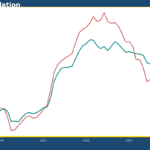

US CPI shows zero inflation in May

US CPI grew 0% in May as the yearly growth rate dropped to 3.27%; core inflation, which stripped out food and energy prices, rose 0.2% and the yearly rate decreased to 3.42%

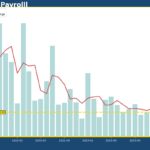

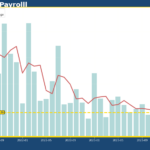

US gains 272,000 jobs in May, blows past expectations

US gained 272,000 nonfarm employment in May blew past market expectations of an 185,000 increase. Meanwhile, unemployment rate rose to 4%, which is the highest level since November 2021.

US PCE inflation holds at 2.7% in April as market expected

US PCE inflation held at 2.7% YoY in April 2024 while core inflation maintained its pace at 2.8% for the third months,

US core CPI rises 3.6% as expected

US CPI rose 3.35% in the year to April, as expected by analysts. Meanwhile, core CPI, which strips out prices of food and energy, increased 3.61%, also as market expected.

US April Jobs Report – Unemployment rate rises back to 3.9% as Nonfarm Payroll...

Nonfarm payroll increased 175,000 in April, a significant reduction from 315,000 in March and fell short of the market expectation of 243,000. Meanwhile, US unemployment rebounded to 3.9%

US labor market cools down further with job openings, hires, quits all drop in...

The March US job opening and labor turnover (JOLT) report shows that job opening rate, hire rate and quit rate all dropped marginally in March, showing further cool down in the US labor market.

UK inflation cools to 3.4% amid service inflation slowdown

Core inflation also slowed to 4.5%, compared to a year earlier.

Canada inflation slows further to 2.8%; rent continues to rise

Canada's CPI rose 2.78% in February, a further slowdown from the 2.86% increase in the January

Canada unemployment rate rises to 5.8% as labor force continues to grow

Statistic Canada on Friday reported that Canada's unemployment rate rose to 5.8%,, reaching the highest since the start of 2022.

Canada inflation drops to 2.9% in January

Canada's headline CPI rose 2.9% in January, hitting Bank of Canada's inflation-control target range of 1% - 3% for the first time since March 2021.