Last Updated:

In this latest episode of “Where is the General Theory of the 21st Century?”, we talk to Professor Lawrence J. Christiano, chairman of the Department of Economics and Professor of Economics at Northwestern University and one of the leading researchers in Macroeconomics and DSGE models.

Following our discussion on post-2008 Macroeconomics developments and the importance of DSGE models in part I of the interview, we asked Prof. Christiano about one of his recent research paper “Understanding the Great Recession”. What does this model tell us about the Great Recession? Does labor participation rate have a role in the developments of the Great Recession? These are the questions we’ve discussed with Prof. Christiano, and he has some great answers below.

“Where is the General Theory of the 21st Century?” is an interview series that explore the evolution of macroeconomics academia since the Great Recession.

Do we have some revolutionary changes in the macroeconomics after 2008, just like we had had the “Keynesian Revolution” after the Great Recession? Why haven’t economists come up with a new General Theory after the Great Recession? Our in-depth interviews with influential economists will provide answers to these questions.

(The transcript is edited for clarity. All mistakes are ours. Cover Photo Credit: IMF Youtube Channel)

Q: EconReporter C: Larry Christiano

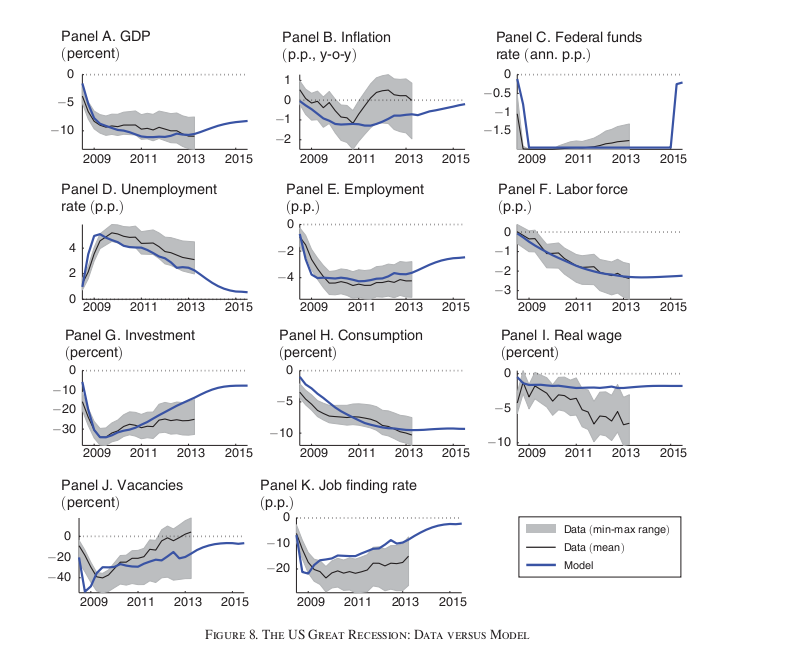

Q: In your recent research “Understanding the Great Recession”, your models show that the fall in labor participation rate is an important factor in explaining the depth of the Recession. In that model, the fall in the participation rate is induced by the financial wedge. What is the financial wedge and why would it lead to lower participation rate?

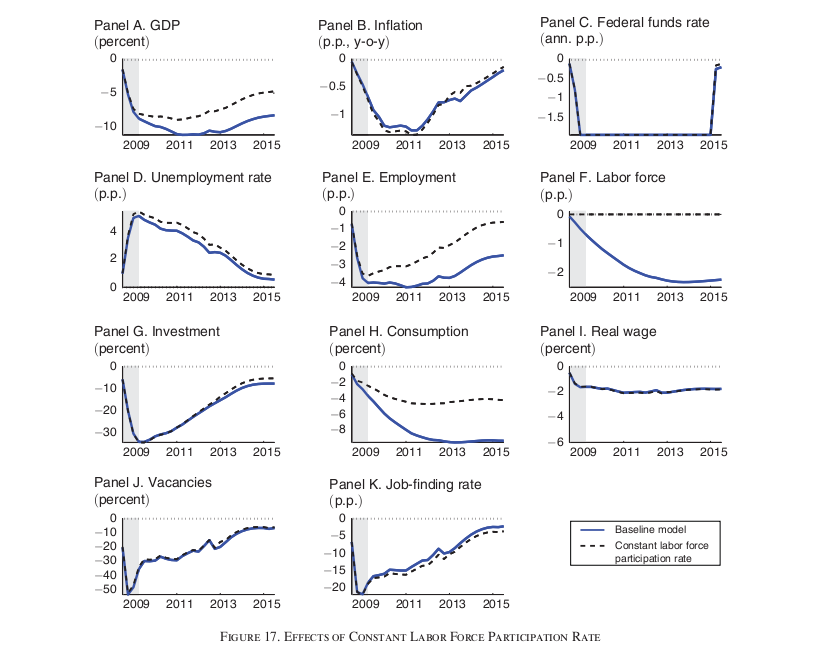

C: First of all, the fall in labor force participation rate in the model is captured by just simply the souring of the labor market. The labor force participation rate in the model represents the decision by the households to send people out to work in the labor market. The labor market looks like a really bad place during the Great Recession and in the model, it looks really bad so people who had a choice chose not to go. That’s the story about the labor force participation rate in the model.

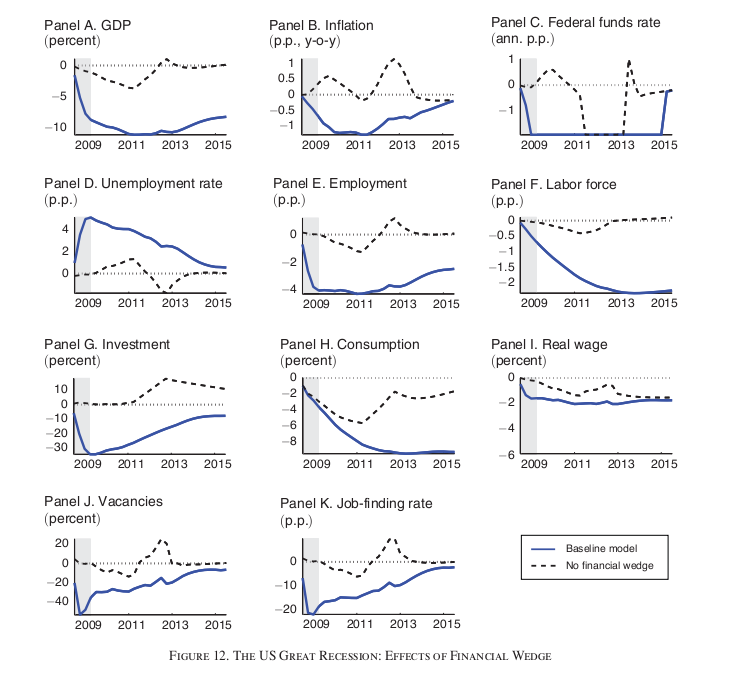

So, there is the thing that called the financial wedge or the intertemporal wedge in the model. The first one operates on the firms’ ability to get funding to finance their ongoing operation. Firms are a lot like households, they have expenditures that they have to make all the time but their receipts don’t come in all the time. University is the classic example. We get receipts four times a year, but we have to spend money every single month, or actually almost every day. As a consequence, in order to do business, businesses have to go in and out of financial markets to smooth this imbalance in receipts and expenditures. That is done through the short-term commercial paper market, largely. They will borrow for four days, for seven days, stuff like that.

That market kind of collapsed during the crisis. In our model, the collapse of that market is increasing the cost of doing business. It also helps to prevent what would otherwise have been a very big drop in inflation. There are other people who explored the data much more carefully and built a much more precise model about that particular phenomenon. They found that firms that have greatest difficulties with financing their operations have higher prices than other firms that have easier access to finance. That’s one kind of financial wedge that play the role preventing inflation from falling as much. It would have fallen more if that hasn’t been present, according to our analysis.

There is also another financial wedge that is sometimes referred as the intertemporal wedge. That has to do with the more classic part of banking. Most of us, when we think about banking, we don’t think about the banks’ daily, weekly, monthly needs to bridge the imbalance between when money comes in and when the money goes out. They call that working capital requirement. The more classic thing is that firms need long-term funding in order to build an investment project and stuff like that.

When something goes wrong with the banking system, one way to model it is that the system acts like a tax. The savers try to put money in the banks and get money back for those investments. But then because of the various problem in the banking system, they don’t get much money back. That look like a tax. That’s why another word for tax in public finance is a wedge.

Anyway, my thinking now has been evolving and I am not sure that would happen. I mean I think what had happened can in principle be captured by that wedge, but the wedge is so “reduced form” that it is hard to interpret.

I think the collapse of the shadow banking system, while in some technical sense can probably be captured by a wedge like that, it is so different that it’s probably best to just model it. Gertler and Kiyotaki are showing us how to do that. Gertler and Kiyotaki are doing the works that need to be done in the basement if you don’t mind continuing that metaphor from before. In the basement, all the equations, all the PhD economists, all the technical nerdy types are all living in the basement. Then you go upstairs and you eventually encounter the Olivier Blanchard, who understand what is going on in the basement by they also understand how to turn things into common sense. They are vital. Without them, the people in the basement would just say crazy things. Then the Blanchards communicate with the higher ups. So, the Gertler and Kiyotaki stuff is really basement work.

So, my own thinking has evolved. What I am trying to figure out a way to make really precise, based on data.

You probably hear of the book, “The Big Short”. The alternative view about the crisis and Sufi and Mian played an important role in describing the view, was that the existing banking system was just rotten. Then in “The Big Short”, there was this one artistic guy who notices that actually these whole things were really bad and he shorted the whole system. That view is very different from the one I was describing. It is very different.

The view I was describing doesn’t focus on the problem in the loans and the leverage restrictions, and all that stuff. No doubt those were problems, but those are problems of all time. I believe that those problems were not enough to crash the system. You needed the collapse in the shadow banking system to crash the system. To really document that, that takes a lot of careful thinking and that is what I am trying to do. But it is very hard because once the system crashes, then all the debts are bad.

If the system crashes, people are going to stop paying their mortgages. They are going to look real bad. They are really bad bet afterwards. You can’t just look and see that lots of people went bankrupt or fail to pay their mortgages and conclude that, therefore, all the mortgages should not have been made in the first place. It could be that the collapse of the banking system because of the shadow banking system was the fundamental cause.

There is a very famous movie in the US called “It’s a Wonderful Life”. In that movie you can kind of see how a bank run can crash a town and all the borrowers in the town, like the one who borrows to renovate the grocery store, that loan may go bad because there was a bank run that causes the economic activity in the town to stop. But then, you wouldn’t have look at that loan and see that they didn’t pay and conclude that that was a bad idea in the first place. The problem was really the vulnerability to bank runs. It was not the loan per se. Wisely, we solve that problem by focusing on the bank runs and providing Federal Deposit Insurance.

We have to be very careful in looking at the crisis, not to infer from the fact that people stop paying their loans, not to infer from that observation to the conclusion that, “Oh, the banking system made bad loans and we have to make sure they cut back their loans severely in the future.” That maybe the wrong thing to do.

Q: Do you agree that macroeconomists haven’t paid enough attentions to the dynamics of the labor market conditions and the participation rate in their models?

C: For me personally, I have invested a lot. I have anEconometrica come out last summer on modeling the labor market [

Unemployment and Business Cycles] . I do think that it is very important. It is very natural for us to think about that. Labor economists have been working for years understanding the labor force. Integrating what they’ve learned into the macroeconomic model is certainly possible.

At the same time, I totally agree with Blanchard that we need lots of models. I think we need models for different kinds of things. We need the high-level models, the three-equation model that sort of summarize the stuff, and we also need the “low-level” models that are very complicated… But then at the “low-level”, we also need models that emphasize different things. For example, in the case of the labor market, in normal time it just seems like the labor force participation rate is really pretty stable and not a big deal. It could be that in normal time, you can say “I am not going to model that.” Since 2008, in 2009 particularly, the labor participation rate suddenly collapsed. At the same time, the recession occurred. Now, there seems to be part of business cycle recession so I think it deserves a lot of focus.

I do believe that there is some complicated judgment you have to make on what it is that you focus on, even in the really complicated models. Models can be infinitely complicated, then you have to somehow draw a line on how complicated it is. Maybe for some purposes, you really want to emphasize on the labor market, for other purposes you might want to avoid it. In the case of the European Central Bank, for example, sometimes you may want to think about a closed economy and not worry about trade with the rest of the world. At other times, you may want to think about that.

I personally think that thinking about the labor market is very important. Part of the reason why we are interested in the business cycle in the first place is precisely that of the variation in unemployment and employment. But it adds a degree of complexity to a model, and maybe for some purposes, it is fine not to think about that. It depends on the question you are asking, it depends on the country you are living in, it depends on the time that you are living in and so on.

Right now, the fall in the labor force participation of people we normally think of as working all the time, like white working-age males between 25-54 years old, that is a puzzling phenomenon. I think we do need to understand that.

Q: Working on this project, I have been thinking what we could add to mainstream macro models. Maybe we should add certain political economy factors in macro models? In recent years, We can see that political conflicts in Washington can, in fact, be a major factor that makes economic policy less effective than we have expected. Do you think we should consider incorporating political economy in the models?

C: It’s interesting that you’ve raised this question. I am chairman of the economics department and one of the things that I think about is: “Are we doing a good job in undergraduate education?” One thing that is bothering me is precisely the question that you are raising. Somehow the political economy has been pulled out of the economics, and there are many things that can’t be understood without bringing in the political economy. For example, US policies on globalization make no sense unless you understand the political economy. The outcome of the election last November, that’s going to have a big economic impact. Obviously, that is political economy.

In the case of undergraduate education, I am trying to figure out how to make courses integrate political economy with normal economics, to think about things like globalization, inequality, energy policy, global warming, etc.

I am saying all of this as a way to tell you that I completely agree with your puzzlement. “Hey, why isn’t political economy part of the picture?” By the way, in the 19 century, it was. Somebody pull the political economy out of the economics. I am not sure why. But I do think that this is an important thing. In growth theory, for example, political economy is very important. Actually, there is a very good paper by Jose-Victor Rios-Rull and Per Krusell on the AER [

On the Size of U.S. Government: Political Economy in the Neoclassical Growth Model] many years ago, they tried to explain why it is that sometimes for long period of time societies are more open to new ideas, and then for a long period of time the same society is less open to new ideas. They have a beautiful political economy model, again a DSGE model, for thinking about that. I do think that we need to integrate those kinds of things.

Although people have written down models which integrate political economy and economics, that is at a much lower level of development than, for example, the integration of financial sector into macro models. But I agree with you, this is a very important thing and it is very strange that it hasn’t been done very much up until now. It’s a mistake.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡

[…] In Part II of the interview, Prof. Christiano explains his recent research “Understanding the Great Recession” and his explanation of the long lasting negative effect of the Great Recession. […]