The most important question for the 30th Jan Fed meeting balance sheet policy, because it is also most underrated by the market.

Let’s read the minutes of December Fed meeting again, specifically this passage:

[R]educing reserves to a point very close to the level at which the reserve demand curve begins to slope upward could lead to a significant increase in the volatility in short-term interest rates and require frequent sizable open market operations or new ceiling facilities to maintain effective interest rate control. These considerations suggested that it might be appropriate to instead provide a buffer of reserves sufficient to ensure that the Federal Reserve operates consistently on the flat portion of the reserve demand curve so as to promote the efficient and effective implementation of monetary policy.

(Emphasis mine)

Here we can clearly see that for the Fed officials, there is a pressing problem in figuring out where is the so-called Saturated Level of Reserves.

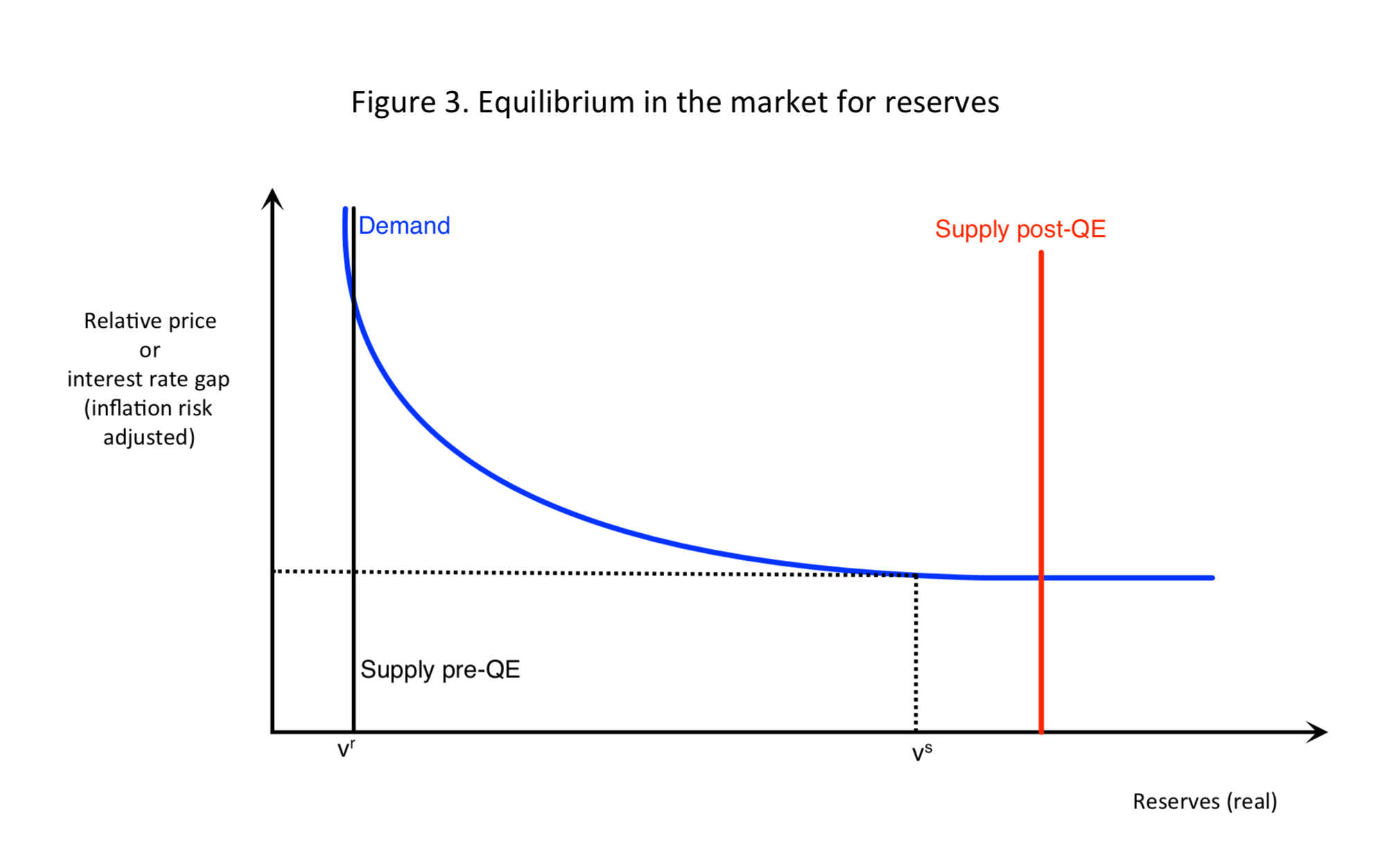

Source: “Funding Quantitative Easing to Target Inflation” by Ricardo Reis

The saturated level of reserve is the point which the opportunity cost for banks to hold reserves disappears, and became indifferent towards holding more reserves. The reserve demand curve beyond this point becomes close to horizontal. (See figure above)

After the Fed’s decision to implement positive Interest on Excess Reserves (IOER) in 2008 and several rounds of QE, the Fed has been operating its interest rate policy at a saturated reserves market. The banks face near zero opportunity cost when holding reserves. This is the so-called Floor system that the Fed is using.

What keeps the Fed’s officials up at night is the fact that the effective Fed Fund rate (EFFR) is the last half year is edging toward the level of IOER.

As EFFR rise clear above IOER was regarded as a flashing signal that the reserves market will soon back to the level below the saturated point, the closing spread between IOER and EFFR, which is zero now (as shown on the graph above), makes the Fed wonders if the saturated level of reserve is much higher than they previously assumed.

That is, the Fed suddenly have an urgent need to re-examine their normalization plan and make sure they can maintain the Floor system. This is the true reason that the Fed needs to consider ending the balance sheet reduction sooner.

As we can see from the last Fed minutes, they have explicitly discussed this option:

Some participants commented on the possibility of slowing the pace of the decline in reserves in approaching the longer-run level of reserves. Standard temporary open market operations could be used for this purpose. In addition, participants discussed options such as ending portfolio redemptions with a relatively high level of reserves still in the system and then either maintaining that level of reserves or allowing growth in nonreserve liabilities to very gradually reduce reserves further.

The Fed determined to keep using the Floor system, that is, maintain the reserve level above the saturated level, because they believe that this system can facilitate the Financial Stability, as illustrated by a proposal by former Fed Governor Jeremy Stein.

But the important question is then, does the Fed know where the Saturated Level of Reserve is? This is the question Chairman Powell need to answer in the post-meeting Press Conference.

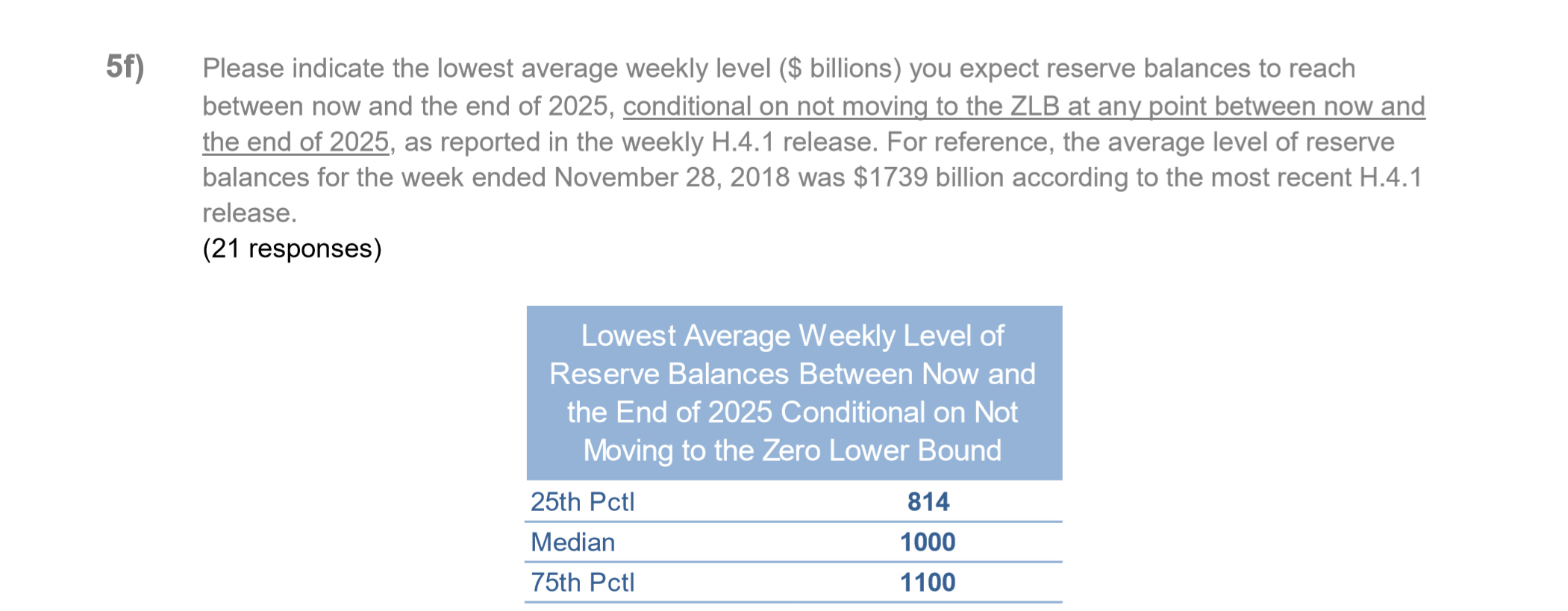

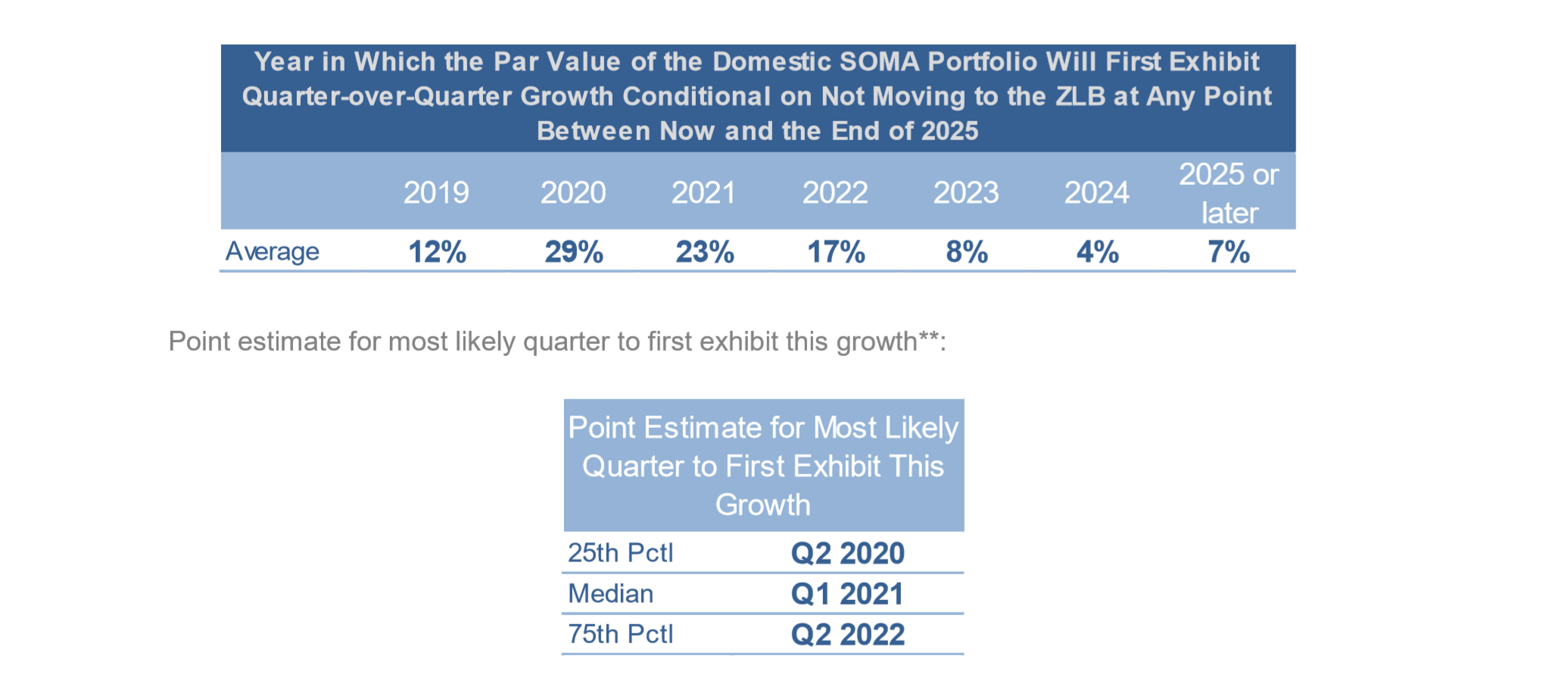

Powell’s answer will likely be based on the result of the December edition of the New York Fed’s Survey of Market Participants. It shows that the median prediction of the banks is that the Fed’s Balance Sheet will start growing again in the first quarter of 2021, which means the balance sheet reduction is likely to stop around the second half of 2020.

Also, the surveyed banks think that the reserve balance will not drop below $1 trillion. This can be interpreted as the market participants’ estimation of the Saturated level of reserve.

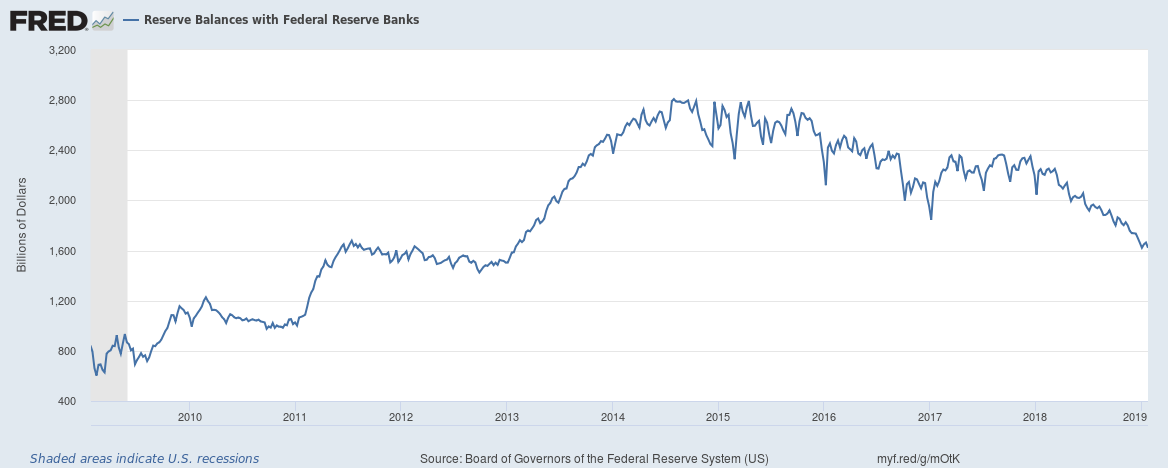

Given the current reserve level is $1.62 trillion, that means the Fed might only be able to retrieve less than $600 billion of reserves before it hit the saturated level and the floor system collapse.

However, should Powell give the $600 billion out in the press conference and fixated the expectation that the normalization is soon-to-be-finished? This is the hard choice facing the Fed officials in this meeting.