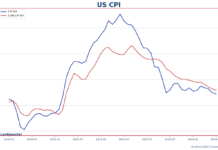

Tag: US CPI

US CPI down to 2.9% in July as disinflation continues

US headline CPI down to 2.9% in July, lowest since March 2021

US CPI shows zero inflation in May

US CPI grew 0% in May as the yearly growth rate dropped to 3.27%; core inflation, which stripped out food and energy prices, rose 0.2% and the yearly rate decreased to 3.42%

US core CPI rises 3.6% as expected

US CPI rose 3.35% in the year to April, as expected by analysts. Meanwhile, core CPI, which strips out prices of food and energy, increased 3.61%, also as market expected.

Is tipflation even part of inflation?

Or, to frame the question in a more technical way: is tipflation even counted as part of Consumer Price Index (CPI) inflation?

US Core CPI rises 3.9% in January

Core CPI: 3.86% YoY (Dec: 3.93%) | 0.39% MoM (0.28%)

US CPI inflation rebounds in Dec to 3.4%

Core CPI inflation continues to decelerate to 3.93%