After holding the policy rate unchanged in the past three meetings, Bank of Canada on Wednesday resumed its rate cut cycle, lowering its target for the overnight rate by 25 basis points to 2.5%.

Forward Guidance Removed

The Bank of Canada, after the July meeting, added a downward biased interest rate guidance to its statement:

“If a weakening economy puts further downward pressure on inflation and the upward price pressures from the trade disruptions are contained, there may be a need for a reduction in the policy interest rate.”

Now the rate cut has materialized, this forward guidance has been removed.

Governor Tiff Macklem, when asked about this change in wording during the press conference, said “we are not as forward-looking as normal, and we are paying close attention to the risk and uncertainties… if those shift, we are prepared to take action.”

Inflation pressure is ebbing

Meanwhile, BoC determined that the inflationary pressure has been dissipating in recent months.

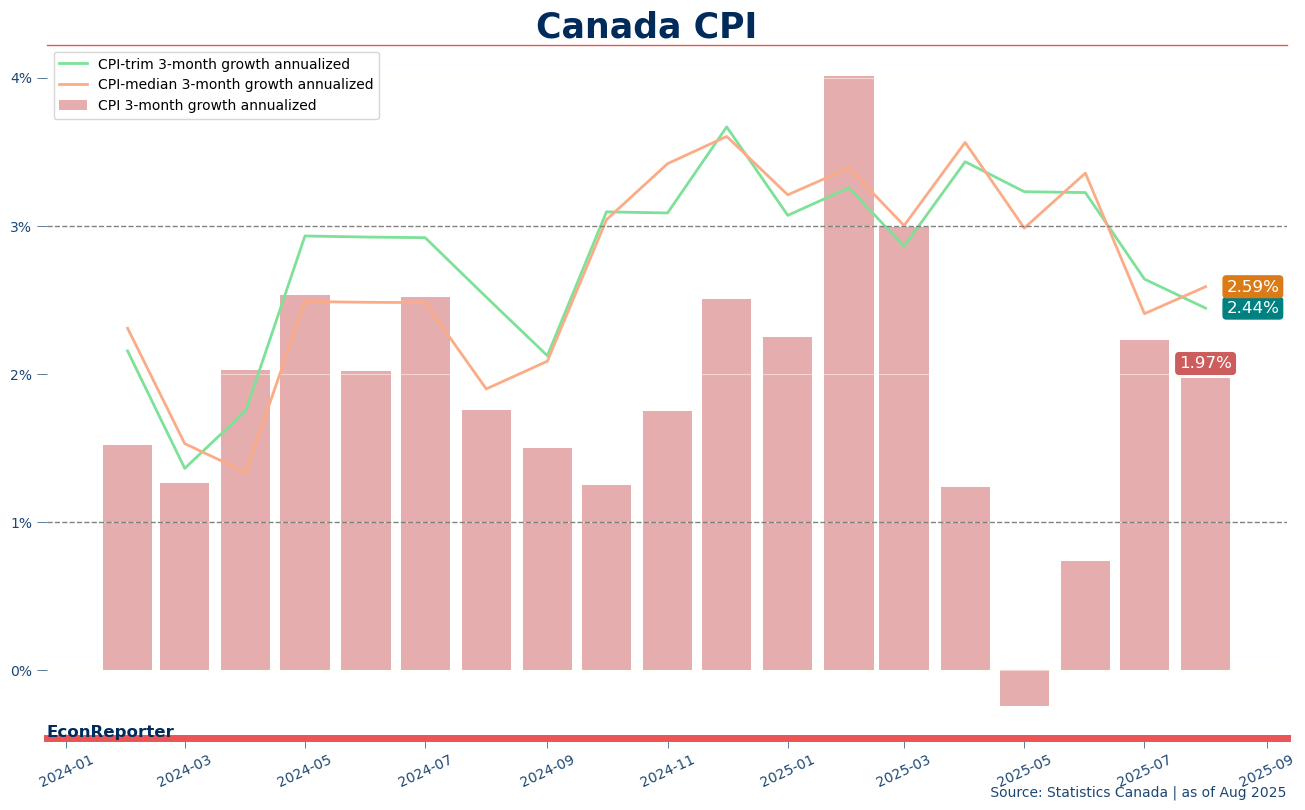

A broader range of indicators, including alternative measures of core inflation and the distribution of price changes across CPI components, continue to suggest underlying inflation is running around 2½%.

One way to observe the easing inflationary pressure is to annualize the 3-month CPI growth rates. As shown in the graph below, the 3-month overall CPI rose around 2% in August while the core inflation measures — CPI-trim and CPI-median— are both around 2.5%, well within the Bank’s inflation target range of 1-3%. “Earlier in the year we saw some upward momentum in the core measures; If you look at the more recent monthly readings on the core measures, that momentum has come off,” said Macklem during the press conference.

The government’s decision to end the counter-tariffs against the US from the start of this month also facilitated the rate cut decision as it would further reduce any worry of inflation.

“For counter-tariffs, the direct effect is a one-off increase in the prices of those goods that will show up as higher inflation temporarily,” Macklem said, ” from our perspective, now that the direct effect of the counter tariff has been removed, that takes away the first-round effect so there won’t be a second-round effect.”

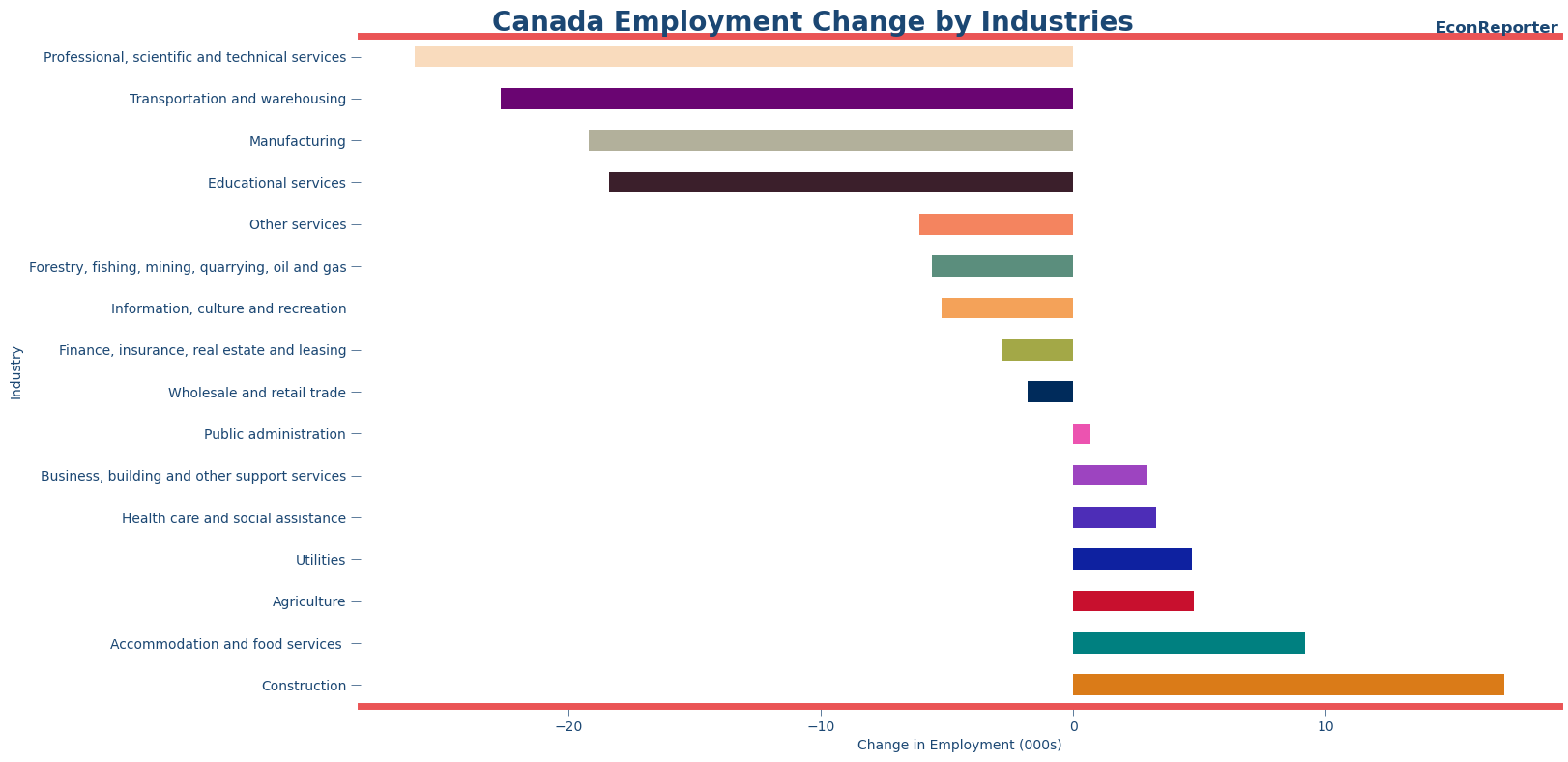

Labor market is weakening, consumer spending to follow soon

The rate cut was obviously prompted by the apparent softening in the labor market, with 66,000 jobs lost in August. As the Bank pointed out, the drop in employment “have largely been concentrated in trade-sensitive sectors, while employment growth in the rest of the economy has slowed,” and monetary loosening is to cushion the economic impact of it.

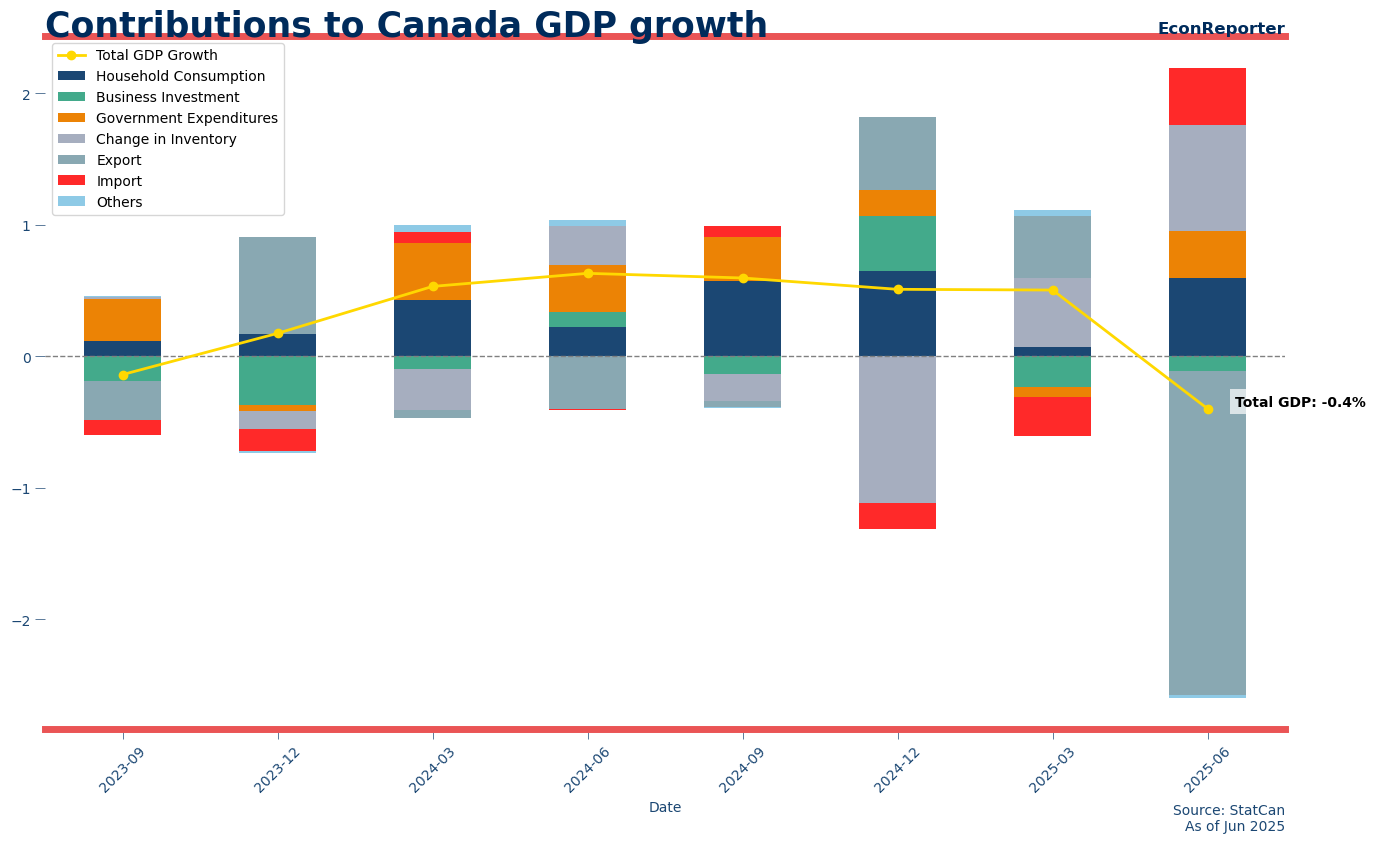

Also, Q2 GDP declined 1.6% as exports to the US dropped substantially and business investment was affected by trade policy uncertainty. Still consumer spending was a bright spot in the economy.

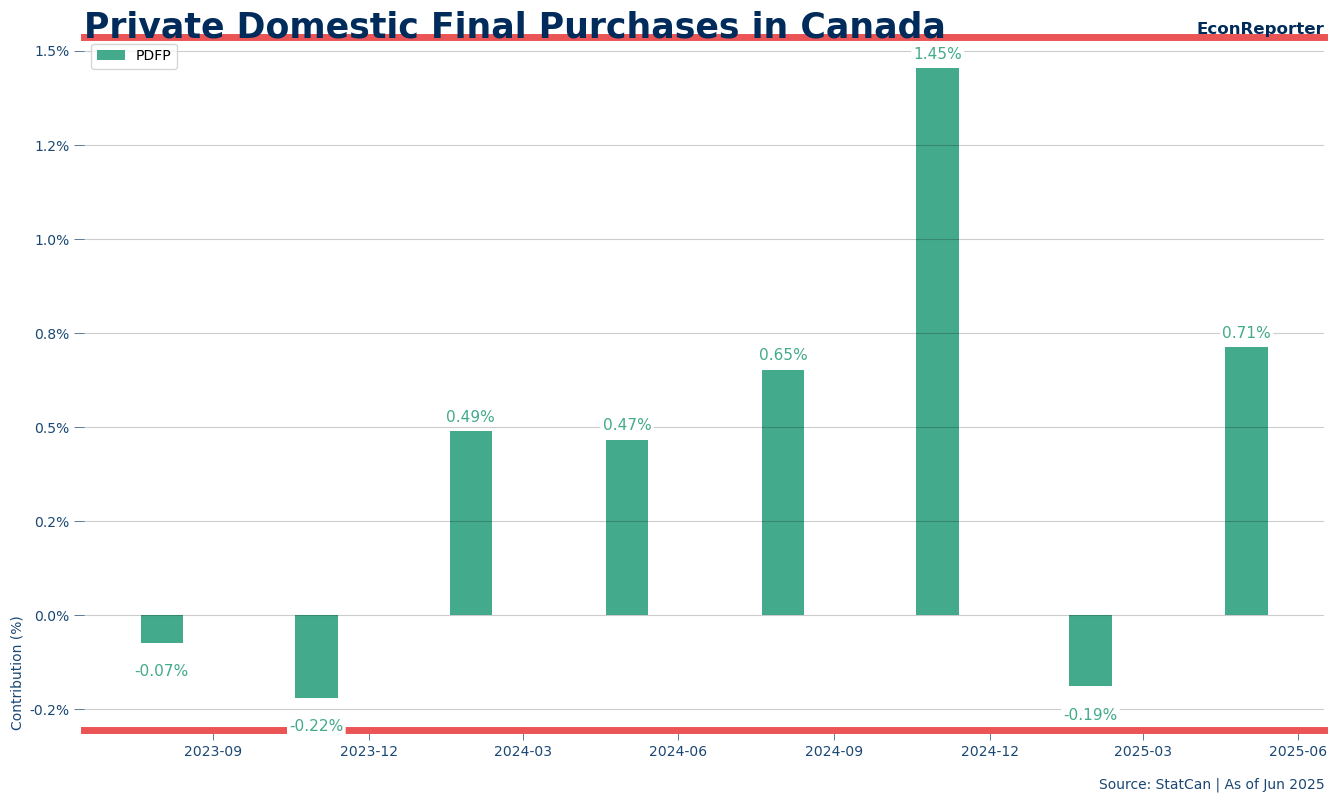

Using the concept of PDFP (private domestic final purchases), a measure of private domestic demand in the economy popularized by the Federal Reserve in recent years, we can see that domestic demand Canada in Canada remained strong in Q2 despite weakening of business investment.

However, the Bank warned that this resilient household spending will likely be dragged down by the slowdown in immigration as well as worsening labor market going forward.

Losing the remaining growth engine would be a huge problem for an economy that is already facing a weakening labor market. All of these make a “risk management cut,” to quote a term used by Federal Reserve chair Jerome Powell today, an appropriate move for the Canadian central bank.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡