Last Updated:

George Akerlof, Nobel winner, writes in his new paper “What They Were Thinking Then: The Consequences for Macroeconomics during the Past 60 Years” on the Journal of Economic Perspectives about his view of how macroeconomics has evolved in the past 60 years. He focused on how the Keynesian- neoclassical synthesis dominated the field, and what problems this dominance resulted.

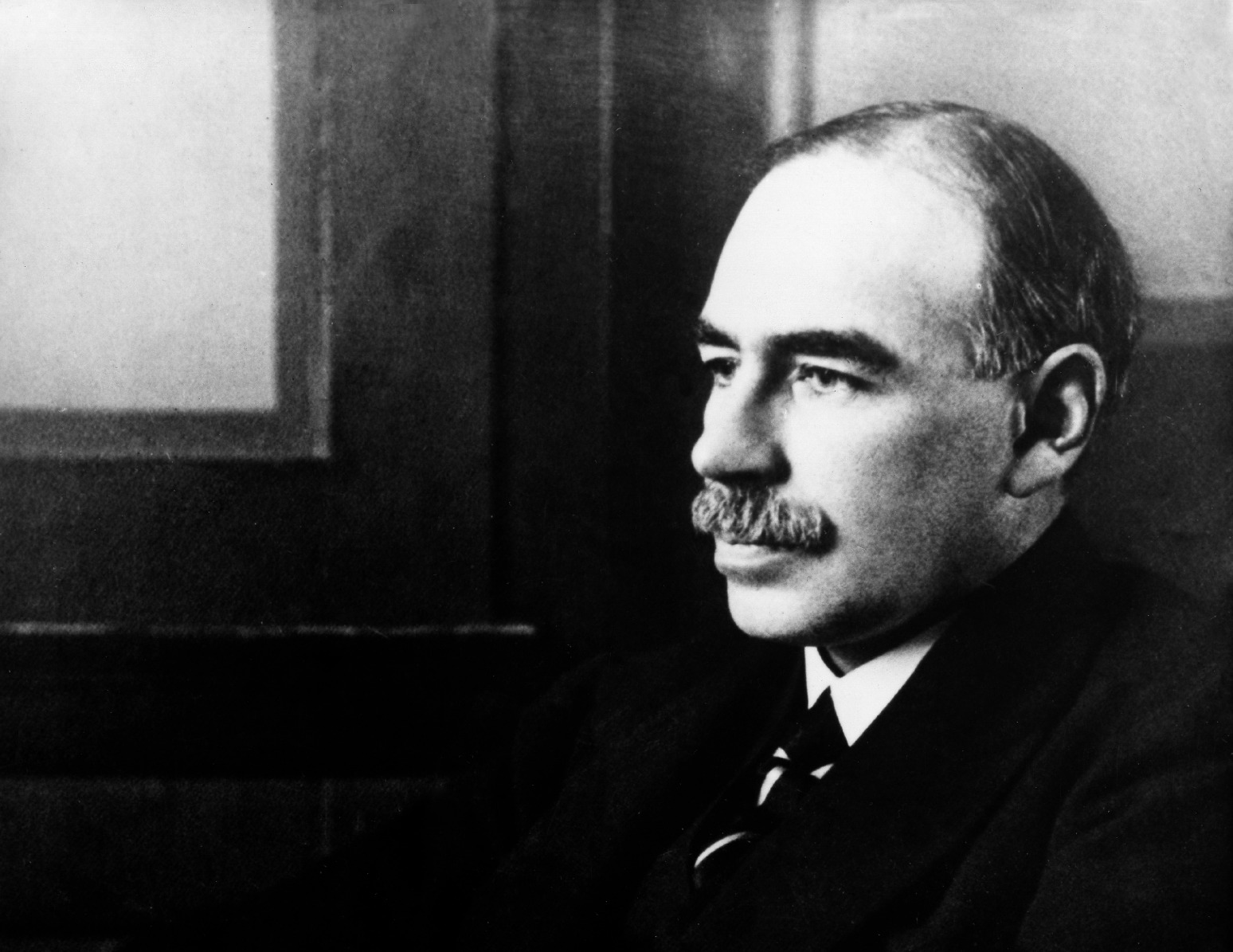

One important point Akerlof makes is that Keynes, in his classic the General Theory, suggested economic downfalls are usually the results of financial fragility, which he explained with his famous beauty contest analogy.

However, these verbal elaborations were excluded from Keynesian-neoclassical synthesis, Akerlof exemplified with John Hick’s paper “Mr. Keynes and the ‘Classics’”, which laid the foundation of Keynesian-neoclassical synthesis:

The first sentence of that article says: “IT WILL BE ADMITTED [capitalization in the original] by the least charitable reader that the entertainment value of Mr. Keynes’ General Theory of Employment is considerably enhanced by its satiric aspect.” Those opening words were not just an odd aside: on the contrary, Hicks’ s major purpose was the rescue of IS-LM from The General Theory ’ s mess-heap of “ satiric entertainment.” That first sentence was thus a dog-whistle warning sign against paying much attention to those ruminations from Keynes on such topics as beauty contests.

Keynes’s beauty contest akin to a game with multiple Nash equilibria, providing a good description of the dynamic underneath the asset markets. Three models Akerlof mentioned,

In a bank run model (like that of Diamond and Dybvig 1983), if only the usual transactors are making withdrawals, there is not much reason to line up at the bank. But if others are lining up out of fears of its insolvency, there is reason to rush to be among those first in line to retrieve one’s deposit. In models of fire sale crashes with collateralized loans (Shleifer and Vishny 1997, 2011), short-term lenders hold collateral from leveraged borrowers. Absent a decline in the value of the collateral, the borrowers do not have a special need to sell it. But once such declines have begun, forced sales can trigger a vicious cycle of further declines in asset values and further forced sales. In models of currency speculation (as in Morris and Shin 1998), he payoff to withdrawal into a foreign currency is negative if other speculators do not make that move. However, the payoff to such withdrawal to a foreign currency is likely quite high if a large number of speculators also withdraw.

Macroeconomics models following the Keynesian-neoclassical, however, were incompatible with these kinds of multiple equilibria models.

But as the preceding description shows, standard models of financial crash differ fundamentally from the standard macro models. Equilibria of those “neoclassical synthesis” models are stable at the point where aggregate demand equals aggregate supply. A small (ε) shift in aggregate demand, or in aggregate supply, produces a small (proportional to ε) shift in the equilibrium…

…These two types of model, then, typically do not fit well together. On the one side, the neoclassical models tend to have unique equilibria. On the other side, multiple equilibria are natural in beauty contest models. Keynes’s example is especially stark, as any one of the “faces”—that is any “point” in the competition—could be an equilibrium. The two types of model thus do not

easily nest each other.👀Advertisement👀

The foundation of macro models, Akerlof explained, is that participants are assumed to perform opposite behaviors: when there is one more supplier, it is more likely for the incumbents to turn and become purchasers, as the price of the products will be lower. But in models of financial crash, an additional seller of an asset is likely to turn other participants into sellers.

It is thus difficult, if not impossible, to produce an aesthetically pleasing model that combines the two types of equilibrium. Such a model would be the equivalent of chicken ice cream.

This was where macroeconomics diverted from Keynes’s The General Theory, and it turned out to have a huge consequence, as Akerlof noted, for example, the discussions about the costs and benefits regarding financial deregulation in the 1990s gave far-from-sufficient weight to the macroeconomic risks of financial crash and, to a certain extent, led to the 2008 financial crisis.

Akerlof, George A. 2019. “What They Were Thinking Then: The Consequences for Macroeconomics during the Past 60 Years.” Journal of Economic Perspectives, 33 (4): 171-86.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡