Bank of England held its policy interest rate at 5.25% with a 7-2 vote amongst officials at its Monetary Policy Committee. While the central bank’s decision was widely expected, the meeting minutes showed that some of the MPC members who voted to hold rate unchanged thought their decisions were “finely balanced”, signaling their willingness to lower rate in upcoming meetings.

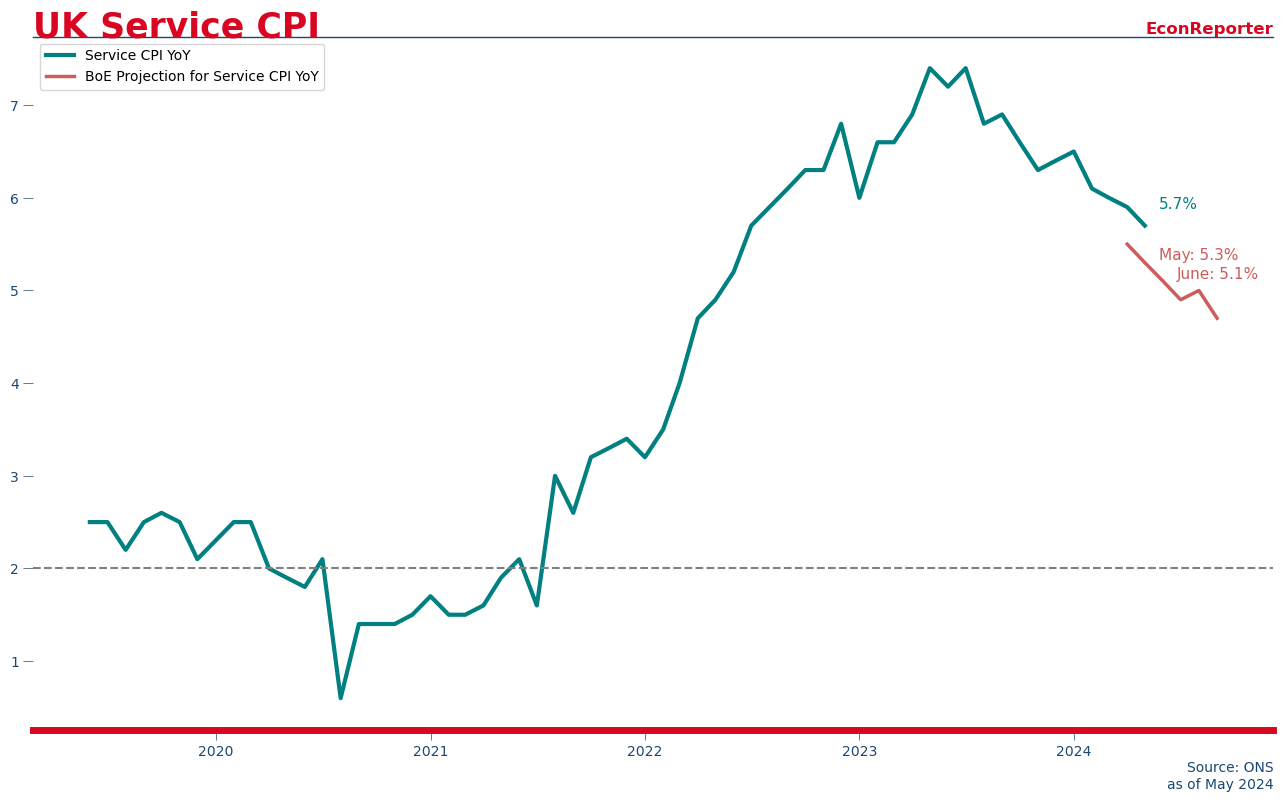

“Some” of those officials decided that the still elevated service price inflation as shown in the May CPI report “did not alter significantly the disinflationary trajectory” that UK is already on. Service CPI rose 5.7% over the year to May, 0.4 percentage point higher than the Bank’s projection in it latest Monetary Policy Report.

The some other MPC members, on the other hand, thought the service inflation signified that the “second-round effects” of increased cost of living may persistently keep UK’s underlying inflation at a higher level. This fraction of officials were seeking “more evidence of diminishing inflation persistence” before they can commit to lowering the base rate.

The Office of National Statistics this week reported that headline inflation in the UK returned to BoE’s 2% in May, while core inflation, which excluded energy and food prices, dropped to 3.5%.

The Bank had previously projected that headline CPI annual growth would drop to 2% in the middle of this year but would jump back up to around 2.4% in July as the favorable base effect from last year’s energy price drop dissipates.

The two dissenting votes, by Swati Dhingra and Dave Ramsden, both preferred to cut the interest rate by a quarter of a percentage point. They think a less restrictive monetary policy is needed to ensure “a smooth and gradual transition in the policy stance, and to account for lags in transmission.” Both Dhingra and Ramsden had voted to cut the rate to 5% in the May meeting

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡