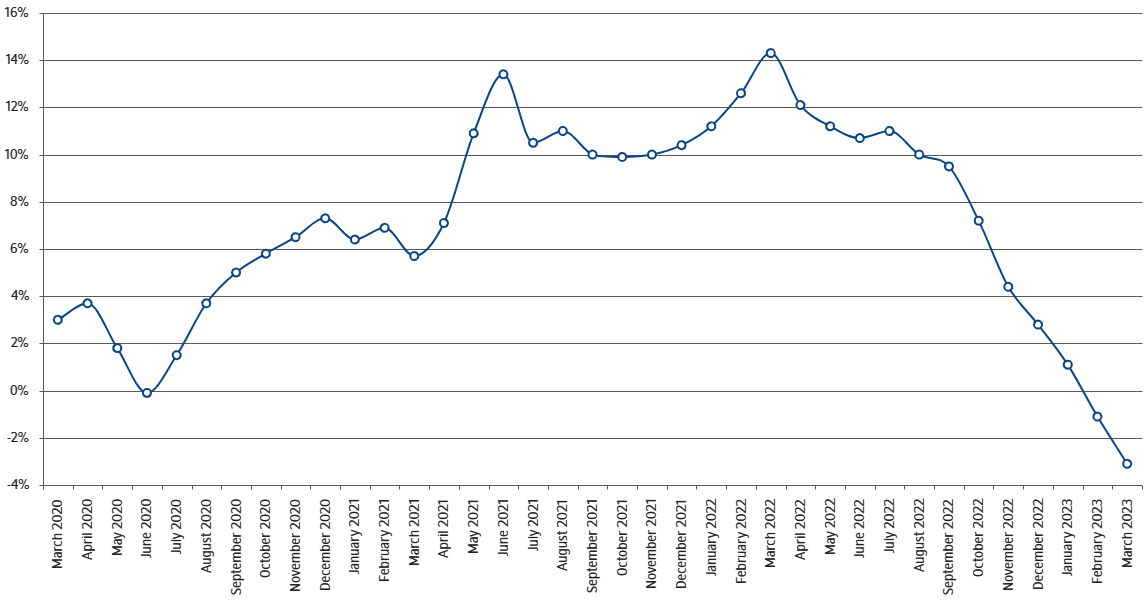

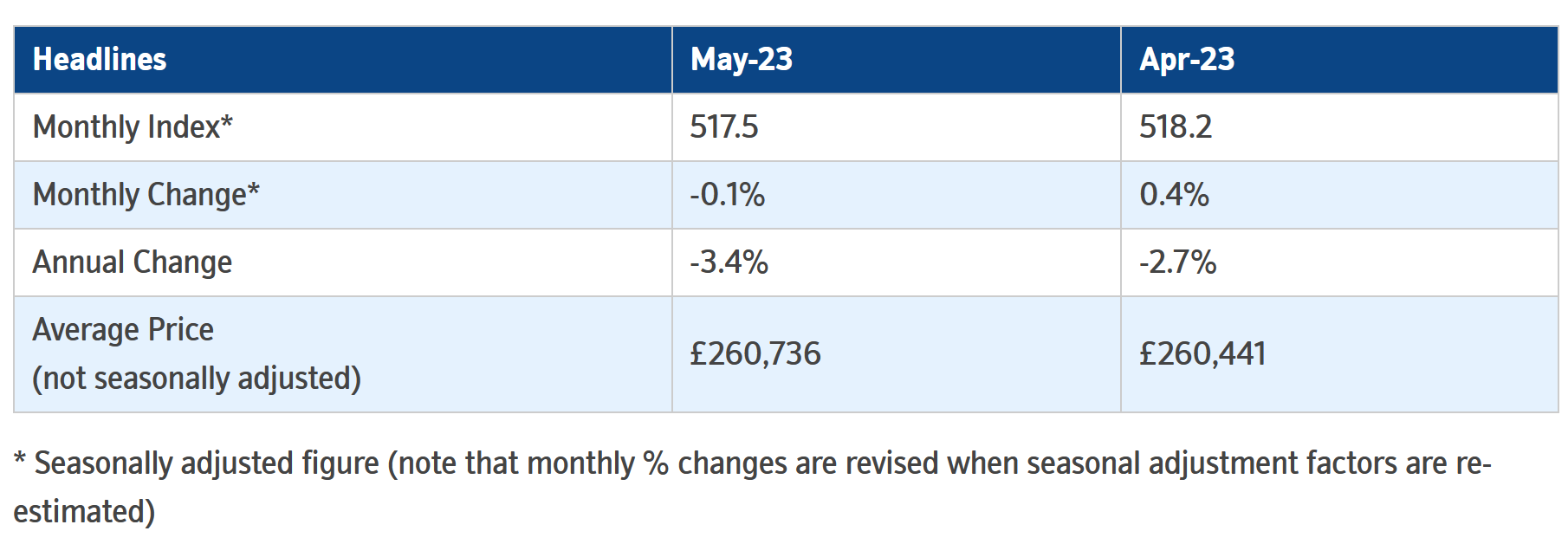

UK house prices continued to decline in May, driven by rising mortgage rates and a significant net repayment of mortgage loans in the previous month, according to the Nationwide House Price Index. The average property prices were 3.4% lower compared to the previous year, accelerating the annual fall of 2.7% in April.

House prices dropped 0.1% MoM

The Nationwide reported a 0.1% MoM decrease in house prices in May, reversing an unexpected rise observed in April. With the exception of the April blip, the Nationwide figures indicate a downward trend in house prices for the past nine months following the Bank of England’s aggressive interest rate hikes.

Nationwide: housing market’s prospects concerning

Robert Gardner, Nationwide’s chief economist, expressed concerns about the housing market’s prospects in the coming months, despite recovery in mortgage approvals and housing transactions.

“[H]eadwinds to the housing market look set to strengthen in the near term,” Gardner noted, citing financial market forecasts indicating that the Bank of England may raise interest rates from 4.5% to 5.5% to bring inflation back to its 2% target. He added that borrowing costs are projected to remain higher for an extended period.

Various lenders, including Nationwide, have already withdrawn fixed-rate mortgage offers and replaced them with higher-cost loans in response to financial market movements following disappointing inflation figures for April, which showed an increase in core inflation to 6.8% from 6.2% the previous month, according to the Financial Times.