Hong Kong’s linked exchange rate system limits he HKD to USD exchange between the range of HKD7.75 – 7.85 per USD.

Within this range, the bilateral exchange rate can move freely. When either of the boundaries is reached, Hong Kong Monetary Authority, the de facto central bank of the city, will intervene by buying/selling HKD from/to the banks in HK.

The quasi-fixed exchange rate regime aligns the HKD interest rate and its USD counterpart in the long run, but in the short run the two rates can diverge.

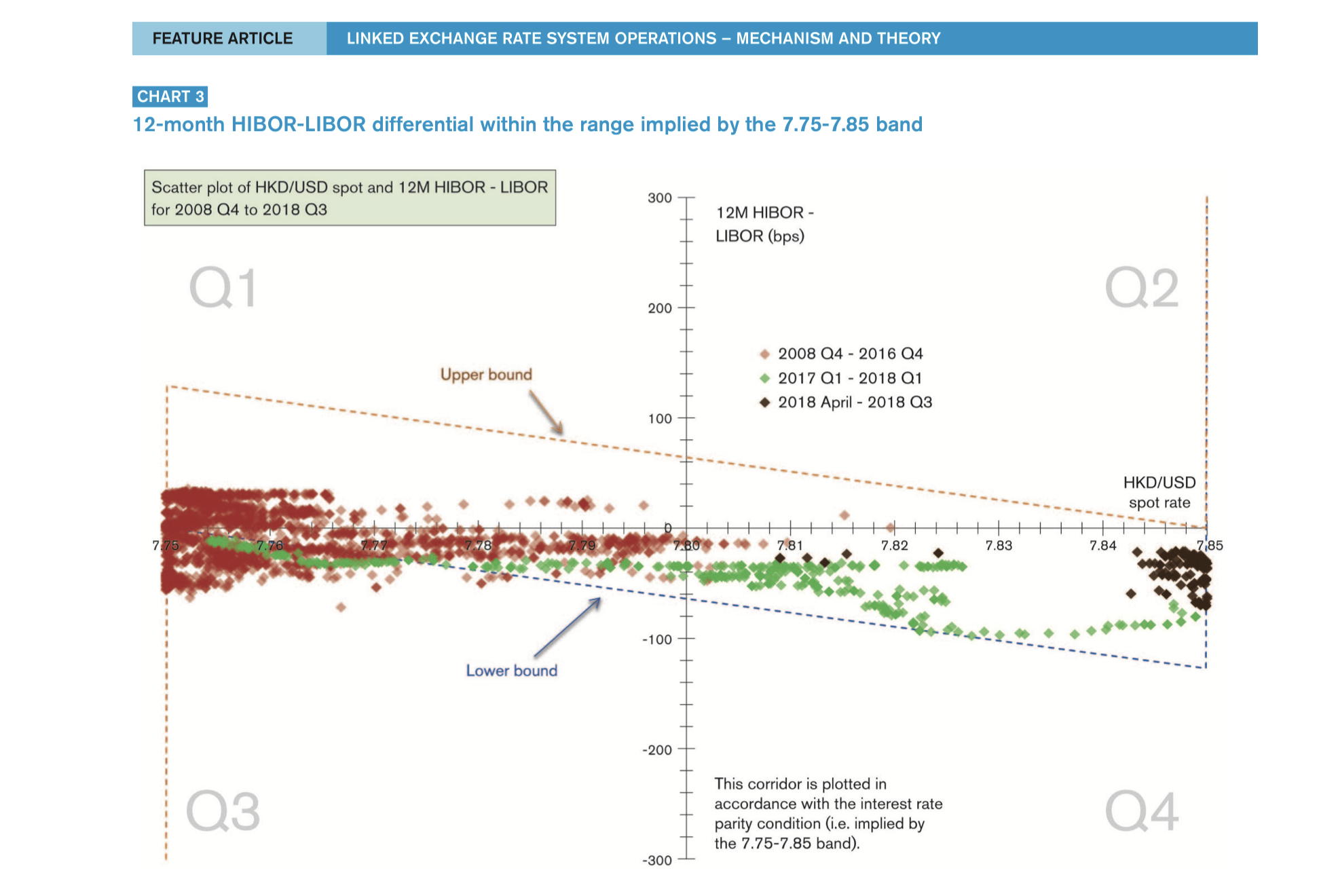

Here is the a graph from HKMA plotting the relationship between HKD- USD exchange rates and HIBOR-LIBOR differential since 2008 Q4 to 2018 Q3, which shows HKD tends to be on the strong side (closer to HKD 7.75 per USD) when the interest rate differential is positive (HIBOR > LIBOR).

One explanation of the relationship is, given the linked exchange rate is credible, when the exchange rate appreciates into the strong side (USD 1 trade for less than HKD 7.8), it tends to depreciate in the future and this expectation allows a positive interest rate differential, which equates the forward looking return in HKD and USD, as the uncovered interest rate parity predicts.

The figure, however, also shows a bias toward negative differential. Researchers from HKMA said that can be explained by a huge transactional demand for HKD, giving an implicit value for having one HKD now, rather than later, which makes the HKD interest rate tends to be lower than the USD one.