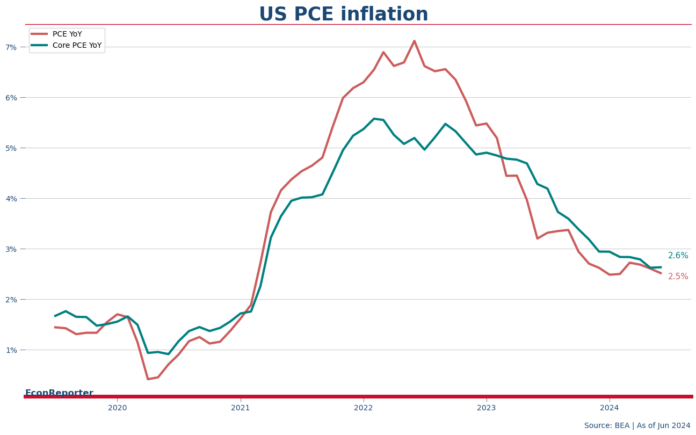

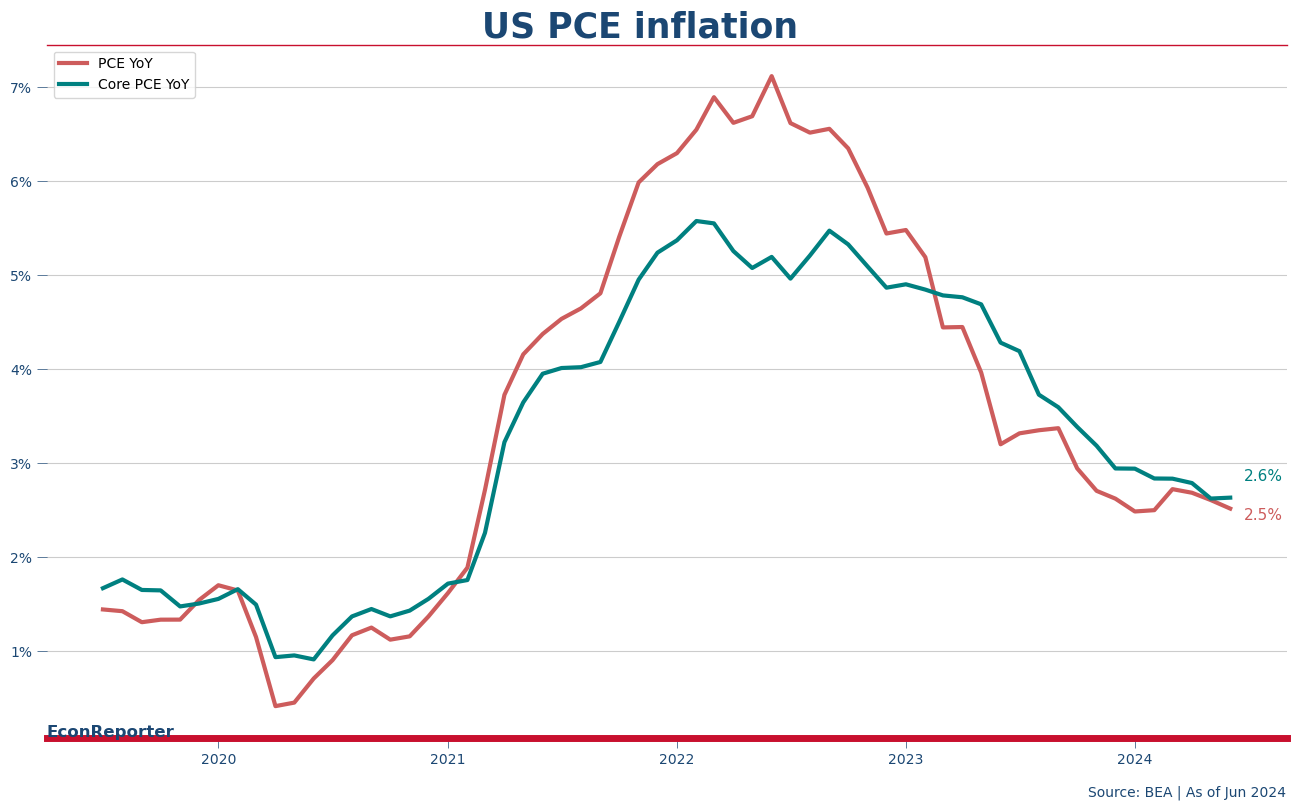

Inflation in the US cooled off further to 2.5% over the year to the end of June, according to the latest reading of US Bureau of Economic Analysis’s PCE price index. Stripping out energy and food prices, core inflation remained at 2.6%, same as in May. Both headline and core inflation year-over-year readings were in line with market expectations.

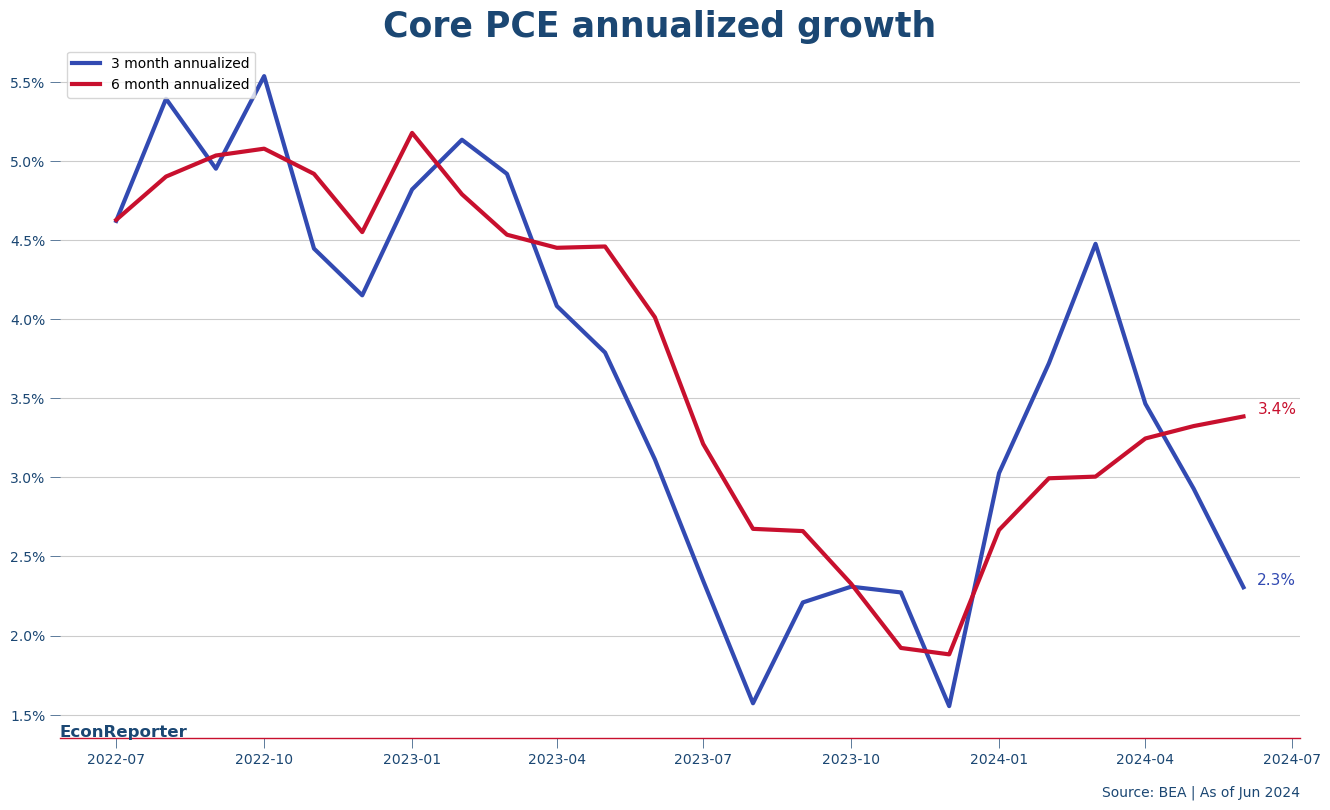

Core PCE inflation, Federal Reserve’s preferred inflation gauge, showed encouraging signs of disinflation through out Q2. Annualized three-month core PCE inflation fell to 2.3% for Q2, down from 4.48% at at the end of March, though not as low as 1.55% achieved at the end of Q4 last year.

Market still firmly believed that the first rate cute in this interest rate cycle will happen at the Sept 18 meeting, as indicated by Fed Funds futures pricing right after the figures was released. Analysts expect Fed Chair Jerome Powell to use next week’s meeting to signal the central bank’s openness to kick off the easing cycle.

Independent Economics Journalism

Stay ahead of the curve — follow EconReporter for in-depth coverage on economics & markets.