Cloud Y

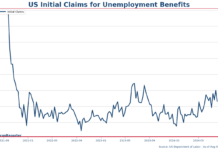

US initial jobless claims falls to 233,000, lower than expected

The number of people filed their initial claim for unemployment insurance benefits in the US fell to 233,000 in the week ending August 3.

Bank of Canada July meeting minutes reveal growing concerns on slowing labor market, consumption

Bank of Canada officials were increasingly concerned about potential risk of consumption slowdown amid growing slack in the labor market and excess supply in the economy when they cut interest rate during July 24 meeting, according to the central bank's summary of deliberations.

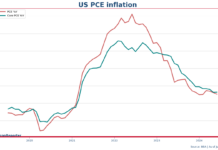

US PCE inflation drops to 2.5% as disinflationary trend continues

Inflation in the US cooled off further to 2.5% over the year to the end of June, according to the latest reading of US Bureau of Economic Analysis's PCE price index.

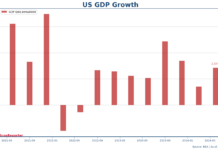

US GDP grows at 2.8% in Q2 as consumer spending remains strong

US GDP grew at a 2.8% annualized rate in Q2, supported by acceleration in consumer spending, increase in nonresidential fixed investment as well as an upturn in private inventory investment

UK retail sales drops 1.2% in June due to poor weather, election uncertainty

Monthly growth rate of UK retail sales volume fell 1.2% in June, after a 2.9% increase in the previous month.

Canada inflation drops back to 2.7% in June

Annual inflation rate in Canada eased back to less than 2.7% in June after a upshot in the previous month, according to Statistics Canada's CPI report.

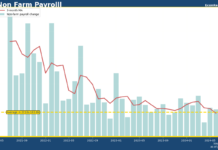

US nonfarm payroll beats expectations in June amid signs of cooling off

US nonfarm payroll increased by 206,000 in June, beating market expectation of 190,000, amid signs that job growth in cooling off as the the Bureau of Labor Statistics revised down the May and April by a combined 111,000 in its report released Friday.

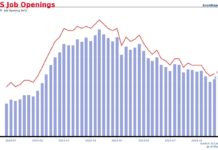

US Job openings increases to 8.1 million in May, JOLT report shows

Job openings increased to 8.14 million in May while the number of hirings in the month was 5.78 million

US PCE price index shows zero monthly inflation in May

US PCE price index showed 0% monthly inflation in May, bolstering market narrative that consumption sentiment has weakened in Q2 and helped easing inflationary pressure in the US economy.

US large banks pass Fed’s stress test with credit card, commercial loans projected to...

The Federal Reserve revealed US large banks passed the 2024 banking system stress test.