Hong Kong’s Monetary Authority (HKMA) maintains a linked exchange rate system between the Hong Kong Dollar (HKD) and the US Dollar (USD). I assume you know this already.

Using the so-called currency board, the HKMA actively participates in the exchange market to buy HKD whenever the exchange rate falls below 7.85 HKD per 1 USD, the weak-side Convertibility Undertaking. Whenever the exchange rate rises above 7.85 HKD for 1 USD, the strong-side Convertibility Undertaking, HKMA sells HK in the market. So HKMA is tasked to maintain that the HKD/USD exchange rate sits between 7.75 and 7.85 HKD per 1 USD, always.

This, I assume you know also.

In recent years, the Federal Reserve raise the benchmark interest rate (which is the Fed Fund Rate) from zero to the range of 2.25 – 2.5 percent. Under the linked exchange rate system, HK’s benchmark interest rate should tightly follow that of the US. We would expect the HKD interest rate to rise in tandem with the US interest rate, otherwise, as the theory dictates, capital will flow from HKD to USD money market and generate a downward pressure in the HKD/USD exchange rate. As the exchange rate is bounded from falling below 7.85 HKD/USD, capital outflow from HKD money market will raise the interest rate, until the rates in HKD market is roughly the same as that of the USD market.

Well, I am sure you know this is not what happened in reality, otherwise, you won’t be reading this article.

For example, as you can see from the graph below from Bloomberg News, since 2016 the difference between 1-month Hong Kong Interbank Offered Rate (HIBOR, i.e. the interbank borrowing interest rate) was almost always lower than the USD counterpart, the 1-month LIBOR.

While we can see if the spread between HKD and USD interest rates widened too much, say above 1 percent, the HKD significantly weakens and falls to the weak-side of the fixed exchange rate. This means the theory still works in general. Nonetheless, we can also see that a substantial gap between HKD and USD interest rate seems to be the new normal.

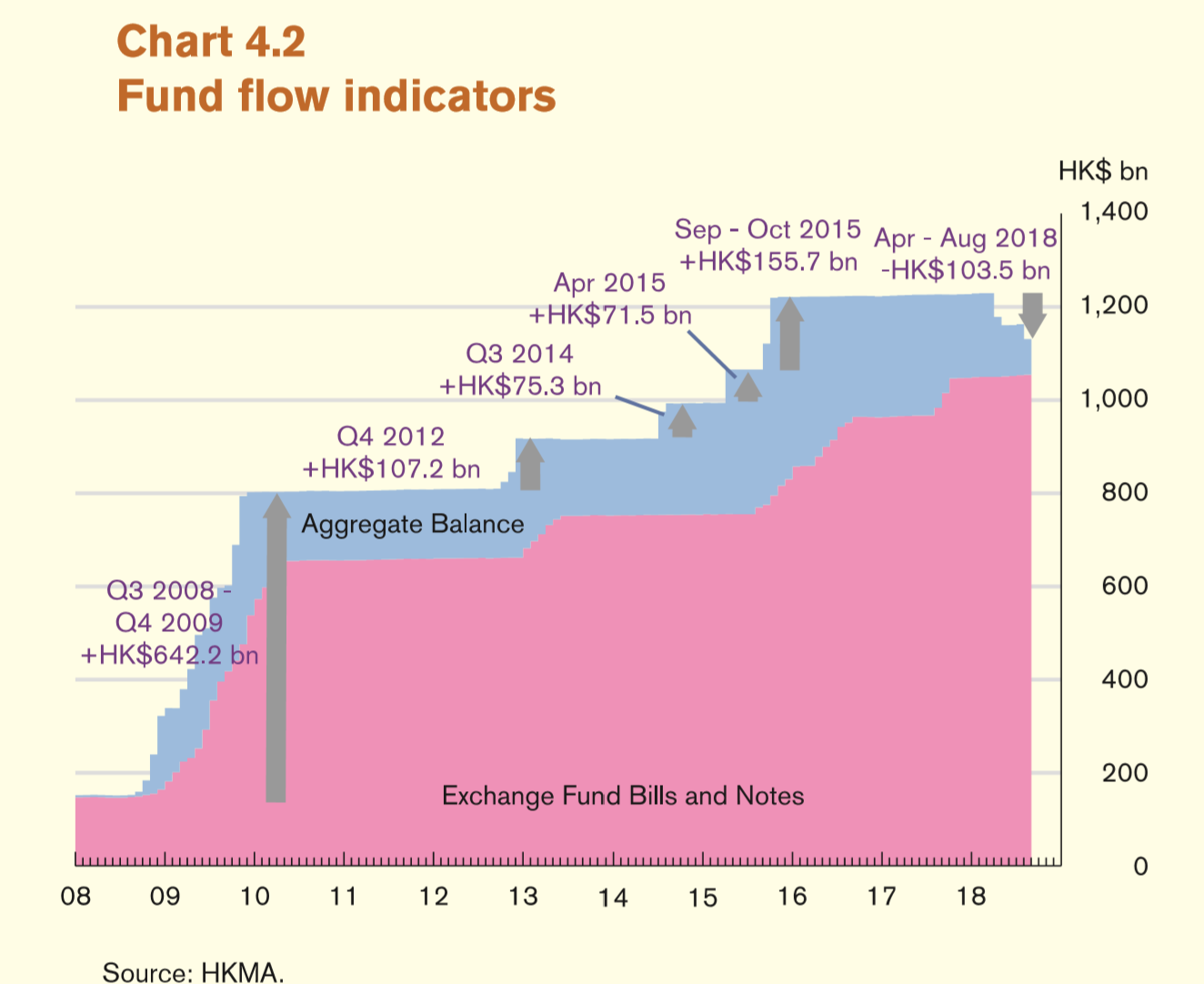

Most of the media reports point to the fact that after three rounds of QE implemented by the Federal Reserve, HK’s banking system is flooded with excess liquidity. This extra cash is stored in the form of Aggregate Balance, which is essentially the bank’s deposit account in the HKMA. As the banks hold an amount of cash much more than they need, it translates to a lower interbank borrowing interest rate as they don’t need to borrow from other banks. Not at a “high” cost at least.

Accordingly, the gap between the HKD rate and that of USD will go away forever if the Aggregate Balance falls to roughly zero. In fact, when the HKMA buy HKD in the market, they are buying it from the banking system and the Aggregate Balance will contract as a result. This method has been keeping the HKD exchange rate in the targeted range.

As the Aggregate Balance has fallen to around HKD 65 billion, from around HKD 400 billion at the start of 2016, most expect that it only took another short period of weak-side HKD exchange rate for the HKD interest rate to shoot up and to be aligned with the USD rate again.

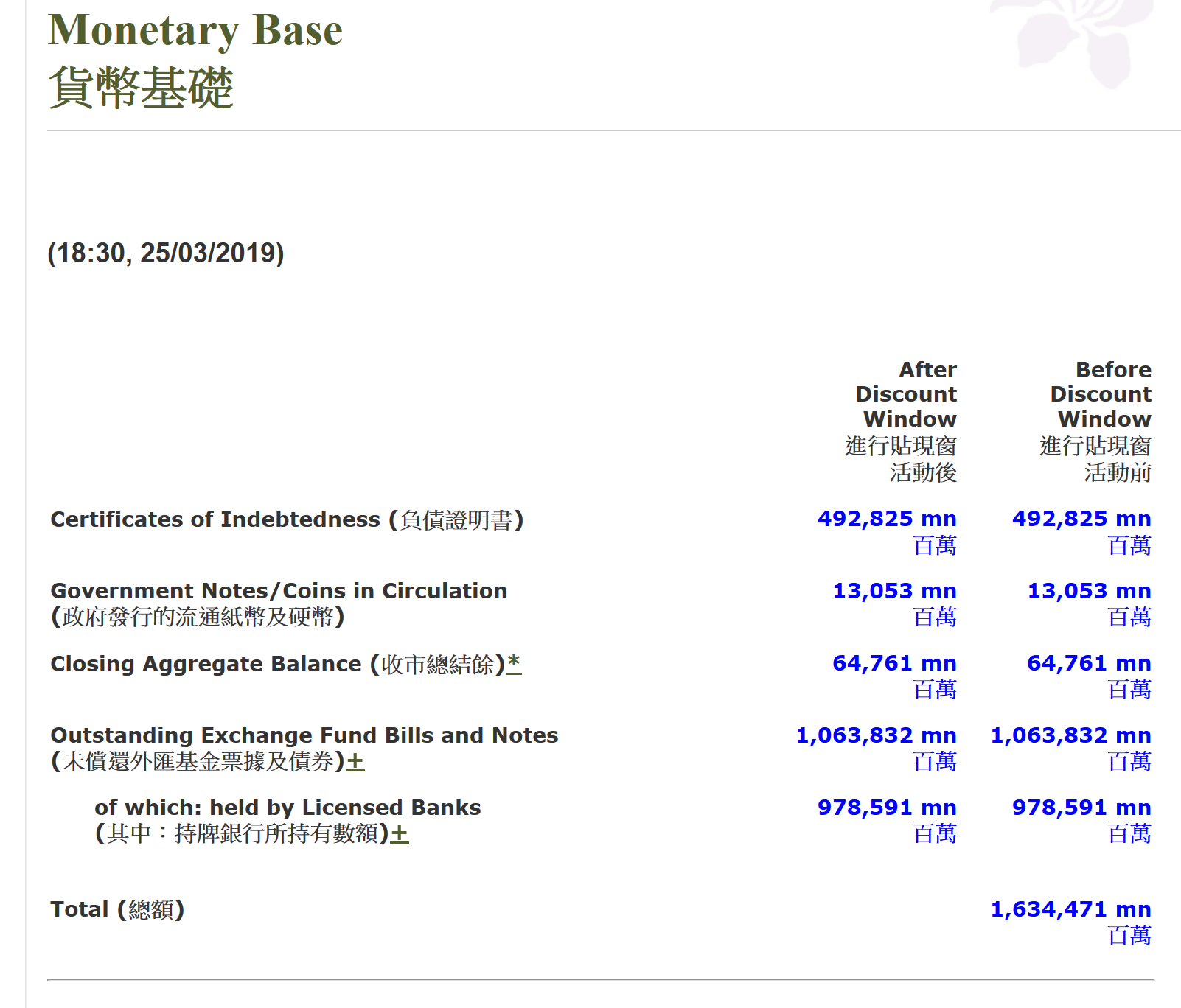

Well, I am sorry to disappoint you – it might not happen. Not that soon maybe. One often neglected basic fact is that Aggregate Balance is only a part of Hong Kong’s monetary base.

Let’s put it this way. When 1 USD enters HK and exchange to HKD, that 7.8 (or any number between 7.75 and 7.85) HKD can become one of two things: Cash in physical form or deposit in the banking system in digital form. The bank can then hold that HKD in one of several forms: put it in Aggregate Balance, hold it as Certificates of Indebtedness, or use it to by Exchange Fund Bills and Notes issued by HKMA. This is the composition of Hong Kong’s Monetary Base by definition.

For our story, Exchange Fund Bills and Notes (EFBN) is most important, yet often ignored. EFBN is a high-quality Hong Kong dollar debt paper, holders can use it as collateral in the money market or borrow money from HKMA’s discount window.

In fact, EFBN is a tool for the HKMA to absorb some of the excess liquidity in the banking system, i.e. maintain the Aggregate Balance from getting too large.

While the Aggregate Balance has been falling in recent year, the amount of outstanding EFBN is not. HKMA has been refinancing the EFBN that were expired with new issues. This is an important factor which ensured the Aggregate Balance falling. If HKMA reduces the supply of EFBN, money will go back to the Aggregate Balance and the excess liquidity will rise again!

Byron Tsang, Associate Professor at Virginia Tech and an economist specialized in Hong Kong Economy, said HKMA can always adjust the supply EFBN to control the level of Aggregate Balance. So the gradual increase in HKD interest rate, and a gap between HKD and USD interest rates, can be interpreted as the result of the deliberated policy by the HKMA.

Hence, the important point is that given the fact that there is still HKD 1 trillion EFBN outstanding, the HKMA has absolute control of the gap between HKD interest rate and that of USD.

Even if the Aggregate Balance fell further in the near future, the gap between LIBOR and HIBOR may continue to exist, if HKMA wants it to. Will HKMA do that? What factors would HKMA consider in determining the size of the interest rate gap?

Sorry, no one except few in the HKMA knows. After all, HKMA can decide what it deems to be fit for maintaining its monetary policy objectives. It does not directly answer to people in Hong Kong.

This is an important potential problem for the Hong Kong economy, but most of us haven’t realized. This is very worrying, in my opinion.