In their recent working paper “Nonbank Lending“, economists Sergey Chernenko, Isil Erel, and Robert Prilmeier provided an insightful overview of the sources and terms of private debt financing during the post-crisis period.

The three researchers built a hand-collected dataset of credit agreements signed by a random sample of publicly-traded middle-market firms between 2010 and 2015. Publicly-traded middle-market firms are defined as firms with revenues between $10 million and $1 billion, and they account for about one-third of all U.S. jobs and of private sector GDP.

Middle-market firms are generally not large enough to have credit ratings and access to market-based debt financing but are required by law to disclose the terms of their credit agreements in SEC filings. Therefore, it allows the researchers to study both the price and non-price terms negotiated by different types of lenders.

The first question is, who are the nonbank lenders?

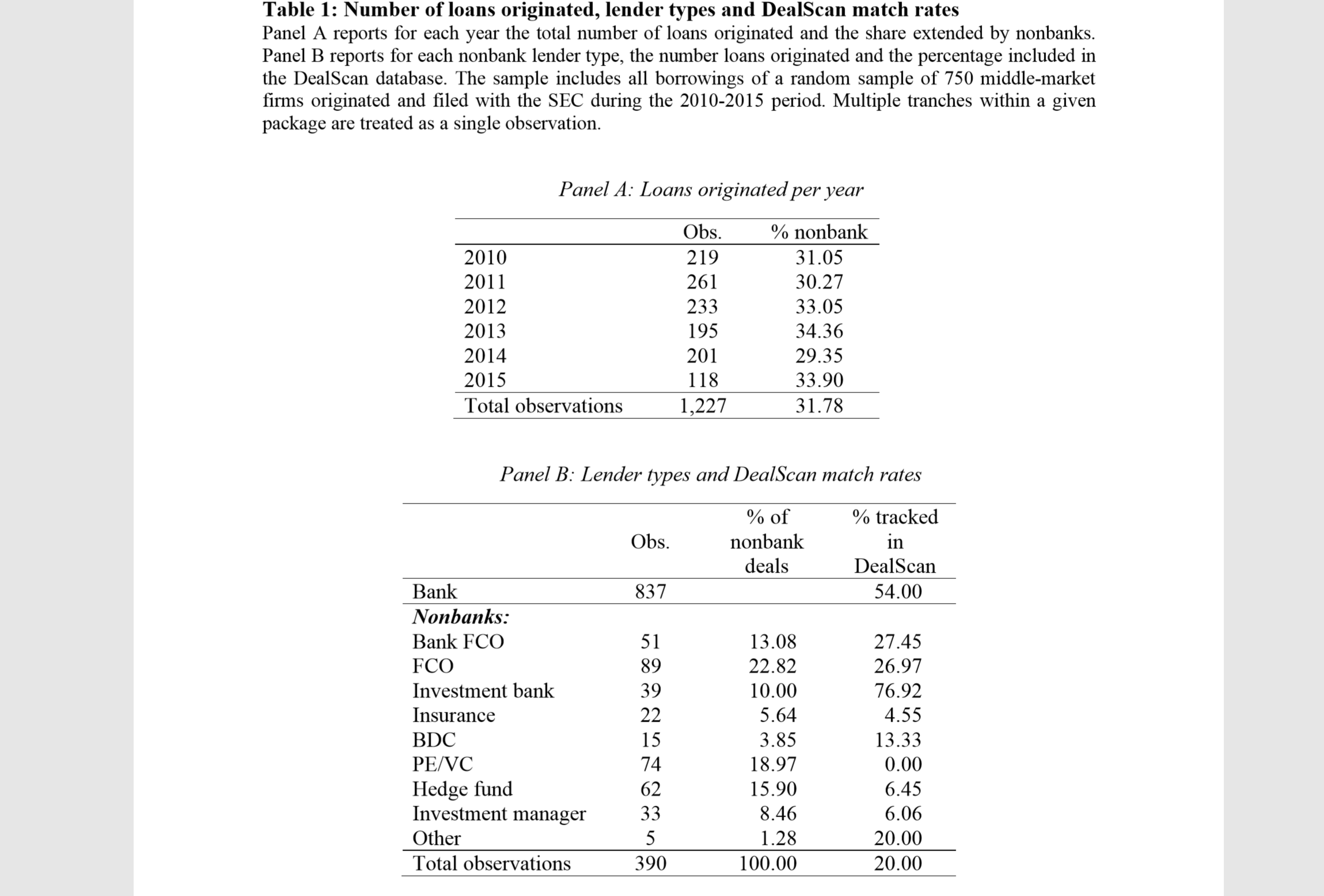

In their sample, the lenders include finance companies (FCOs), bank finance companies (bank FCOs), investment banks, insurance companies, business development companies (BDCs), private equity (PE) and/or venture capital (VC) funds, hedge funds, investment managers, and others.

Among them, FCOs (23%), PE/VC firms (19%), and hedge funds (16%) account for the largest share of nonbank lending.

Firms that borrow from nonbanks are younger, as nonbank borrowers are on average 28 years old compared to the sampled bank borrower’s 37 years firm age. Nonbank borrowers also tend to spend a larger fraction of their assets on R&D, around 9% on average, compared to 5% of bank borrowers. Nonbank borrowers get smaller loans ($74 vs. $188 million) also.

One important difference between the two is that nonbank borrowers are significantly smaller than bank borrowers in terms of their book assets and EBITDA. The average nonbank borrower has book assets of $364 million and EBITDA of $30 million, while an average bank borrower has book assets of $604 million and EBITDA of $75 million.

In fact, EBITDA and negative EBITDA, in particular, are important determinants of whether a firm borrows from a nonbank lender. Consistent with the hypothesis that banks lack expertise in maximizing the value of collateral and therefore they rely on cash flow as the principal source of loan repayment. Furthermore, banks may be reluctant to extend loans to firms with negative EBITDA because such loans would be rated “substandard” by regulators.

On the interest rate front, nonbank loans are priced 457 basis points higher than the interest rate on bank loans, although part of this difference is due to nonbank borrowers being riskier. Controlling for firm characteristics and other loan terms, the economists suggest that the average difference in interest rates is still around 200 basis points between the bank and nonbank market.

Nonbank loans generally have higher reported leverage prior to loan origination (36% vs. 26%) than bank borrowers. Higher leverage is consistently associated with a significantly higher probability of borrowing from a nonbank lender. A 10% increase in leverage is associated with about a 4% increase in the probability of borrowing from a nonbank lender

Another noteworthy characteristic is that nonbank lenders are significantly less likely than banks to include financial covenants or performance pricing provisions in their loans. The authors conjectured that, rather than relying on financial covenants to monitor borrowers’ ex-post performance, nonbank lenders engage in extensive ex-ante screening.

Nonbank lenders such as hedge funds and other asset managers may have a comparative advantage in identifying good investment opportunities. And the type of unprofitable, R&D intensive firms that these lenders provide funding to may require more ex-ante screening than older than established firms that are already profitable. If nonbank lenders do engage in more ex-ante screening than bank lenders, we may expect nonbank borrowers to experience larger announcement returns around loan origination.

The authors tried to verify this hypothesis, and they find there are large positive abnormal returns on the stock price of the middle-market firms around announcements of nonbank loans. Nonbank loan announcement returns are 1.5% higher than those for bank loans. When controlling for firm and loan characteristics, the return difference remains similar at 1.3% (though it loses statistical significance). The results are suggestive that at least some market participants becoming aware of the successful closing of a loan before the 8-K is filed, hence created the abnormal return.

Here is the full paper:

Nonbank Lending by Sergey Chernenko, Isil Erel, Robert Prilmeier :: SSRN

We provide novel systematic evidence on the terms of direct lending by nonbank financial institutions. Analyzing hand-collected data for a random sample of publ