Last Updated:

Here is a new working paper from the IMF which tries to assess the impact of media sentiment on equity markets.

In this research, economists Samuel P. Fraiberger, Do Lee, Damien Puy and Romain Ranciere use the fraction of positive and negative words in each article to capture the tone of news published, then construct a daily news-based sentiment index for 25 advanced and emerging countries between 1991 and 2015. In their estimation set-up, the researchers use a lag of up to 8 days for the news sentiment index and try to predict the cumulative equity returns response for the next 20 days.

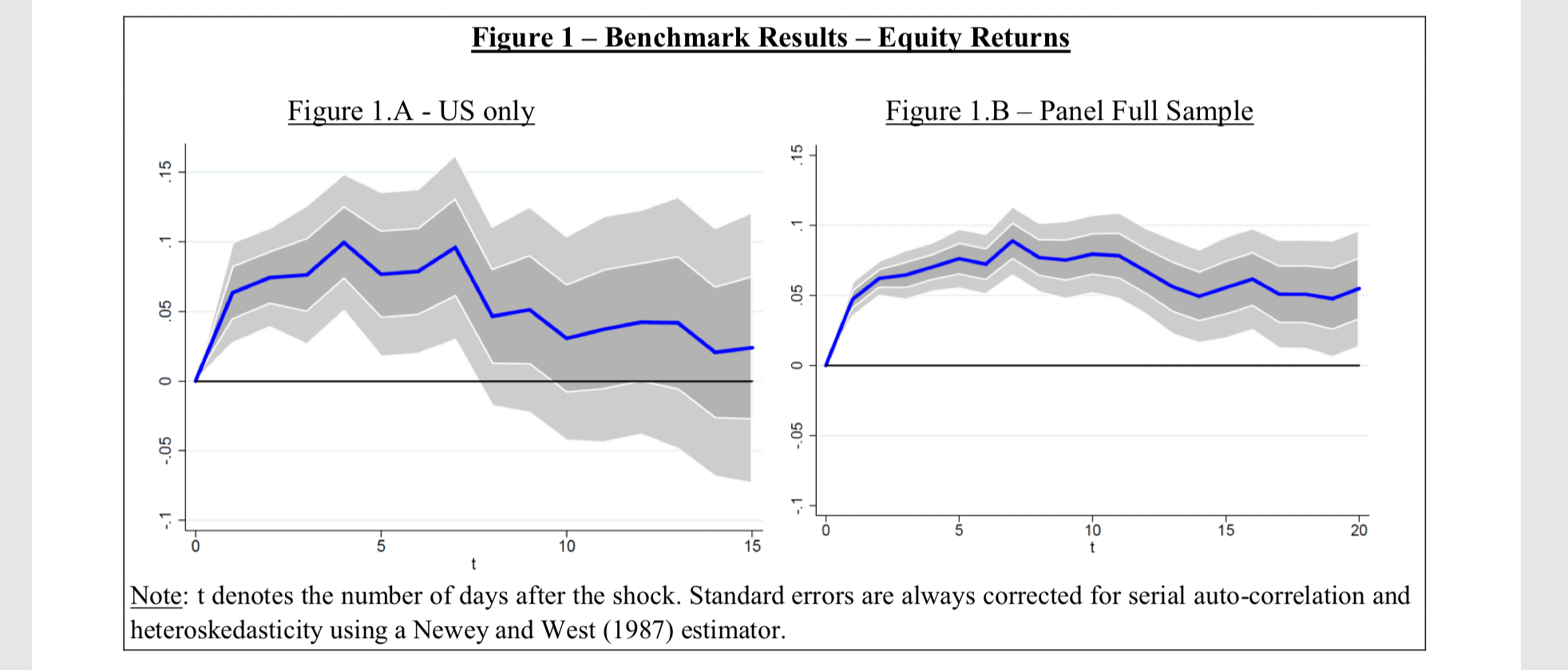

In the left panel of the figure below, we can see the effect of good news – measured by a one standard positive deviation in sentiment – on equity returns in the US. Good news generates positive but transitory returns; the response peaks slightly below ten basis points and is not statistically different from zero after one calendar week.

The effect of news sentiment on asset prices is not limited to the US. The right-hand panel is the effect of a standard definition increase of the full sample news sentiment index. It is clear that a positive sentiment shock implies a positive and economically significant increase in equity returns. Although the magnitude of the impact at the peak is similar to the US – with a peak estimated at nine basis points – the return reversal is not complete in this case.

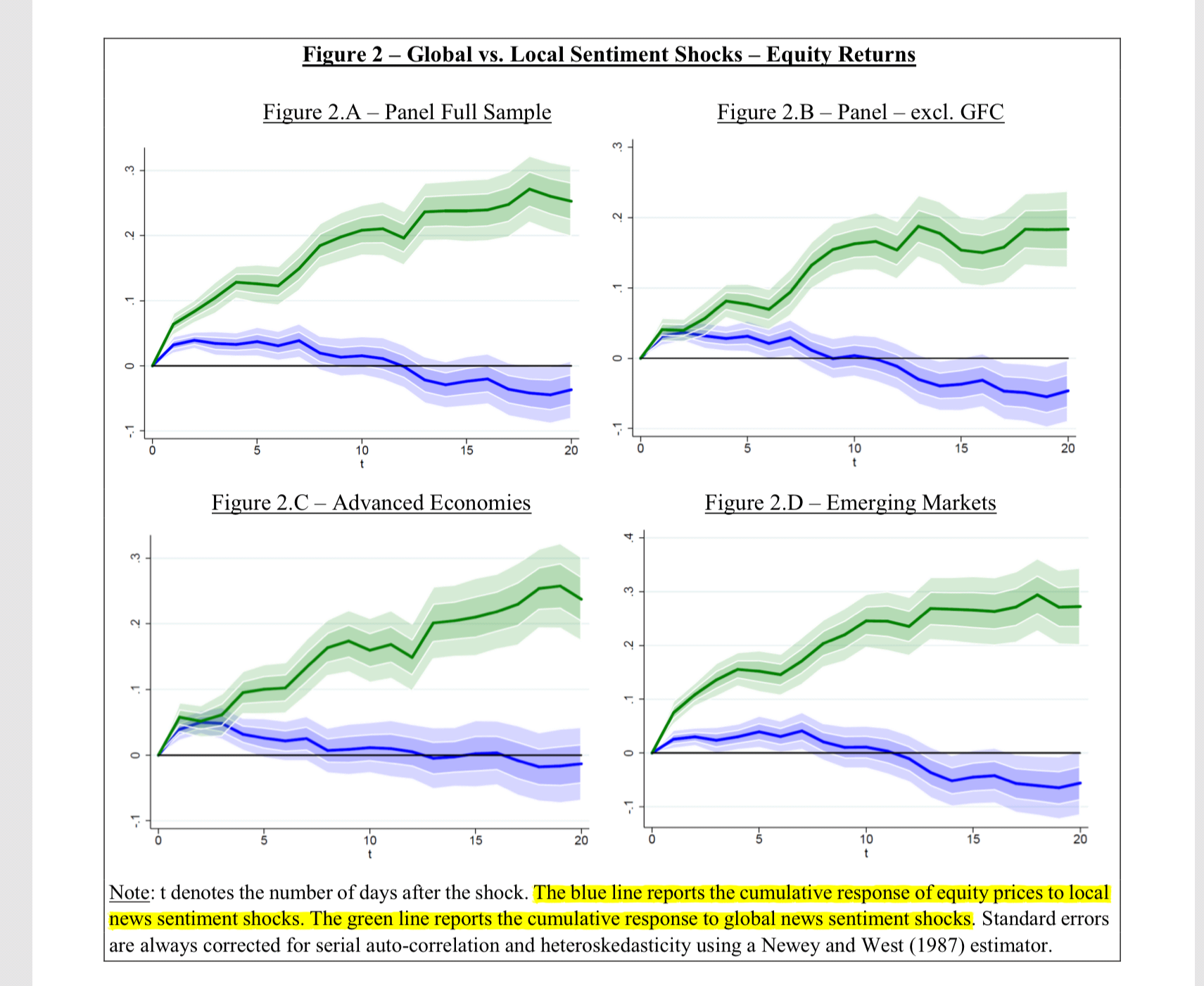

The four researchers then separate the effect of ”local” and ”global” news for further analysis. In their sample, about 60% of the corpus consists of local news, which only mentions one country and conveys rather specialized content. By contrast, the remaining 40% of the corpus contains articles discussing multiple countries. Typical multi-country news is an article, for example, about “Fears of Brazilian devaluation hit emerging markets,” which mentions multiple countries and their interrelations.

Controlling for the global sentiment affects the size and shape of the response of the local news sentiment (blue line in the figure below), the cumulative response being roughly twice smaller (5 basis points) than the benchmark estimates mentioned above. This indicated the existence of pure “sentiment” shocks, affecting both advanced and emerging countries, during which the tone of local news affect investor sentiment and prices momentarily before returning to their fundamental values.

In sharp contrast, the global news sentiment shocks have a stronger and permanent effect on returns (green lines in the graph above). The total permanent impact is around 25 basis points roughly five times the size of the local sentiment shock. This long and lasting impact on world stock markets suggests that global news contain genuinely new information about fundamentals that is only slowly incorporated into stock prices; Or, the sudden changes in global news sentiment are strong enough to cause drifts that do not reverse in the short run, even in the absence of new information about fundamentals.

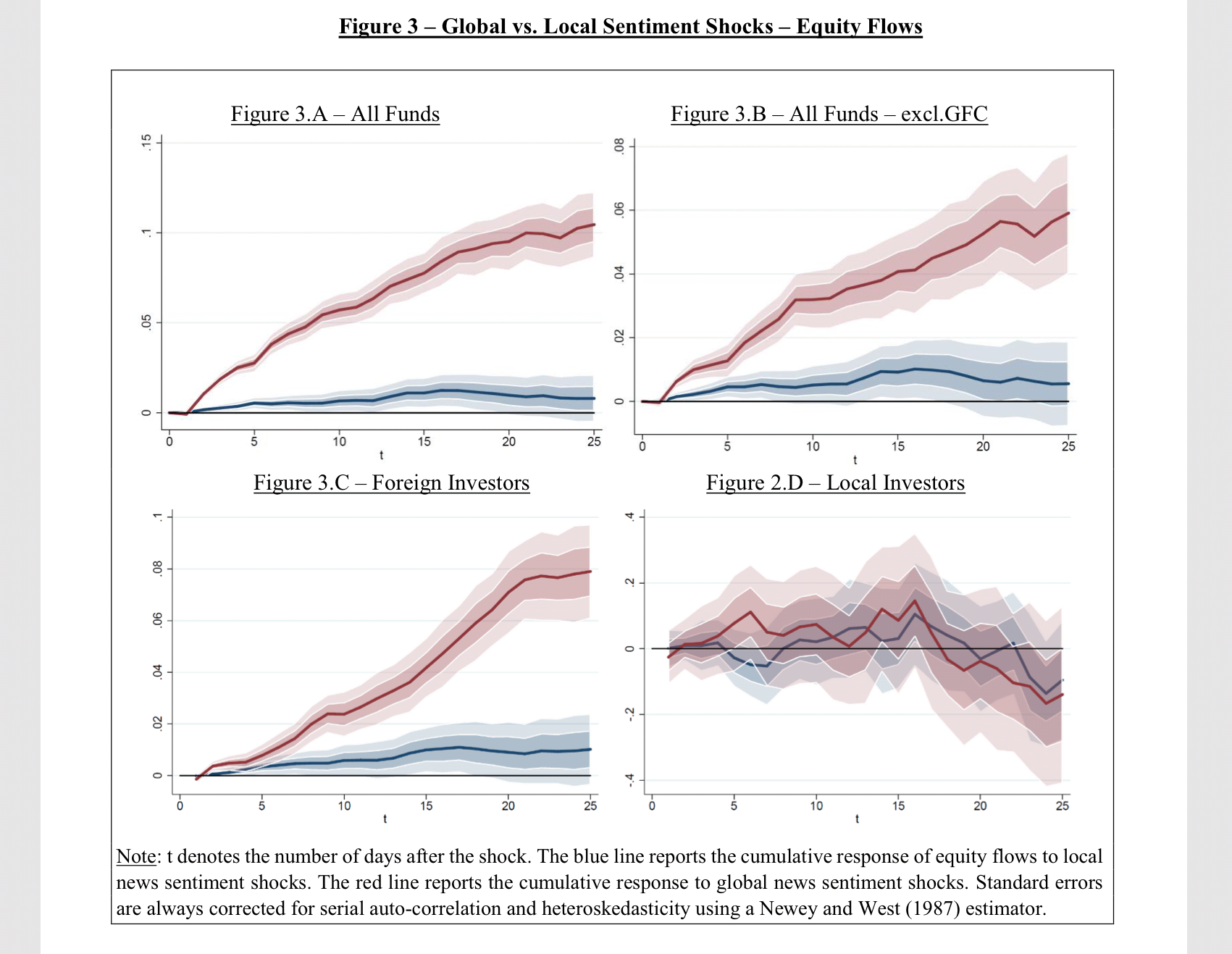

Another analysis they perform is to check the relationship between the news sentiment index and equity flow. They find a very similar response like the one with equity prices. Although local news optimism attracts equity fund flows, it does so only temporarily. We estimate a statistically significant cumulative increase at the peak of 0.01% (blue lines in the graph below).

Optimism in global news (red lines in the graph below), on the other hand, generate a larger and permanent inflow of equity, which peaks after two weeks around 0.1%.

Then they break down the equity flows into ”local” and ”foreign” investors (the lower two panels in the graph above), and find that these results are almost entirely driven by foreign investors. The response of local equity investors is not significantly different from zero at all horizons and for both types of shocks (at 5% significance level).

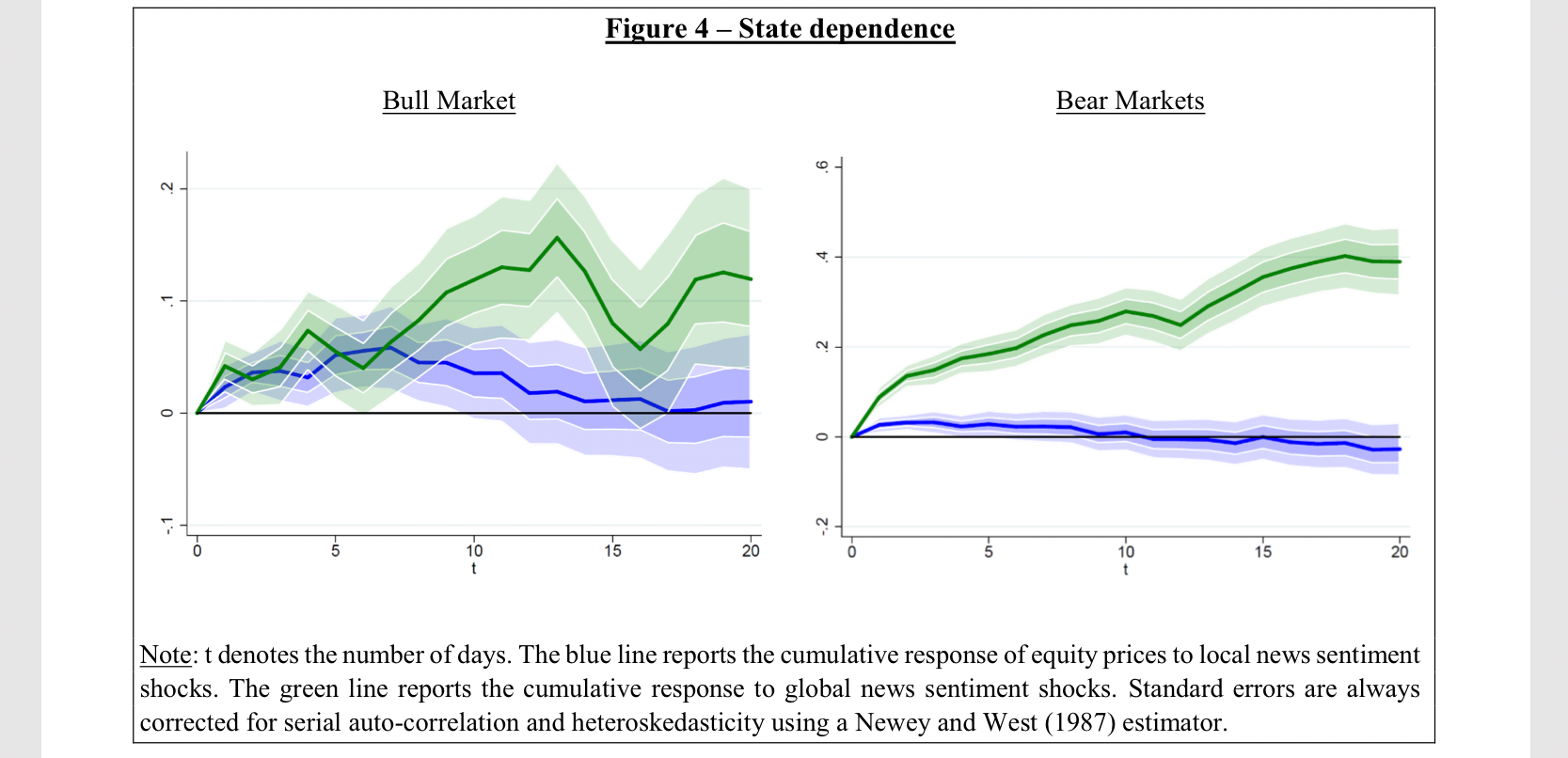

The stock market response to the news sentiment also dependent on the market trend. If we define Bull (and Bear) markets are defined as periods during which the global equity market – measured by the Dow Jones World Index – is above (below) its trend, we can see, in the graph below that the impact of global sentiment shocks are roughly four times stronger in global bear markets

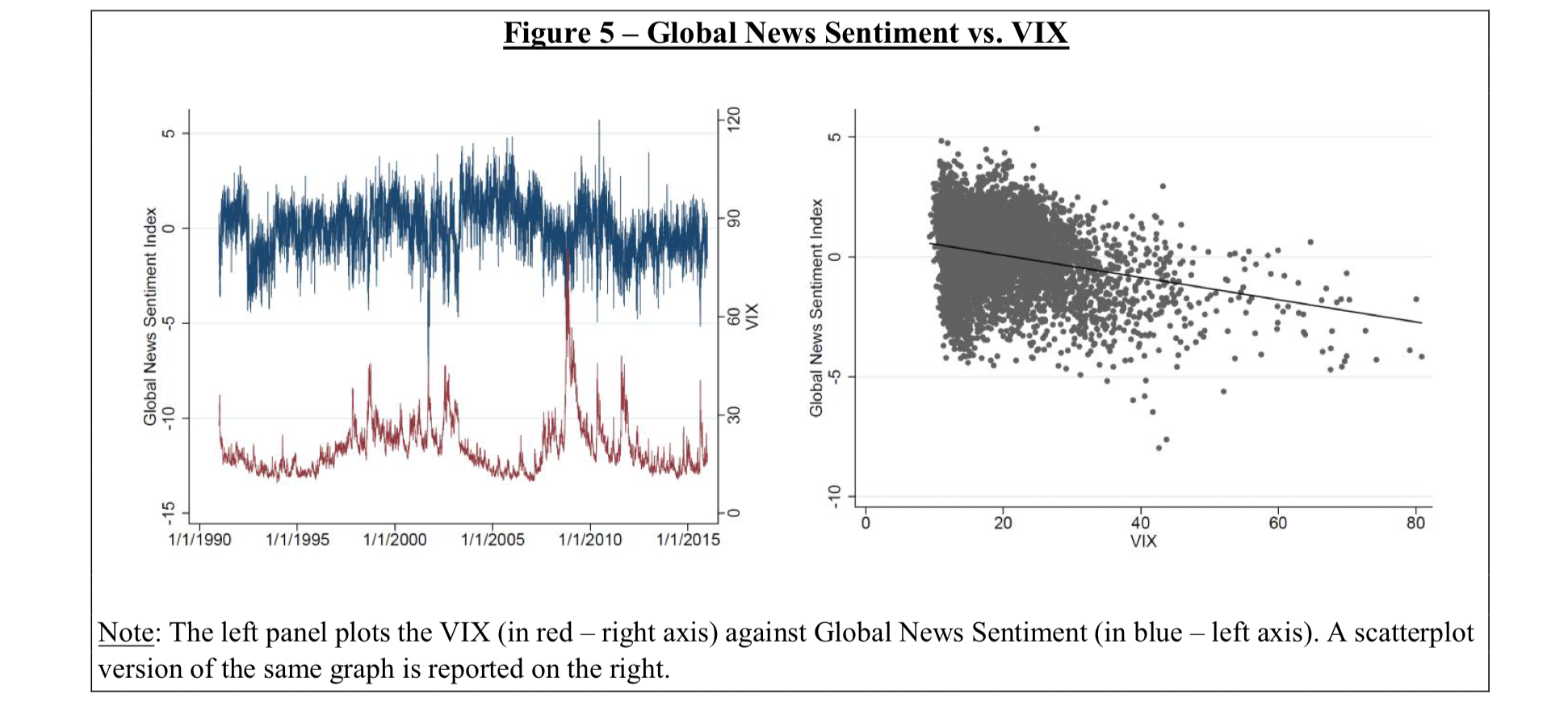

The four researchers also compared the news sentiment index to the VIX. As shown in the figure below (left panel) the two are negatively correlated, and spikes in VIX are always matched by a significant and synchronized drop in global news sentiment, suggesting that they both capture episode of heightened market stress. However, in many instances, movements in global sentiment are not matched by changes in the VIX. That is mostly because good news is not well captured by the VIX, as VIX is the so-called ”fear index” which is usually a proxy of global market turmoil rather than global market optimism.

Here is the full paper:

Media Sentiment and International Asset Prices

Author/Editor: Samuel P. Fraiberger ; Do Lee ; Damien Puy ; Romain Ranciere Publication Date: December 10, 2018 Electronic Access: Free Full Text. Use the free Adobe Acrobat Reader to view this PDF file Disclaimer: IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡