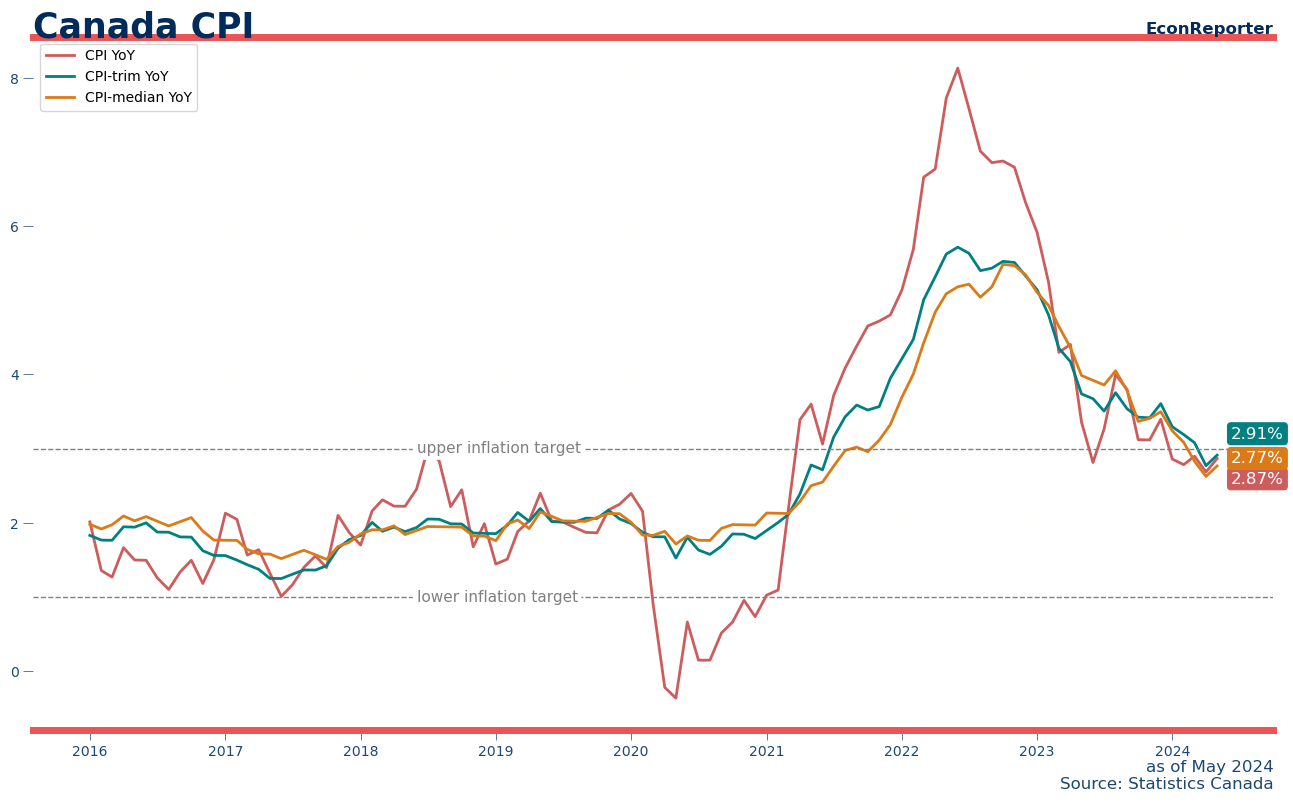

Inflation in Canada rebounded to a 2.9% year-over-year increase in May, after the StatCan reported the slowest consumer price increase in more than two years in the previous month.

The re-acceleration came as the CPI rose 0.31% over the month after seasonal adjustment, the fastest monthly growth rate since December.

Bank of Canada’s two inflation targeting benchmarks, CPI-trim and CPI-median, still fell within the central bank’s acceptable range of 1%-3% despite the upswing.

StatCan cited higher prices for certain services, including travel tours, rent and air transportation, as drivers for higher headline CPI inflation. Prices for travel services rose almost 12% in May, leading to the year-over-year growth rate to 4.4%, up from zero change in April. Demand for travel tours, along with air transportation, are driven by increased trips to the US, the national statistical office added.

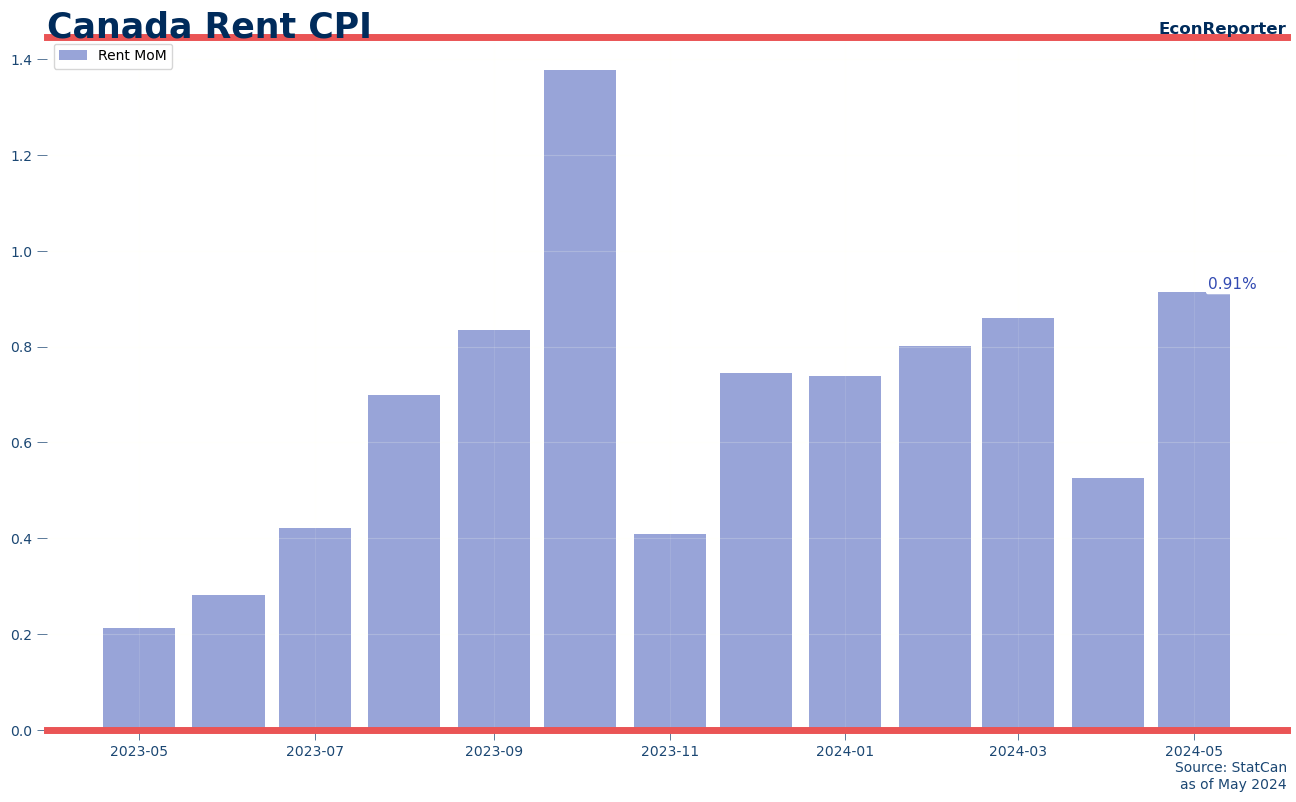

Meanwhile, as monthly increase in rent jumped to 0.9%, rent inflation sped up to close to 9% for the year ending May, up from 8.2%.

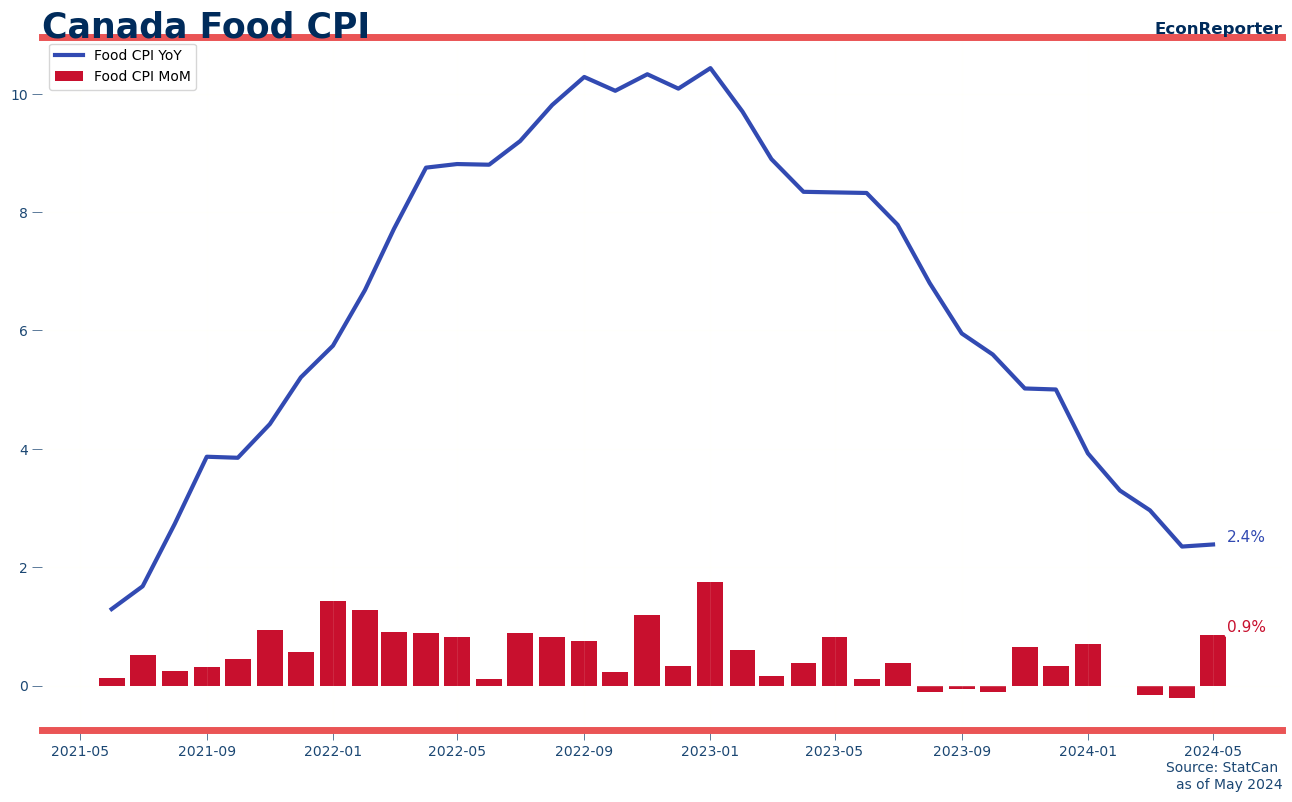

Food prices also saw a notable increase last month with a 0.9% MoM rise, highest since Jan 2023.

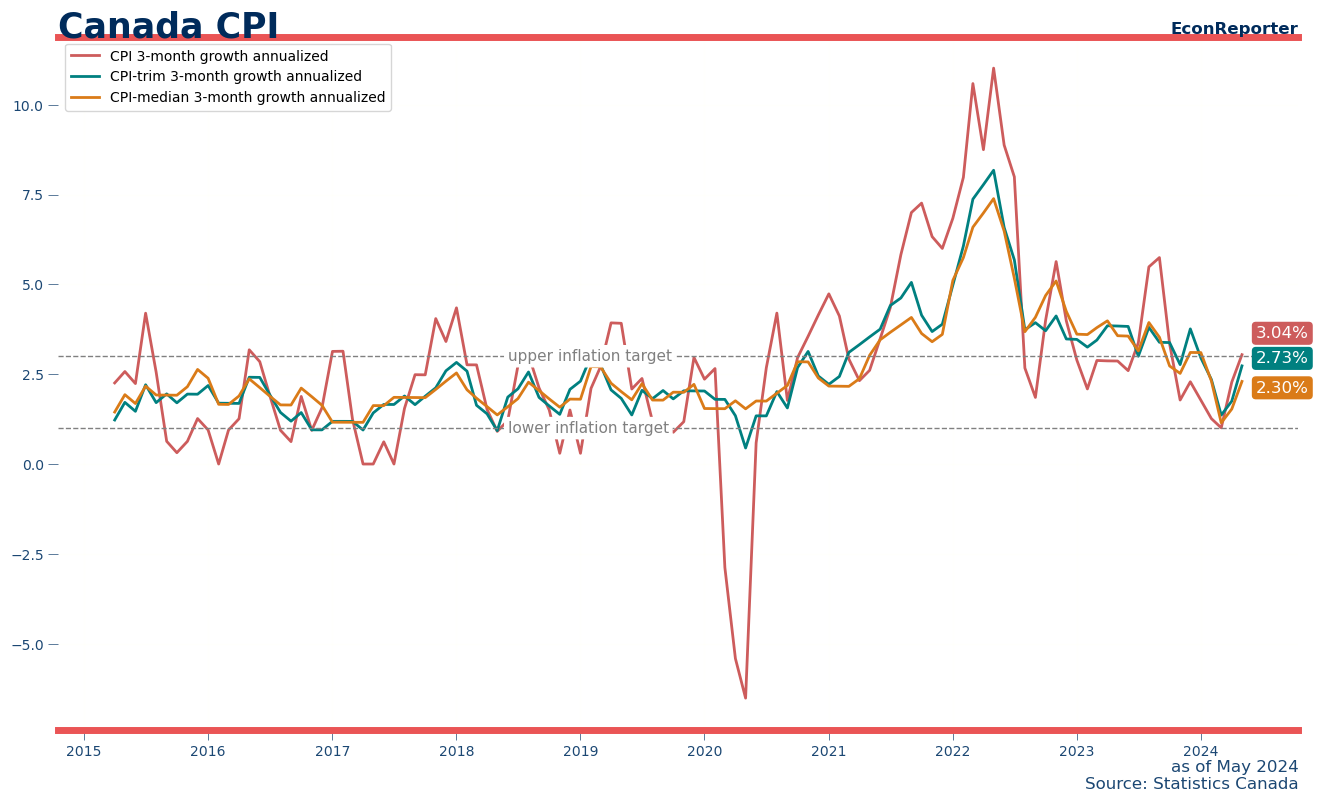

Bank of Canada earlier this month cut its policy interest rate by a quarter percentage points to 4.75%, partially on the basis that the 3-month annualized rates of core inflation slowed to under 2% in March and April. The 3-month rates, however, jumped back to 2.7% for CPI-trim and 2.3% for CPI-median following the release of latest CPI figures.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡