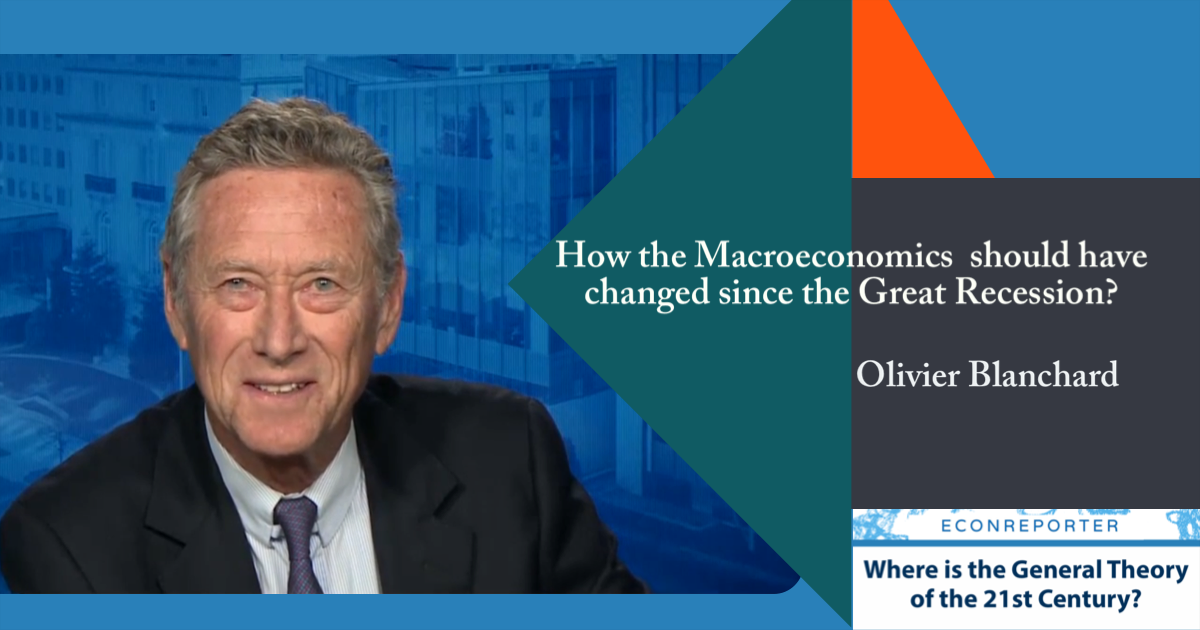

The model you should use to explain Macroeconomics to your Mum | Q&A with...

>Professor Olivier Blanchard further explained the role empirical research on DSGE models, how to teach undergraduates macro after the Great Recession, and his research on hysteresis.

How Household Debt affect the Global Business Cycles | Q&A with Atif Mian |

In this installment of the interview, Professor Mian explains the major findings in his recent research paper "Household Debt and Business Cycles World Wide" and the important implications of that paper.

What is Neo-Fisherian and FTPL? | Q&A with John Cochrane |

Cochrane discusses with us his view on the development in Macroeconomics since the Great Depression. He also explains what Neo-Fisherian and Fiscal Theory of Price Level are, and why they are important for understanding the current economic situation around the world.

Performance of Macroeconomics is not that bad! | Q&A with Ricardo Reis |

In the interview, Ricardo Reis discuss with us his latest research project - "Reservism", the study of the role of reserves on central bank balance sheets and their implications for central bank solvency, quantitative easing, and the ability to control inflation.

US needs large-scale Covid testing urgently: Nobel winning economist Paul Romer

In an exclusive interview with EconReporter on Tuesday, Romer, co-recipient of the 2018 Nobel Prize in Economics Science, urged the US to adopt large-scale testing immediately to halt this most detrimental economic slump ever since the Great Depression in the 1930s.

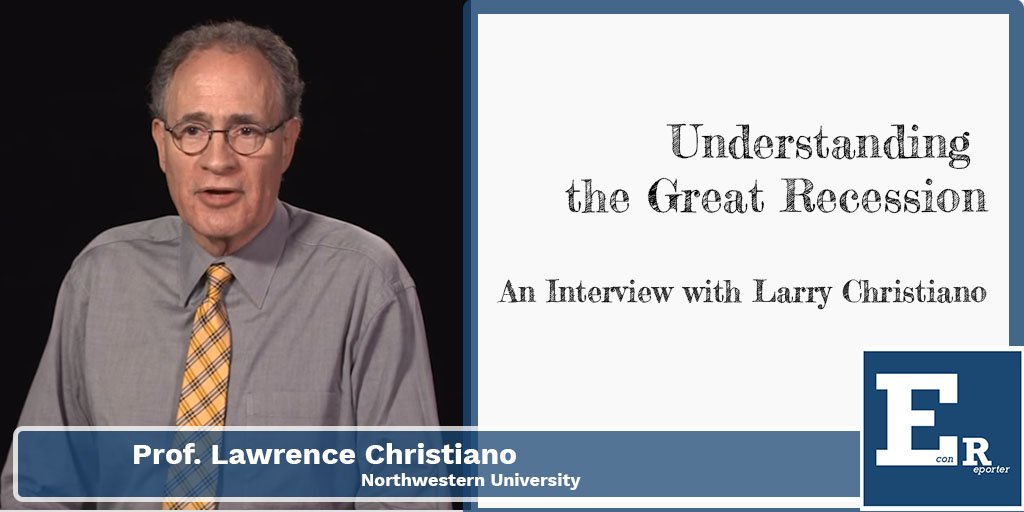

Understanding the Great Recession | Interviews with Larry Christiano |

Larry Christiano, one of the most prominent researcher on DSGE model, explains what his research "Understanding the Great Recession" tell us about the Great Recession as well as labor participation rate's role in the developments of the Great Recession.

Fiscal Theory of Price Level and State of Macroeconomics | Q&A with John Cochrane...

John Cochrane talks about Fiscal Theory of Price Level and how can we apply this theory on the current macroeconomy.

Is Inequality part of Macroeconomics? | Interview with Branko Milanovic |

Branko Milanovic discusses whether the study of inequality can be considered as part of macroeconomics and how should macroeconomists incorporate his idea of Kuznets Waves into their models.

Market Monetarism and Macroeconomics | Q&A with Scott Sumner |

This is the second installment of our interview series "Where is the General Theory of the 21st Century?".

In this second installment, we continue...

How to Maintain Prosperity for All | Interview with Roger Farmer

Roger Farmer explains : Why central banks should consider stock market intervention in stabilizing the employment markets?