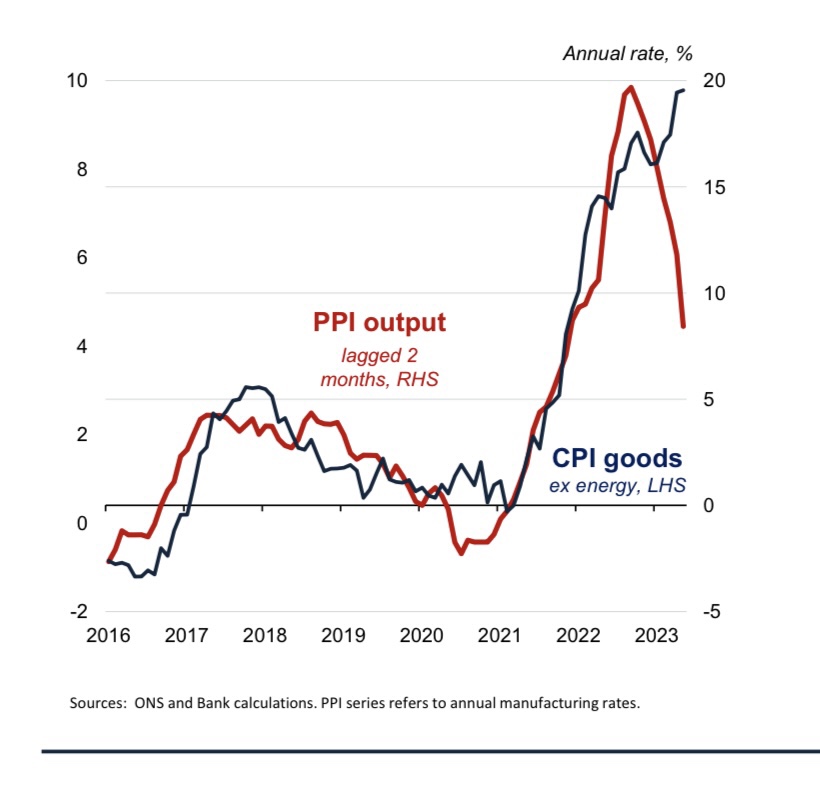

One of the leading indicators Bank of England (BoE) uses to predict the future direction of goods inflation is the manufacturing producer price index (PPI) growth rate.

In the June Monetary Policy Committee meeting, however, the Bank’s officials mentioned the relationship between the two figures has broken down this year, raising uncertainty of whether the country’s goods inflation is really peaking soon.

According to the minutes:

“Core goods CPI inflation had diverged from manufacturing PPI inflation recently, whereas historically these series had shown strong co-movement. The possibility of a reassertion of this historical association in the near term posed a downside risk to the outlook for core goods CPI inflation.”

In a speech presented at the ECB Forum on Central Banking on Wednesday, BoE chief economist Huw Pill showcased a graph to illustrate the disconnection of the two figures:

The two-month lagged manufacturing PPI usually exhibits a similar trend as goods CPI ex energy prices.

Nonetheless, the rapid fall of PPI since mid-last year has yet been followed by a similar drop in goods inflation, giving the Bank some headaches in making accurate predictions over the country’s price level.

--- Follow us on Bluesky and Google News for our latest updates. ---