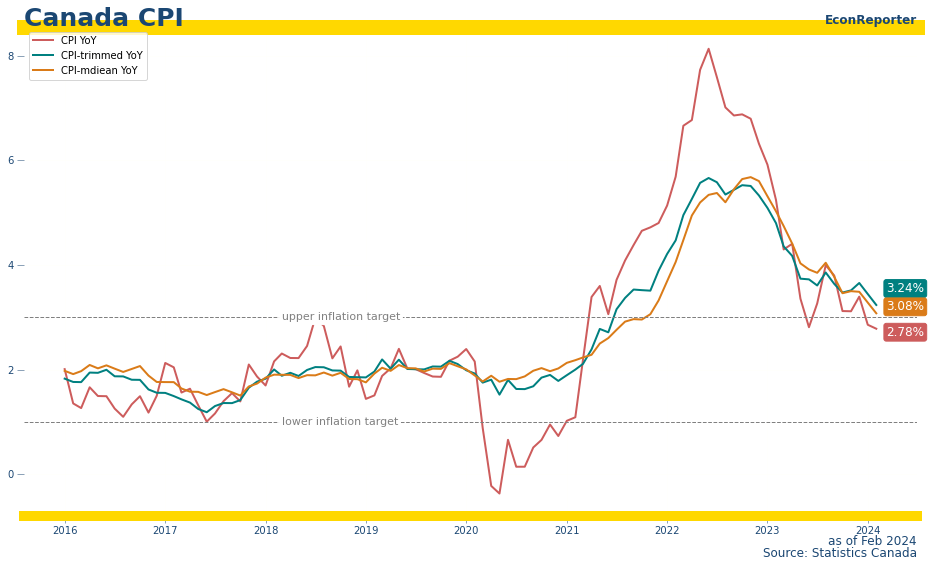

Canada’s CPI rose 2.78% in February, a further slowdown from the 2.86% increase in the previous month.

- Monthly growth rate of CPI was 0.32%, up from zero inflation in January.

The two core inflation Bank of Canada adopted declined further, edging closer to the 3% upper limit of the central bank’s inflation target range, which centers around 2%

- CPI-trim dropped to 3.24%

- CPI-median to 3.08%

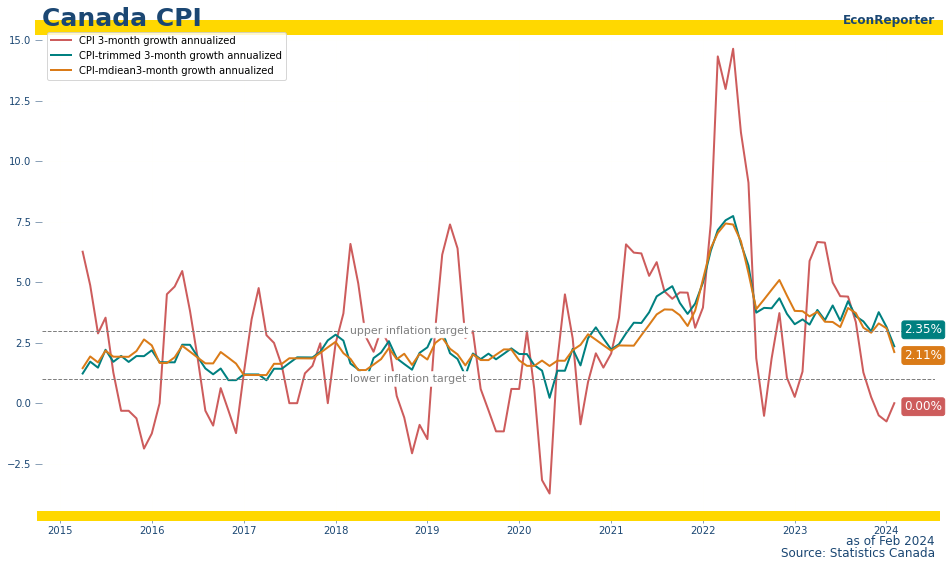

Three-month inflation: 0%

The inflation picture is even more encouraging if we look at three-month annualized rate

- for the last three months, headline inflation was zero.

- CPI-trim increased 2.35% YoY

- CPI-median was even lower, at 2.11%

Both core inflation gauges are close to 2% target in the three months to February.

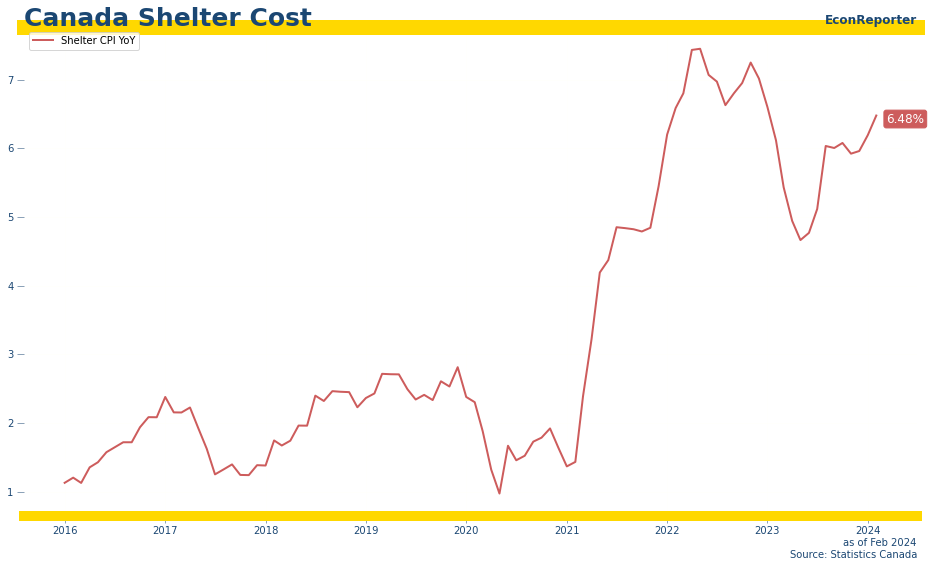

Shelter prices rises 6.5%

Still, shelter cost growth continues march high, reaching 6.48% in February.

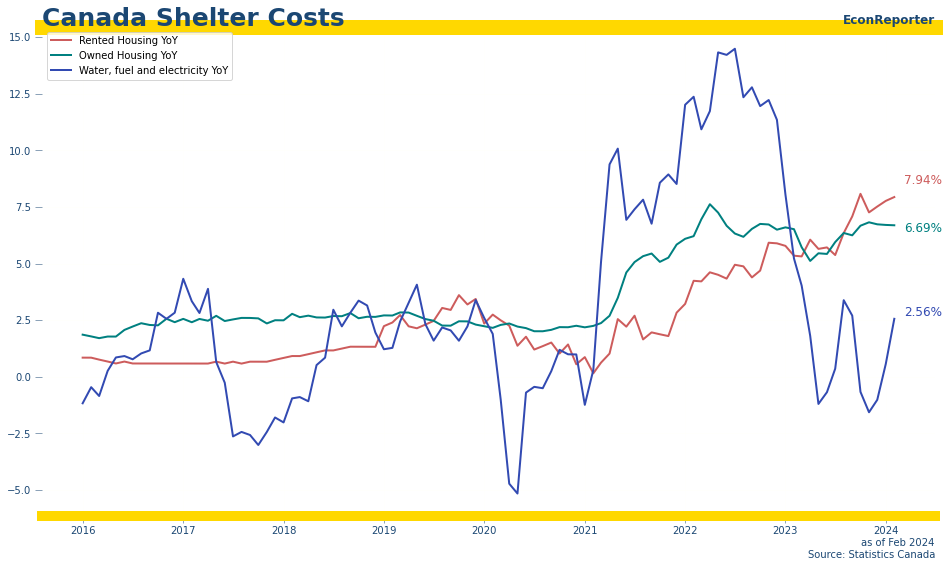

The increase is driven by the continous rise in the cost of rented accommodation

- rented accommodation costs are 7.94% higher than a year ago, as rent CPI alone rose 8.16% over the year;

- cost of owned accommodation is rising at roughly the same rate as in December and January, at a yearly rate of around 6.7%, as the increase in mortgage interest cost slowed to 26.3%, compared to 27.4% in the previous month.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡