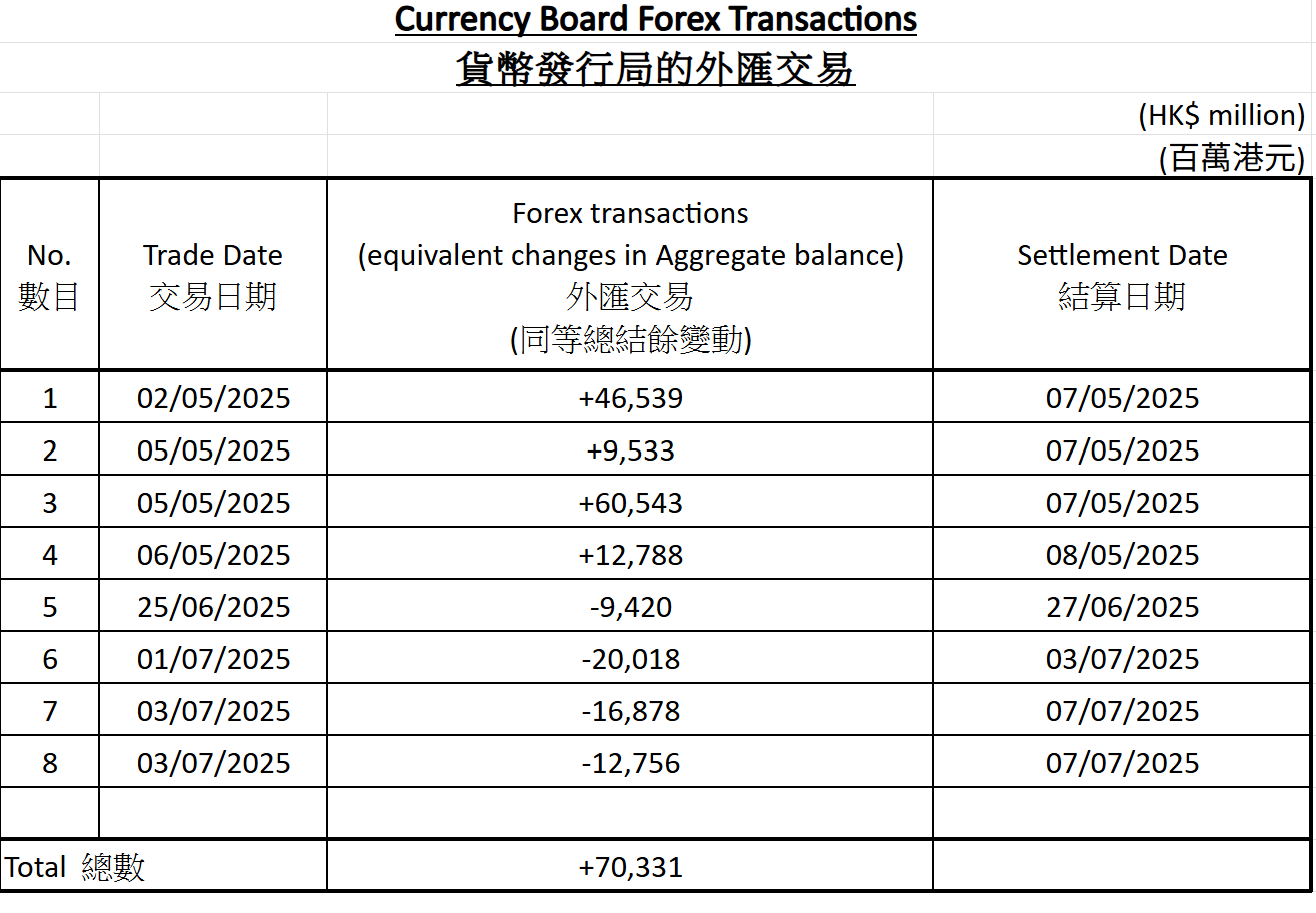

Hong Kong Monetary Authority (HKMA) intervened twice in the foreign exchange market on Thursday (July 3) to soak up a total of HKD 29.6 billion from the city’s interbank liquidity market, as HKD exchange rate fell toward the weak end of its official trading band.

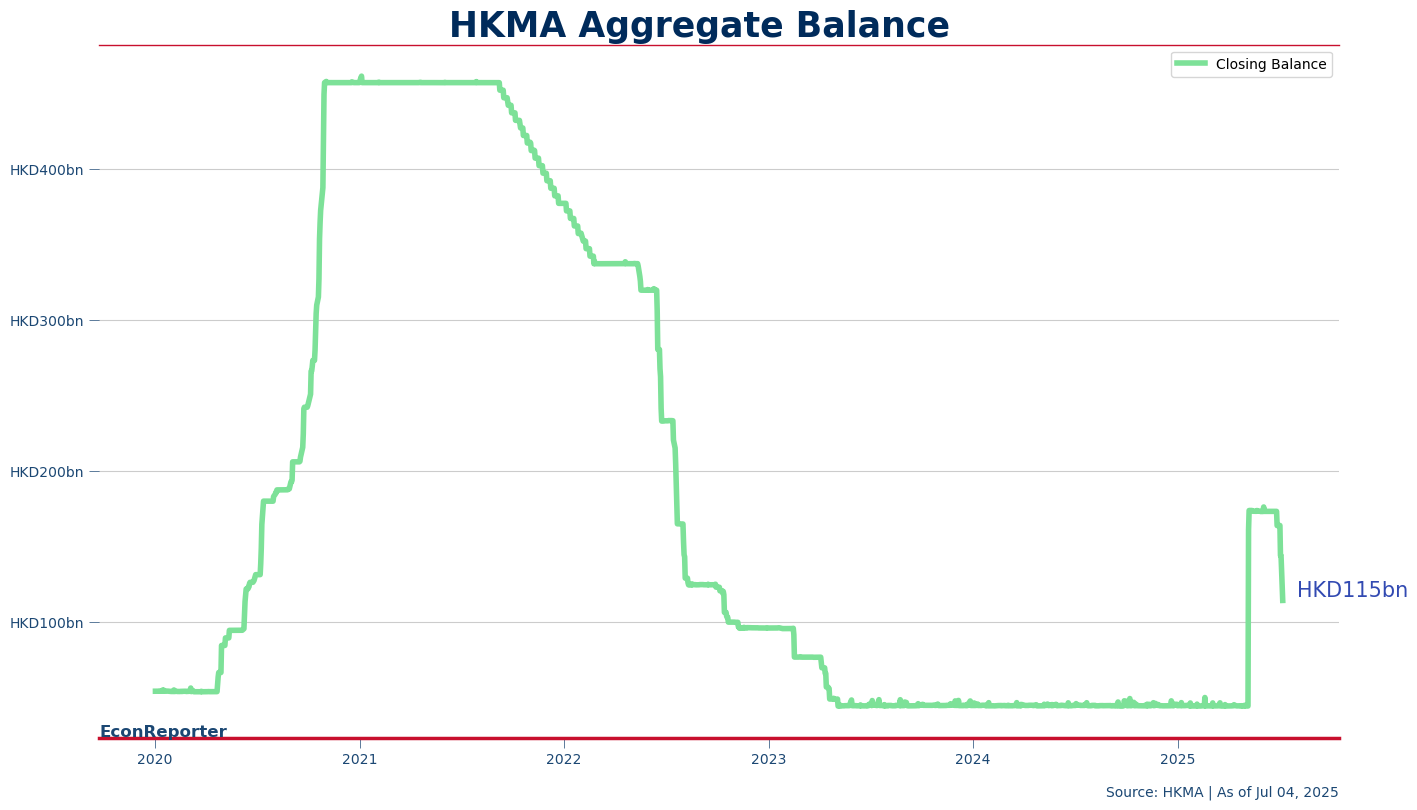

- The foreign exchange intervention, which sells USD to the city’s banks in exchange for HKD, will reduce the Aggregate Balance, the sum of all clearing account banks hold with the HKMA and a gauge of interbank liquidity in the city’s banking system, to HKD 114.5 billion when the foreign exchange transactions settled on Monday.

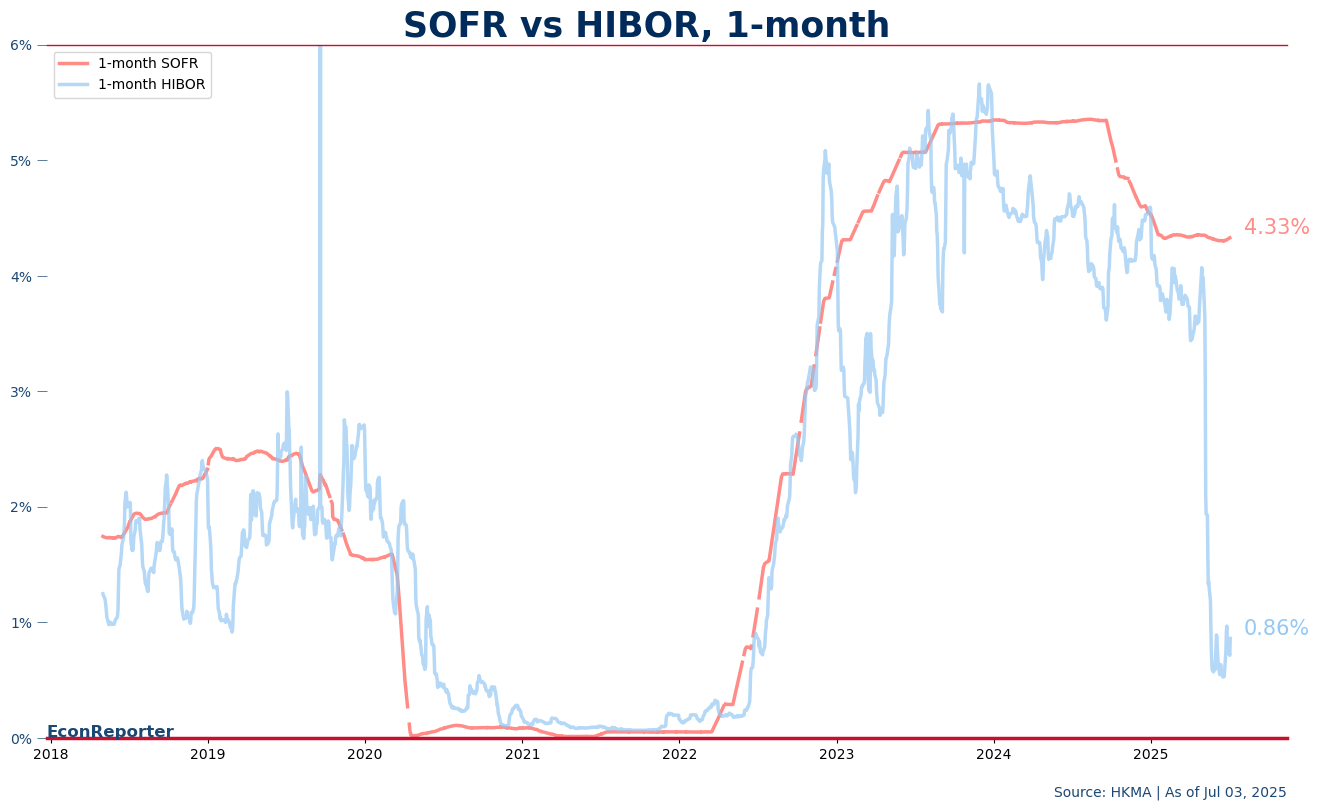

By absorbing liquidity away from the interbank market, Hong Kong Interbank Offered Rate (HIBOR) will likely rise from its unusually low-level back toward alignment with its US counterparts.

- Since HKMA injected HKD 129.4 billion into the interbank liquidity pool via four interventions in early May, the one-month HIBOR, which is the key interest rate tie to most variable mortgage rates in the city, dropped to three year-low and created a persistent HK-US interest rate gap above 3 percentage points.

- One-month HIBOR on Friday edged up to 0.86%, from 0.71% on the previous day; 30-day SOFR was 4.32% at Thursday closing.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡

🚨Advertisement🚨