The faster the credit growth, the worse it is for real growth (output per worker). This is what Stephen G. Cecchetti and Enisse Kharroubi want to explain in their NBER working paper “Why Does Credit Growth Crowd Out Real Economic Growth?”

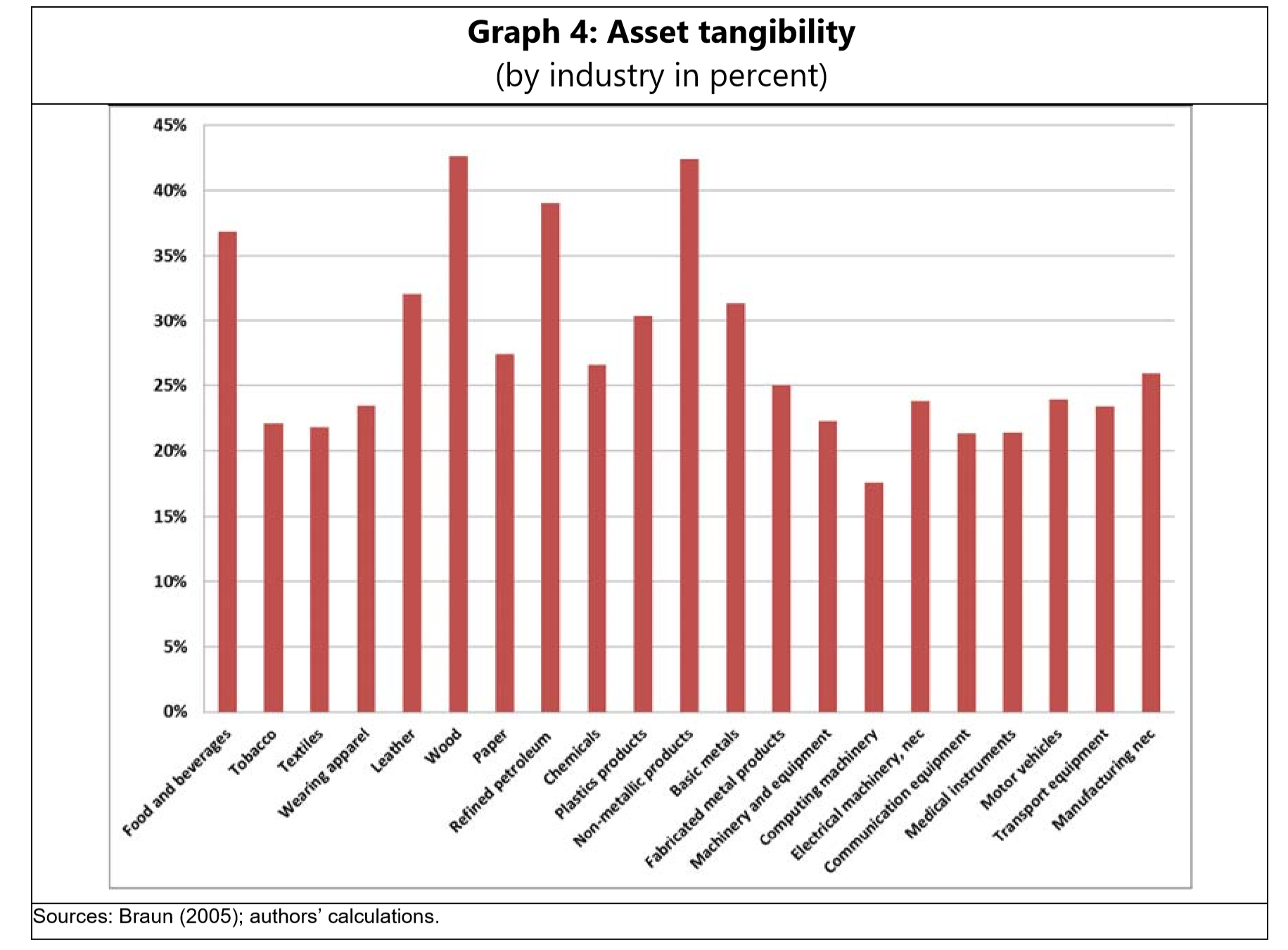

As the two economists have shown in their research, with a sample of 20 advanced economies from 1985 to 2009, the real GDP and real credit growths are correlated as would be expected, positively. But in the case of real GDP per worker, the correlation turns negative. That is, as real credit grows faster, labor productivity growth declines.

The left-hand panel of the graph above plot growth in real GDP on the vertical axis against growth in real credit to the private sector on the horizontal axis. In the right-hand panel, it is growth in real GDP per person employed versus growth in real credit to the private sector.

The left-hand panel of the graph above plot growth in real GDP on the vertical axis against growth in real credit to the private sector on the horizontal axis. In the right-hand panel, it is growth in real GDP per person employed versus growth in real credit to the private sector.

The negative relationship between finance/credit growth and real economic growth is an empirical fact which many economists have tried to explain. In this paper, Cecchetti and Kharroubi built a model which assumes entrepreneurs’ choice of a project depends on both current and future ability to borrow. In this case, the ability to use the output to secure funding is essential for the entrepreneurs, so they bias toward choosing projects that are easy to obtain financing, even if the return or productivity of those projects are low.

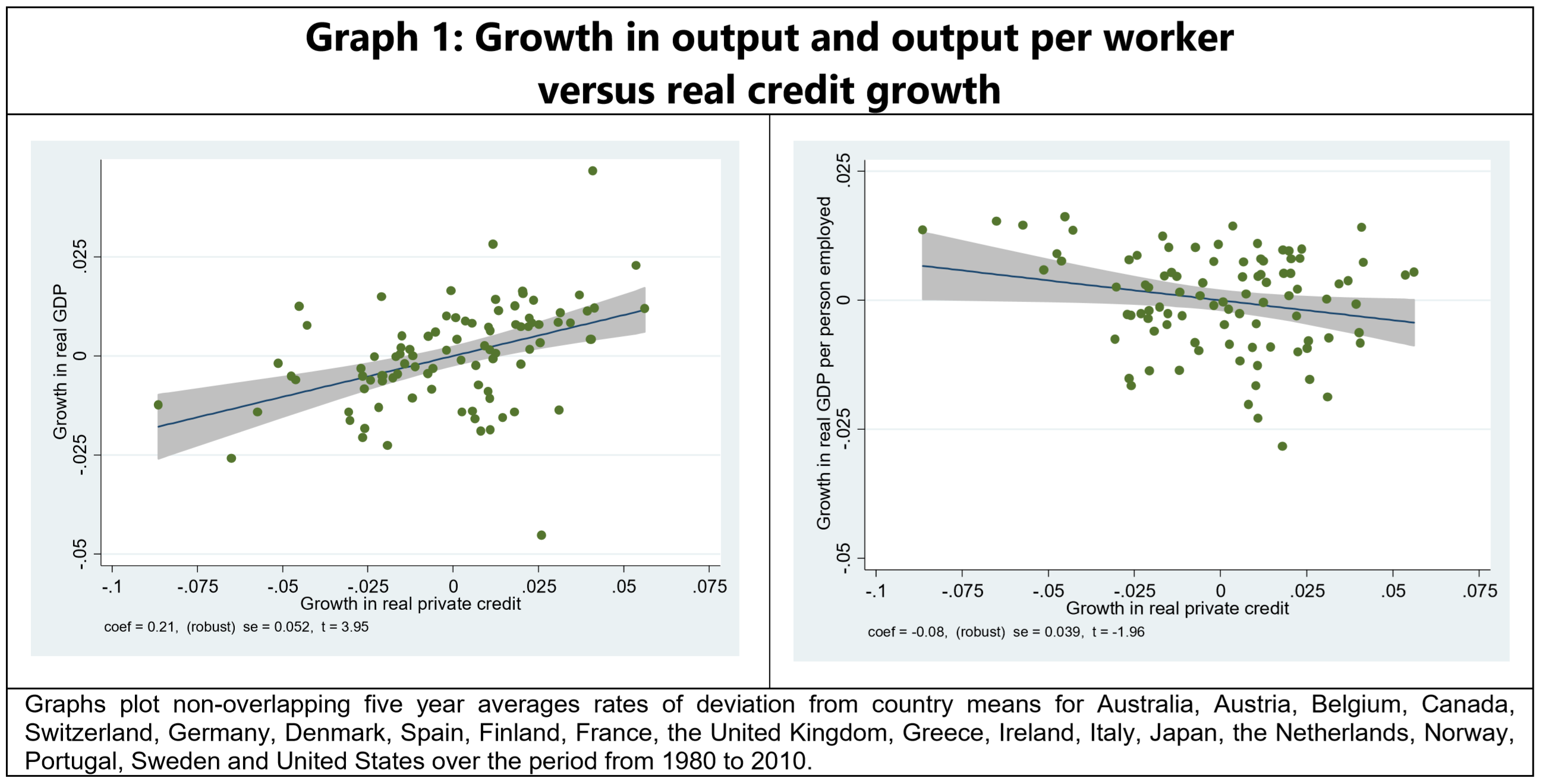

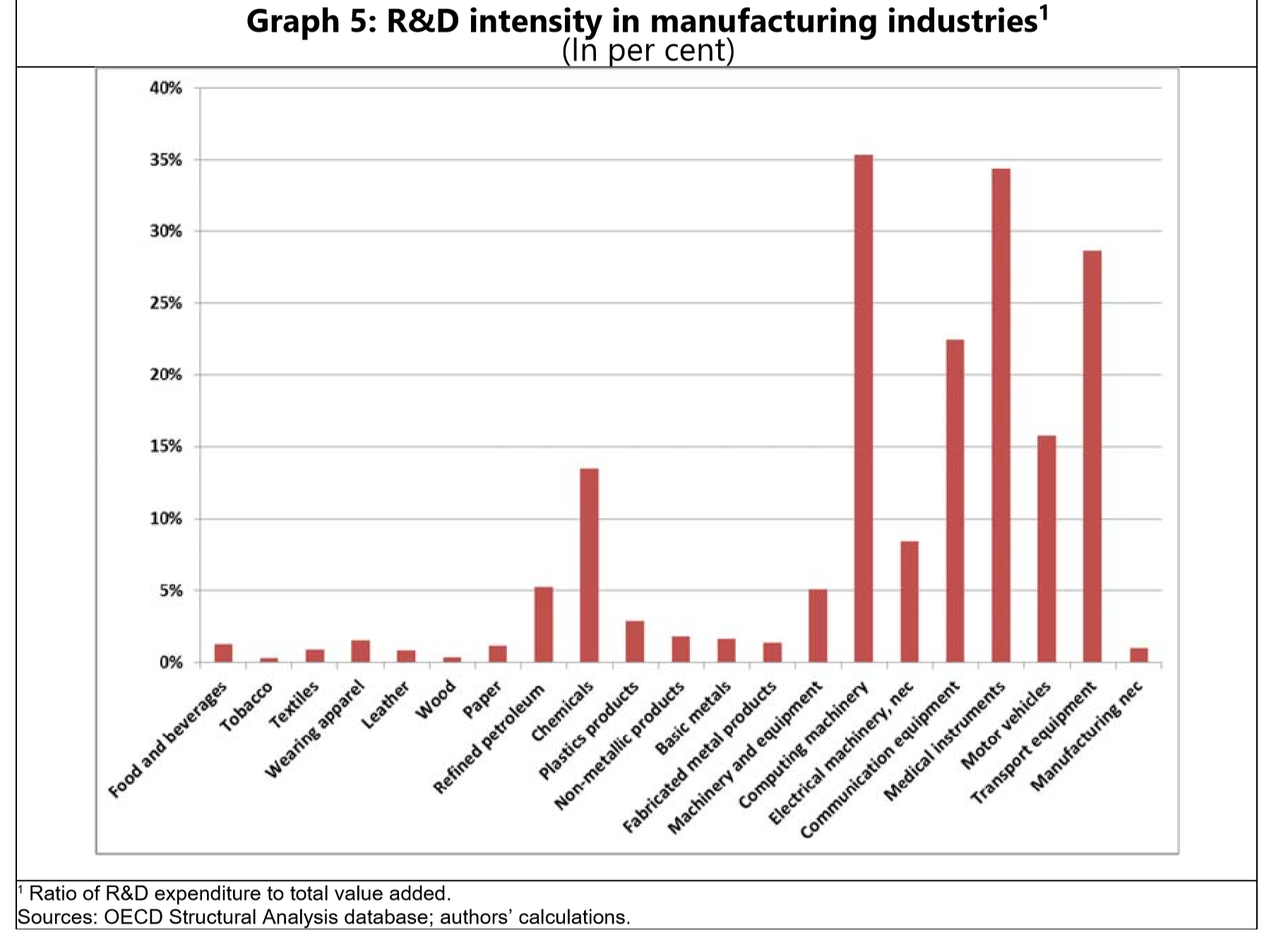

Hence, the faster the growth in credit, the safer and less productive the projects are undertaken, therefore the slower the real growth. The testable implication of the model is that projects with more tangible asset will be less harmed as credit growth increase. So, industries with higher asset tangibility or lower R&D intensity tends to grow faster in a credit boom.

Confirmed by the regression result, labor productivity growth and industry-level asset tangibility have a positive relationship, given positive credit growth. According to the difference-in-difference estimate, the productivity of an industry with high asset tangibility located in a country experiencing a financial boom tends to grow 3½-4½ percent a year more quickly than an industry with low asset tangibility located in a country not experiencing such a growth.

Confirmed by the regression result, labor productivity growth and industry-level asset tangibility have a positive relationship, given positive credit growth. According to the difference-in-difference estimate, the productivity of an industry with high asset tangibility located in a country experiencing a financial boom tends to grow 3½-4½ percent a year more quickly than an industry with low asset tangibility located in a country not experiencing such a growth.

The relationship between labor productivity growth and R&D intensity, on the other hand, is negative, given positive credit growth also. The productivity of a sector with high R&D intensity located in a country with a rapidly-growing financial sector grows between 2 and 2½ percent a year more slowly than a sector with low R&D intensity located in a country whose financial system is growing slowly, as indicated by the difference-in-difference estimate.

In sum, as low productivity industries usually have more tangible assets, which allow them easier to obtain funding this is especially true in times of rapid growth in finance and credit. The unintended consequence is that labor productivity and the real economic growth ended up slower.

Here is the full paper on NBER:

Why Does Credit Growth Crowd Out Real Economic Growth?

NBER Working Paper No. 25079 Issued in September 2018 NBER Program(s):Monetary Economics We examine the negative relationship between the rate of growth in credit and the rate of growth in output per worker. Using a panel of 20 countries over 25 years, we establish that there is a robust correlation: the higher the growth rate of credit, the lower the growth rate of output per worker.

EconReporter is an independent journalism project striving to provide top-notch coverage on everything related to economics and the global economy.

💡 Follow us on Bluesky and Substack for our latest updates.💡