The economics of tax evasion is a growing field in academic economics. There are much new exciting research trying to understand the mechanism behind global tax evasion. “The Missing Profits of Nations” by Thomas R. Tørsløv, Ludvig S. Wier and Gabriel Zucman is one of the most noteworthy research on the dynamic behind global tax evasions.

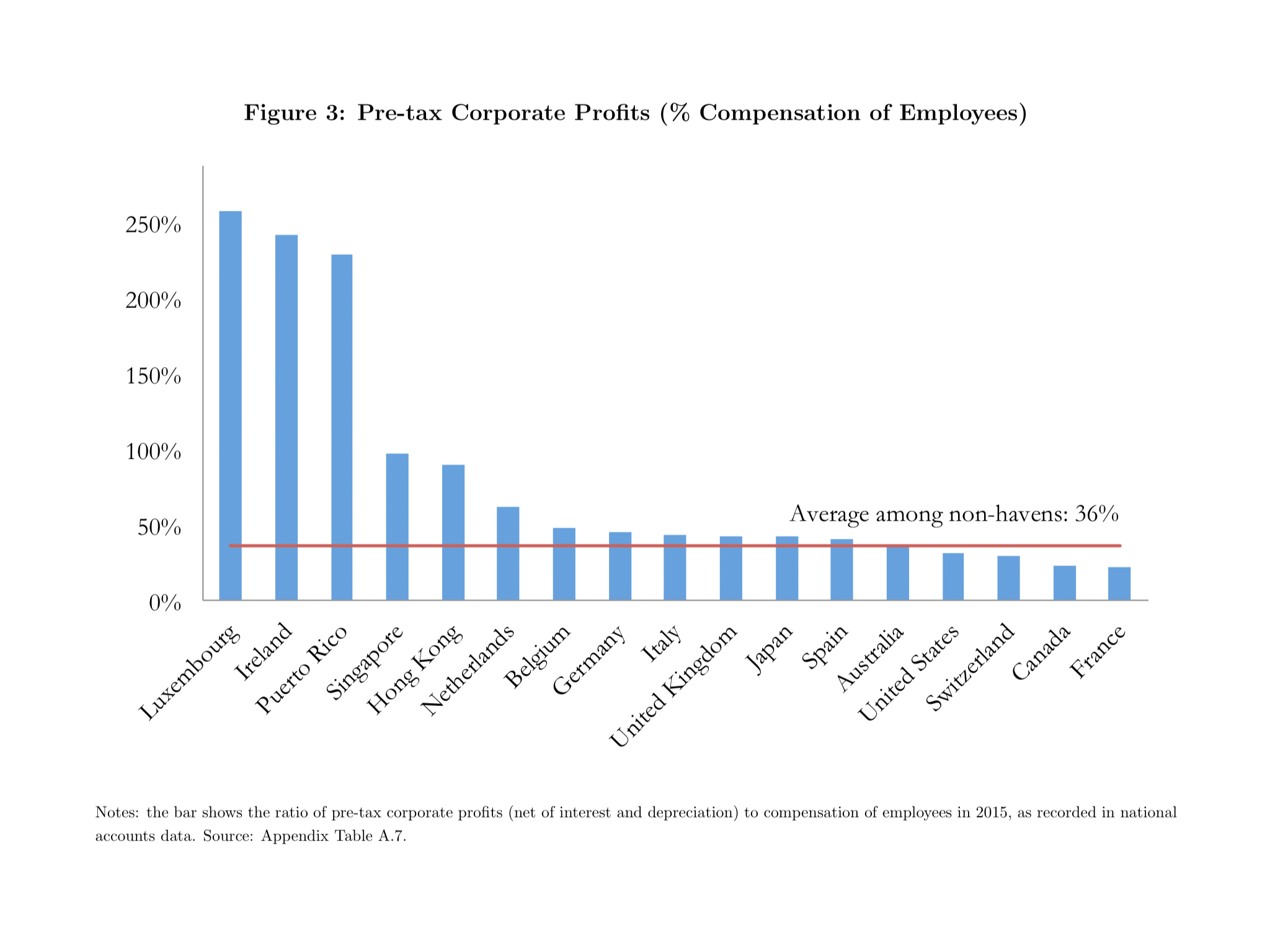

One important founding of Tørsløv et al. is the vastly different behavior of the profit to wage ratio for companies in tax havens and in “normal” advanced economies. According to their research, the profit to wage ratio of companies in tax havens, which mostly consisted of affiliates of multinational corporations, are above 100%; in Ireland, Puerto Rico, and Luxembourg, the ratio even exceeds 200%. But the same ratio in non-haven countries is averaged 36%, in the US it is 31% and 42% in the UK.

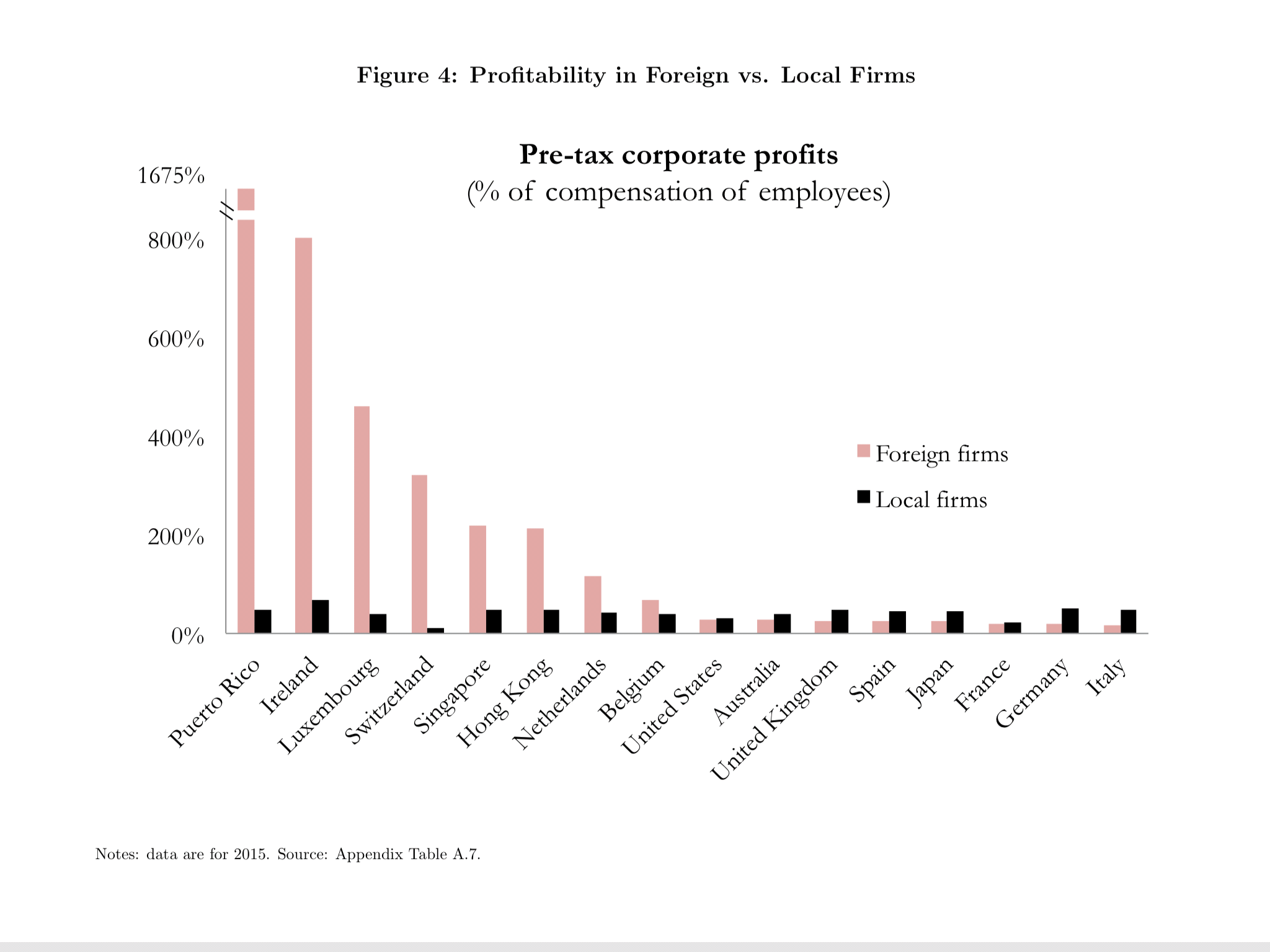

Also, the profit ratio for foreign affiliates is much higher than the local firms. But the local firms in different countries, whether it is a haven or not, have a similar profit to wage ratio. This further indicates that the foreign affiliates in haven counties have an abnormally high profitability, another indication of profit-shifting of multinationals.

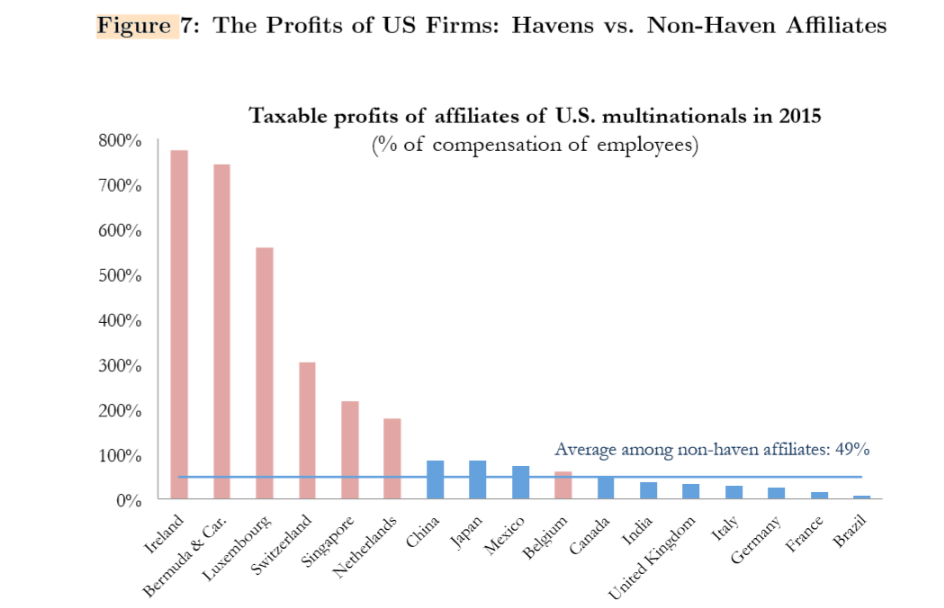

An alternative way to measure the extent of profit-shifting is by comparing the profit-to- wage ratio of affiliates in tax havens and affiliates in non-havens. Using the data of US multinationals, the researchers found that haven affiliates much more profitable than non-haven affiliates in the same sector.

These are evidence of vast profit shifting by multinationals to tax havens. Assuming the profit ratio in havens and non-havens should be equal, the three economists estimated that more than $600 billion in profits were shifted to tax havens in 2015.

How they shift the profits?

In general, there are three ways for multinationals to shift profits. First, multinationals can manipulate infra group exports and import prices. Subsidiaries in non-haven countries export good and services at low prices to related affiliates in tax havens.

Second, multinationals shift profits using intra-group interest payments. Subsidiaries in high- tax countries borrow money at a relatively high-interest rate form affiliates in low-tax countries.

Third, multinational shifts the intangibles, such as trademarks, logos, and algorithms, to affiliates in tax havens and continuously transfer “profits” in the form of royalties to them.

Understanding the profit shifting behavior is vital for evaluating the limitations of mainstream explanation on the dynamic of corporate tox change.

The standard theory is that non-haven countries want to attract investment capital, so they cut the tax rates. However, the profit- shifting methods mentioned suggests that multinationals do not inject physical or investment capital to tax havens. They only artificially transfer their intangible asset and profit into the affiliates in haven countries. This process “inflates” the economic statistics of the havens; However, the real economic benefit of such profit-shifting is minimal.

[Traditional Chinese version of this article can be found here]