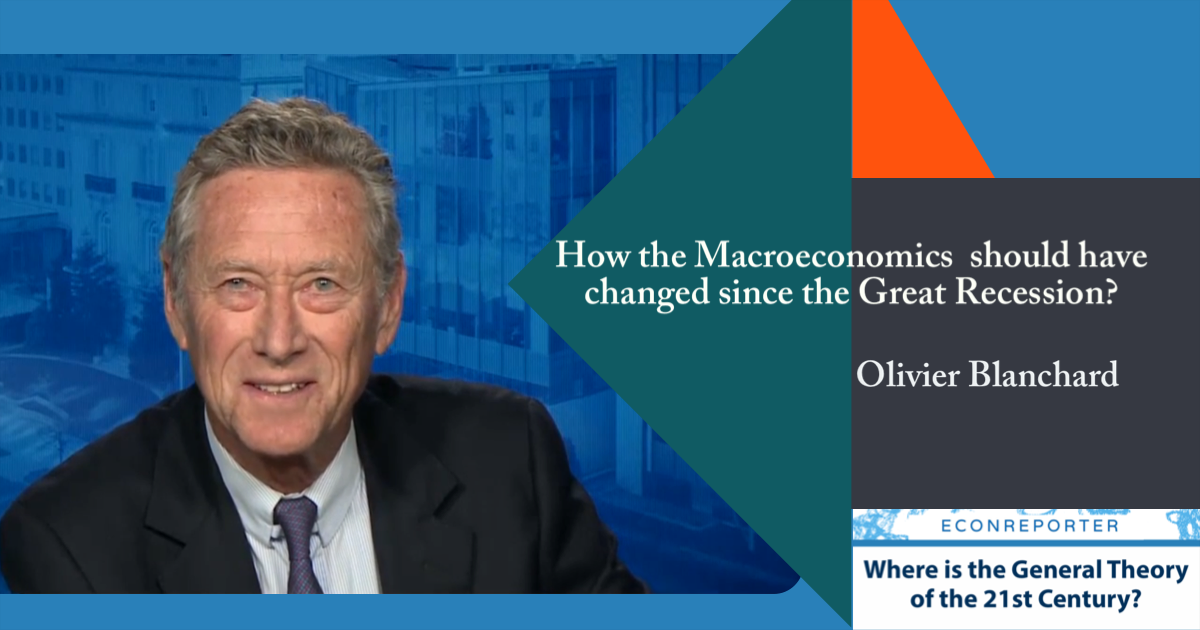

The model you should use to explain Macroeconomics to your Mum | Q&A with Olivier Blanchard

>Professor Olivier Blanchard further explained the role empirical research on DSGE models, how to teach undergraduates macro after the Great Recession, and his research on hysteresis.

DSGE model and the State of Macroeconomics | Q&A with Olivier Blanchard |

In this interview, Blanchard discussed his view on the role of DSGE model in modern Macroeconomics and policymaking. He also explained his decision to rewrite his macroeconomics textbooks after the Great Recession. His recent research on hysteresis was also discussed.

What Macroeconomists agree with each others, according to Blanchard

Olivier Blanchard a list of things that macroeconomists normally agreed on and need no further discussions.

Why Negative Rate is a better policy tool to Higher Inflation Target? Bernanke Explains…

In his latest Brookings blog post "Modifying the Fed’s policy framework: Does a higher inflation target beat negative interest rates?", Ben Bernanke compares two...

Fiscal Theory of Price Level and State of Macroeconomics | Q&A with John Cochrane |

John Cochrane talks about Fiscal Theory of Price Level and how can we apply this theory on the current macroeconomy.

What is FTPL (Fiscal Theory of Price Level)?

The Fiscal Theory of the Price Level says that money has value because the government accepts it for taxes, and inflation is fundamentally a fiscal phenomenon

What is Neo-Fisherian and FTPL? | Q&A with John Cochrane |

Cochrane discusses with us his view on the development in Macroeconomics since the Great Depression. He also explains what Neo-Fisherian and Fiscal Theory of Price Level are, and why they are important for understanding the current economic situation around the world.

Market Monetarism and Macroeconomics | Q&A with Scott Sumner |

This is the second installment of our interview series "Where is the General Theory of the 21st Century?".

In this second installment, we continue...

Latest

Featured

-- Advertisement --