Last Updated:

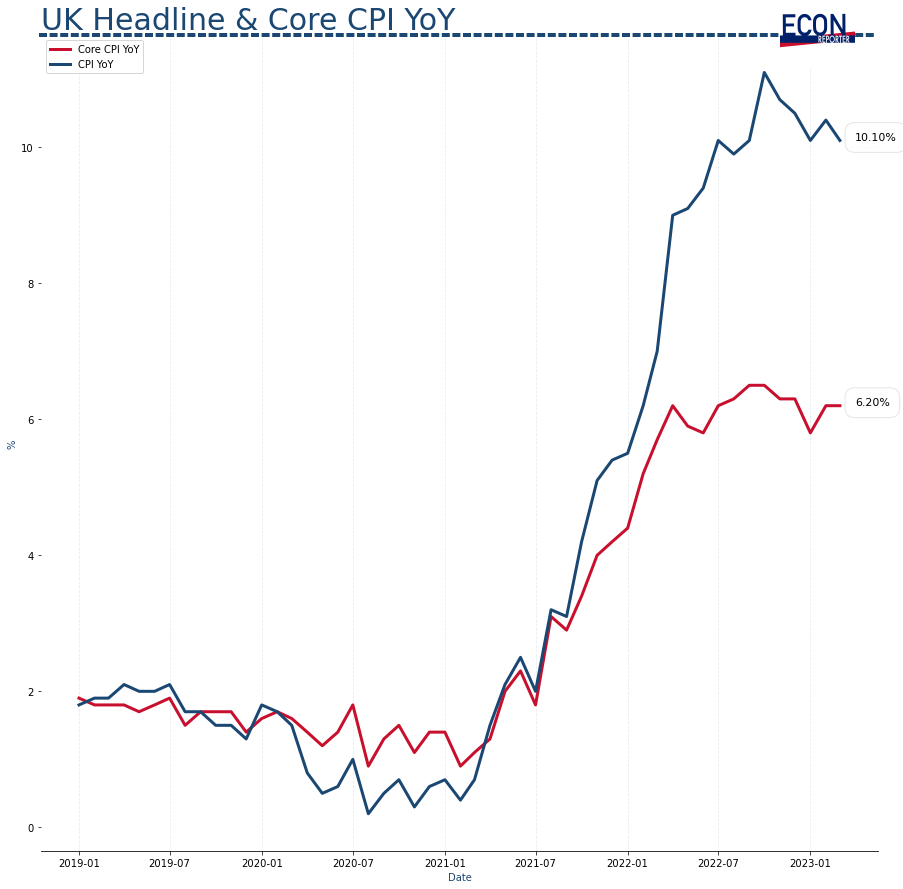

The UK CPI rose 10.1% in the year to March, still remain in double digits even though analysts expected the annual rate to fall to 9.8% (FT). Even when measured with the core-inflation, which excluded the prices of food, energy, alcohol and tobacco, also remained at a high level of 6.2%

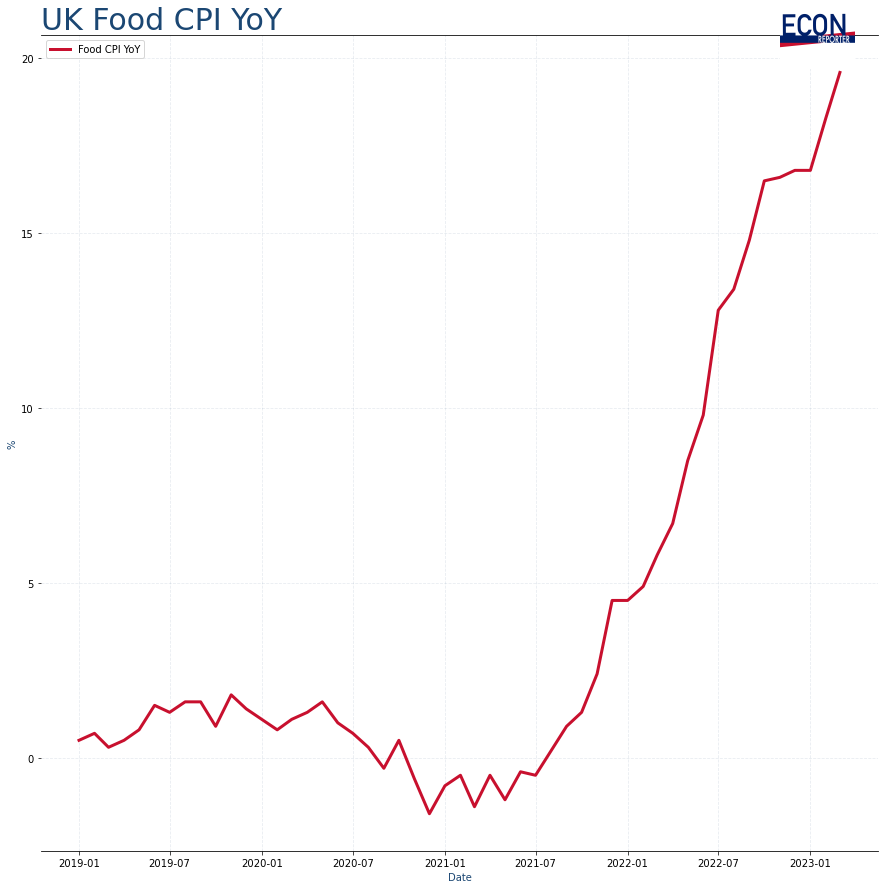

The stubbornness in headline inflation is mostly driven by the accelerating food price inflation. The annual price increase for food items reached 19.6% last month, higher than the 18.3% rate in the previous month which was already the highest reading for the series since it started in 1989.

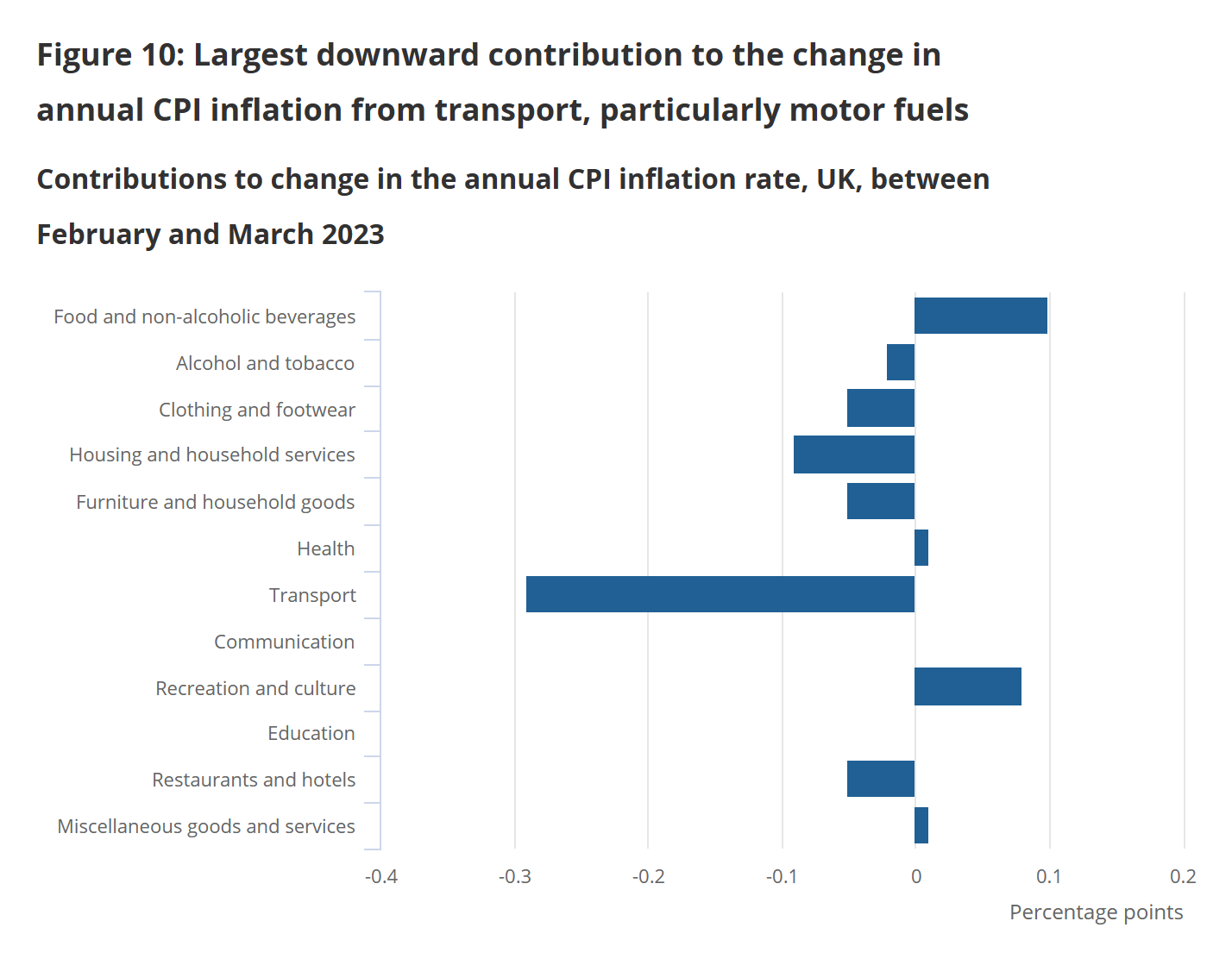

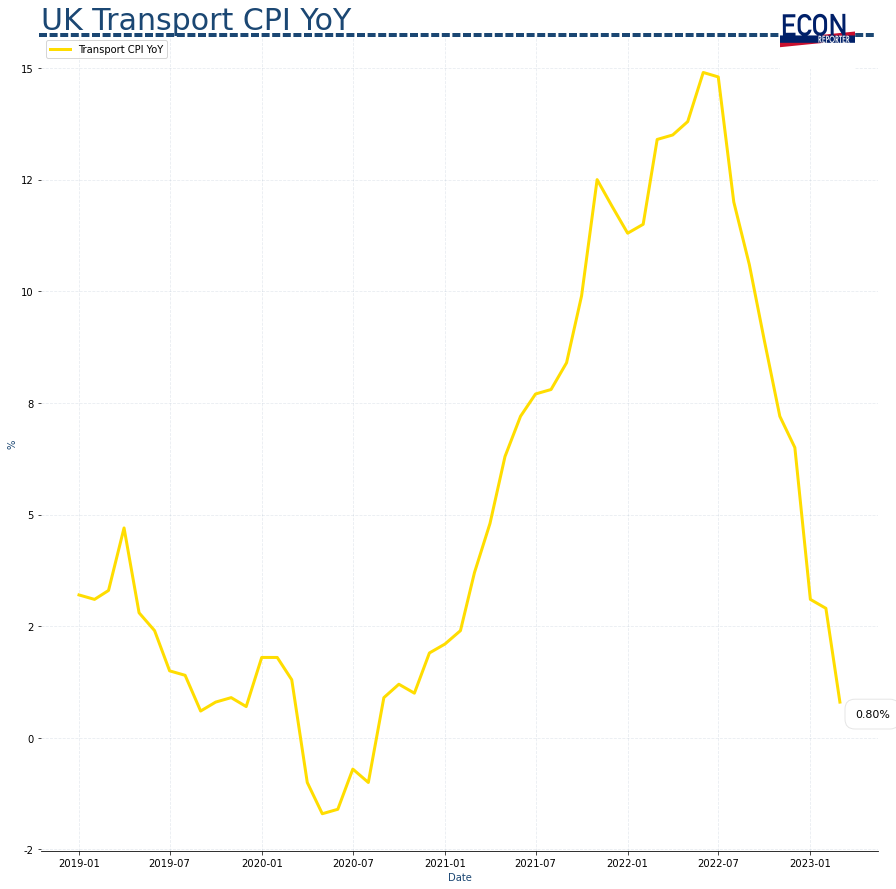

The impact of the spike in food and non-alcoholic beverages prices, however, was offset by the drop in transport prices, which included the cost for motor fuels.

Transport price index, which account for more than 13% of the headline index, rose a mere 0.8% in March, the lowest rate since Aug 2020.

Within the category, petrol and diesel saw a 8.4% and 2.4% annual reduction in prices. However, transportation services including airfare and rail ticket cost climbed 7.6% in the year to March.

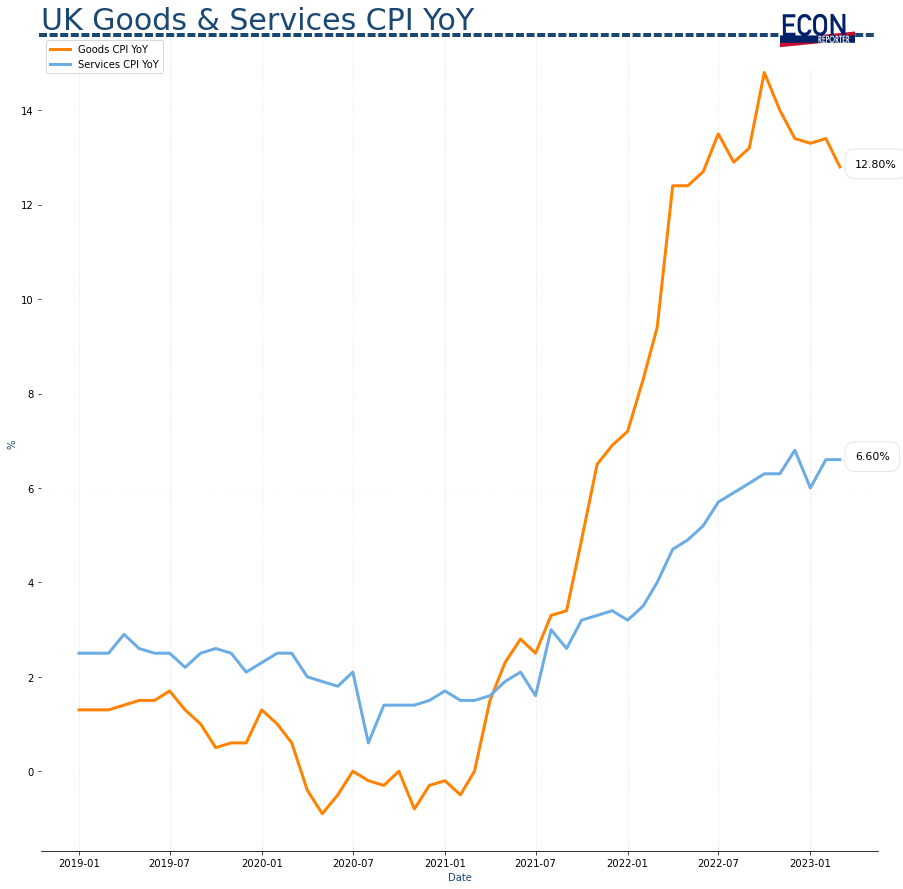

In terms of the two major categories of UK inflation, goods CPI decelerated to a yearly increase of 12.8%, which is still an exceedingly high rate for the liking of Bank of England.

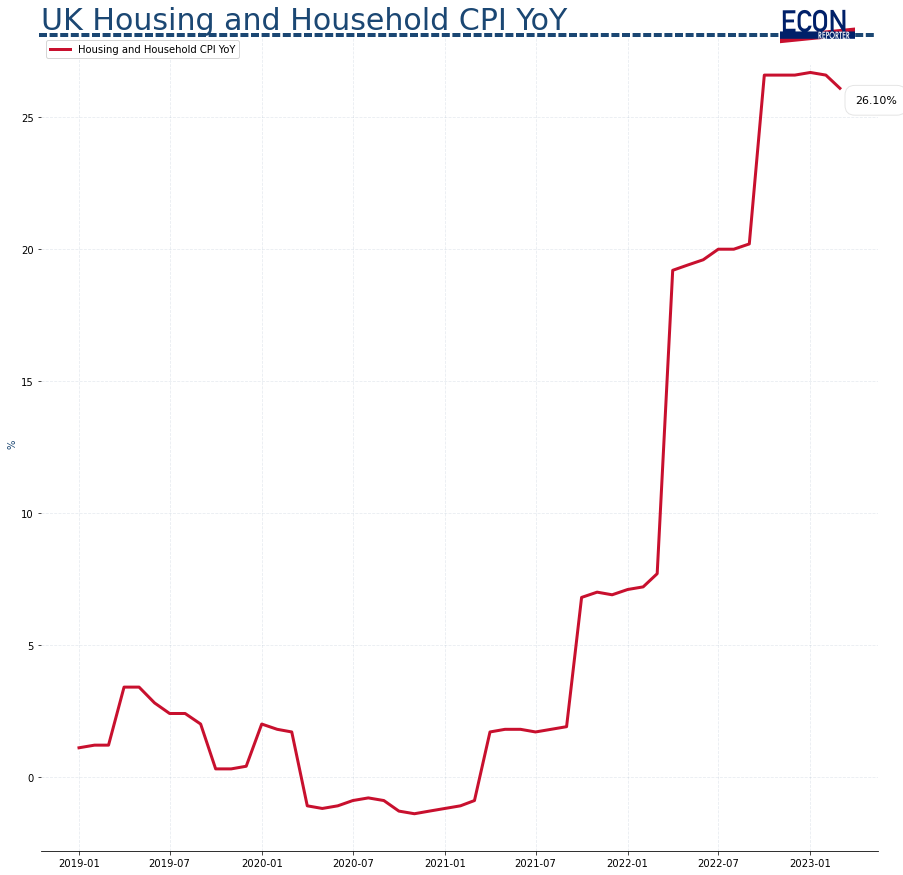

Service inflation also yet to show a falling trend, remaining at a 6.6% rate in March. For example, the cost for housing and household services, which includes the cost of electricity, gas and water, still recorded a year over year 26.1% increase, just a bit lower than February’s 26.6%.

Source: ONS

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡