On Sept 18, the Federal Reserve decided to cut rate by an supersized 0.5 percentage point. The decision finally ended the weeks-long market debate of whether the central bank would cut 25 or 50 basis points.

During Wednesday’s press conference, Powell mentioned he doesn’t think the Fed is behind the curve in stimulating the economy to prevent it from sliding into recession. “I don’t see anything in the economy right now that suggests the likelihood of a downturn is elevated,” he said. The half point cut also got “broad support” among members of its monetary policy making committee, the

FOMC, Powell added.

One important thing, though, didn’t reach the headline: The Fed has never been this “confused” about where the natural rate is currently at.

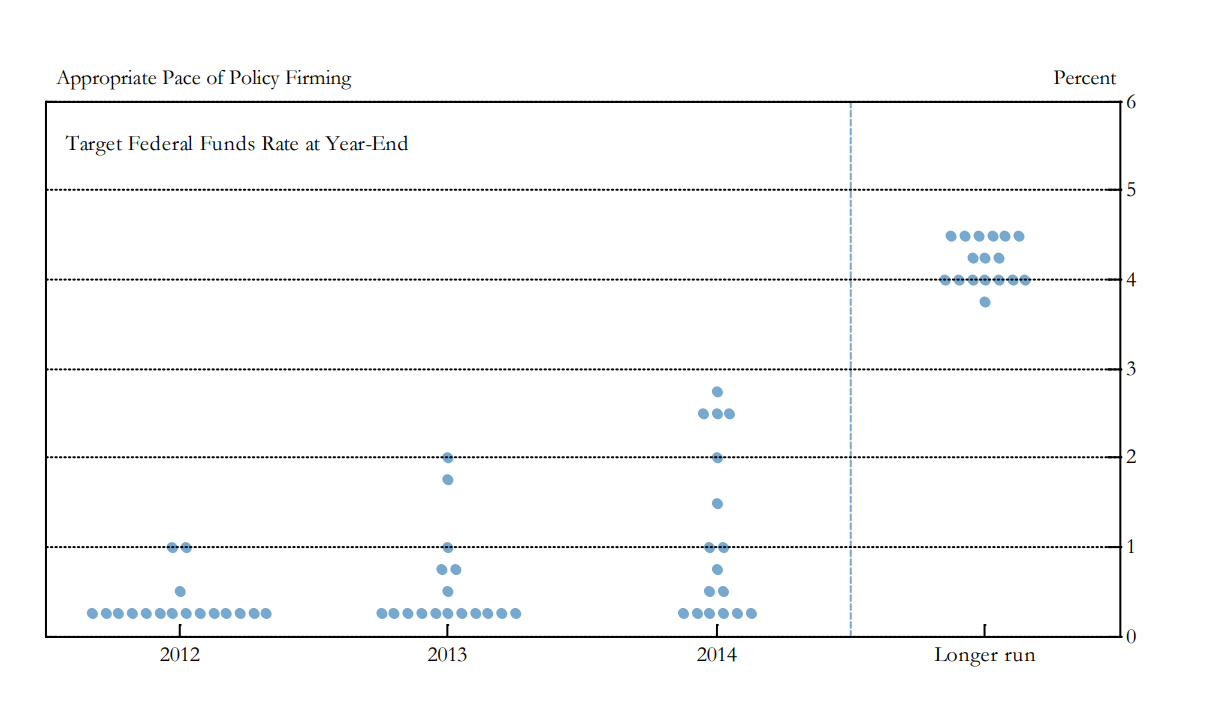

Longer-run dot plot has never been so ‘slim’ before

If we look at the dot plot and focus on the “longer run” projections for appropriate interest rate target, we would see a very “slim” shape. After checking all 51 Summary of Economic Projections the Fed released since the dot plot was first introduced in Jan 2012, I can confirm that the “longer run” rate projections plot has never been this “slim”.

According to the Fed’s official explanation, “longer-run projections represent each participant’s assessment of the rate to which each variable would be expected to converge under appropriate monetary policy and in the absence of further shocks to the economy.” Hence, analysts generally treat these as Fed officials’ individual thinking of where the theoretical neutral rate rest on.

Then what do I mean “slim” here? Generally, FOMC members’ minds think alike. Their neutral interest rate projections quite commonly cluster on one to three interest rate level.

For example, look at the first ever dot plot above. Seven participants picked 4% as their preferred neutral rate and six chose 4.5%. This is the normal pattern in a dot plot, the longer-run rate projections usually cluster at certain levels. It has always been the case that at least one neutral nominal rate level was picked by no less than five Fed officials.

As you can see from the current dot plot above, though, this track record has been broken. We have three members who chose 2.5% and another three who chose 2.75%. And these are already the largest clusters.

A “slim” dot plot also means the dispersion of participants’ projections is now wider than usual. The range of neutral rate projections currently spans from 2.375% to 3.75%, a 1.5 percentage point spread. While this is not unprecedented, as it also happened in the June SEP, it’s a bit wider than the about 1 percentage point we usually see in the earlier period.

So how ‘restrictive’ is the monetary policy now?

Powell in the press conference had repeatedly signaled that the half-point rate cut is not aimed to combat a potential recession, as the US economy is still “solid”, but to reduce the restrictiveness of monetary policy such that “strength in the labor market can be maintained.”

When the talk about restrictiveness, it’s about the distance between the current interest rate and the theoretical neutral rate. The closer the two rates get, the less restrictive monetary policy is. Now, though, the FOMC hosts an never seen before diverse view on whether the neutral rate currently is, then comes the question of how will they decide the pace and the size of future cuts?

This is especially true after the Fed decided to front-load the easing cycle with a 50 bps cut. As we move closer to the FOMC members’ projection range (as stated above 2.375% to 3.75%), it’s foreseeable that more disagreement on the easing strategy will emerge, making the path of future interest rate path a bit more uncertain.

Commenting on the neutral rate level, Powell said, during the press conference: “My own sense is that we’re not going back to [the negative levels]… the neutral rate is probably significantly higher than it was back then.”

“Significantly higher than the pre pandemic era” is probably the only consensus the FOMC can reach on the neutral rate front right now.

EconReporter is an independent journalism project dedicated to providing top-notch coverage on all things economics.

💡 Follow us on Bluesky and Substack for our latest updates.💡