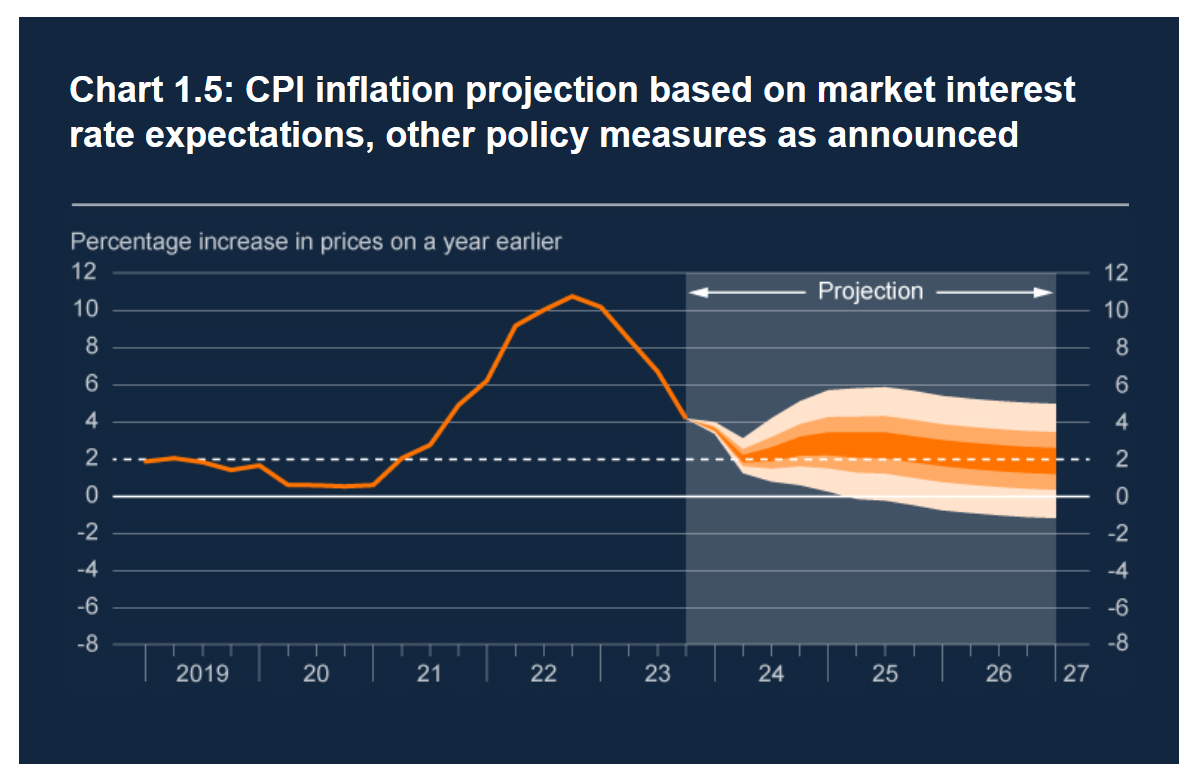

Bank of England Governor Andrew Bailey confirmed during an interview with the Financial Times that the central bank would likely “retire” its fan chart economic projections following the completion of a review, led by former Federal Reserve Chairman Ben Bernanke, on the Bank’s forecasting process.

- Fan charts would probably be replaced by “alternative scenario” projections, which illustrate how policy might react under different economic developments.

- Jonathan Haskel previously said a wider adoption of alternative scenarios could help the public understand how the bank’s modelling worked and what are the reasonable parameters for policy uncertainty.

Problem of fan chart?

Ex-BoE official Michael Saunders earlier this month described, in a Reuters article, that BoE’s internal forecasting process as “sometimes dysfunctional” when MPC members disagree with the bank’s projections.

- “The problem that needs solving is that the Bank publishes a forecast which many MPC members – often the bulk of MPC members – don’t think is a realistic description of what the economy’s likely to do,” said Saunders.

Adopting dot plot?

It’s been speculated that the Bank may consider introducing some form of dot plot into its Monetary Policy Report

- dot plot was first introduced by the Fed in Jan 2012, during Bernanke’s tenure as chair to the US central bank, to anonymously disclose each FOMC member’s fed fund rate projections as well as the individual economic forecasts behind their thinking.

- “I’m certainly in two minds about the dot plot,” said Bailey, as it may pressure MPC members to openly discuss their interest rate expectation.

- “The advantage of the dot plots is it gives the individual members a chance to express a view on where they’re thinking interest rates will go over time,” Saunders said.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡