BoC: Good Economic Rebound, But We will Keep Our Options Open

The Bank of Canada on Wednesday decided to hold policy rate at 2.25% unchanged, as expected by markets. However, what is a notable is the Bank continues to show dovish bias given the recent rebound in economic data.

Dec 2025 Decision:

Decision:Hold

Overnight Rate:2.25%

Key Message:If the outlook changes, we are prepared to respond.

The general message presented in BoC’s rate decision statement, as well as governor Tiff Macklem press conference introductory statement, can be summarized as “yes, but!” as they adopt cautionary reading on all the “good” data observed in Q3.

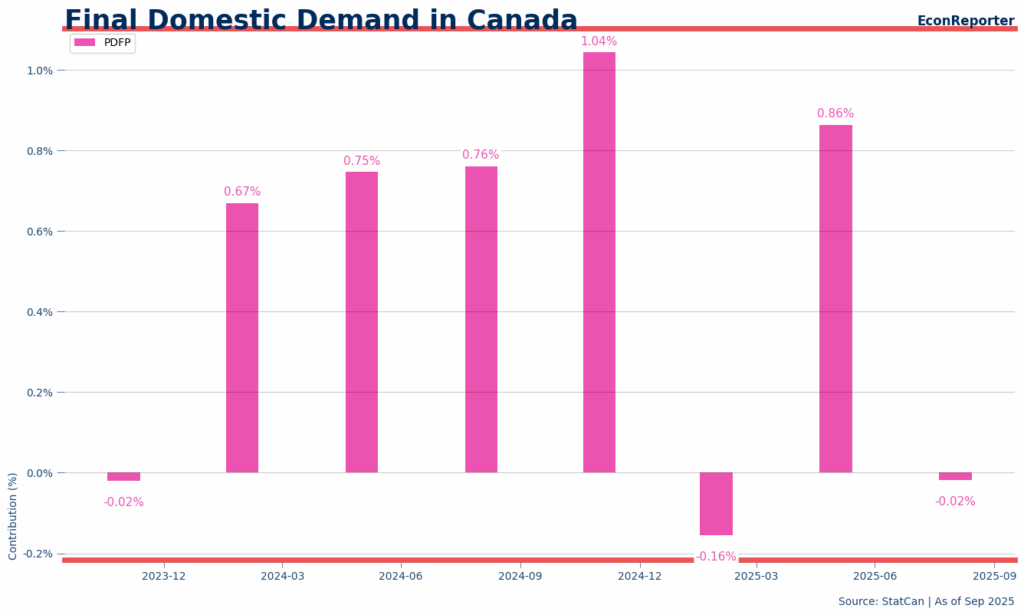

Commenting on the GDP rebound in Q3, the Bank cautions that the reading “largely reflected volatility in trade” and started referring to final domestic demand as an alternative indicator of strength of Canadian economy. Final domestic demand comprises household and government consumption as well as private and government investment and strips out all the external trades. This shows the Bank has reservations on recent rebound.

Final Domestic Demand shows that the Canadian economy was flat in Q3 (or down 0.02%), indicating local demand is rather lackluster. This stands in stark contrast to the 0.6% rise in total GDP, which was boosted mostly by lower imports.

(We have previously noted that Private Domestic Final Purchase (PDFP), a sum of only household consumption and business gross fixed capital formation, shows a similar trend to Final Domestic Demand.)

However, The Bank also predicts that “growth in final domestic demand to resume” in Q4, but will be offset by an “anticipated decline in net exports.”

How about the three consecutive positive job growth since September? “Looking ahead, however, we’re seeing muted hiring intentions across the economy,’ Macklem said in his opening statement.

So, while the BoC thinks that “the current policy rate at about the right level to keep inflation close to 2%,” their messaging is still that they want to keep their options open. They don’t want the framing going forward to be a choice between holding or raising rates, especially against the backdrop that “the upcoming review of the Canada-United States-Mexico Agreement (CUSMA) is creating uncertainty for many businesses.”

“Uncertainty remains elevated. If the outlook changes, we are prepared to respond.” This line on the post-meeting statement should be interpreted as a signal that the BoC is still open to rate cut, if the economy faces further headwinds.

EconReporter is an independent journalism project dedicated to providing top-notch coverage on all things economics.

💡 Follow us on Bluesky and Substack for our latest updates.💡