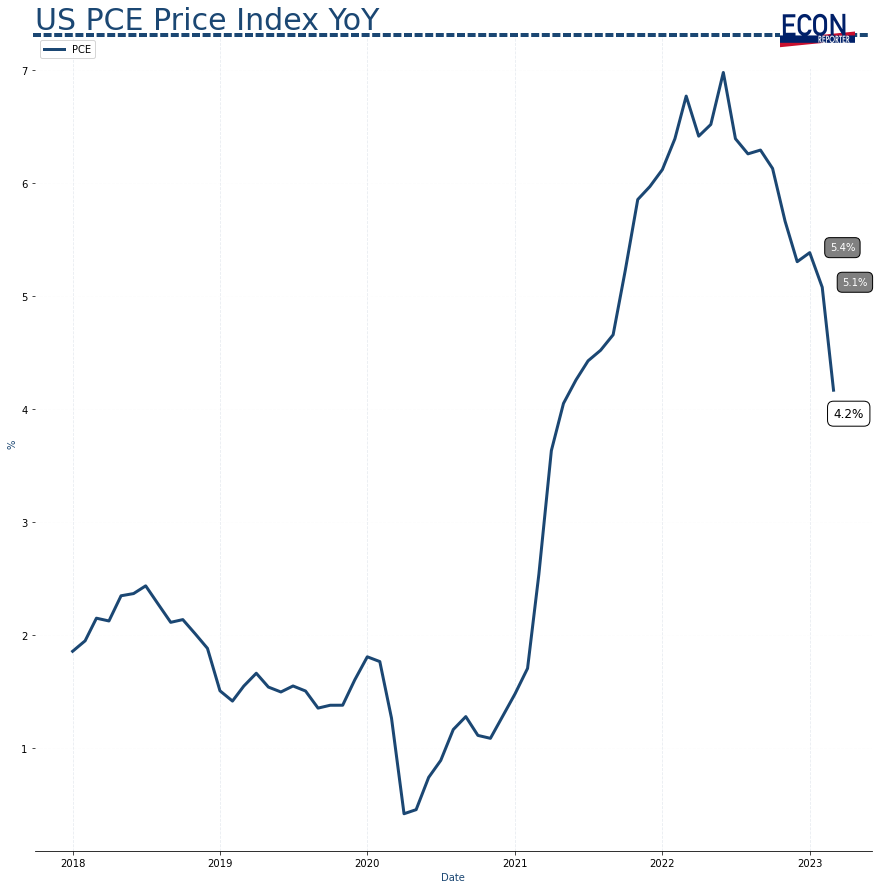

Headline inflation figure from the PCE price index shows a clear deceleration in March, with the year over year rate dropped to merely 4.2%, down from 5.1% in February.

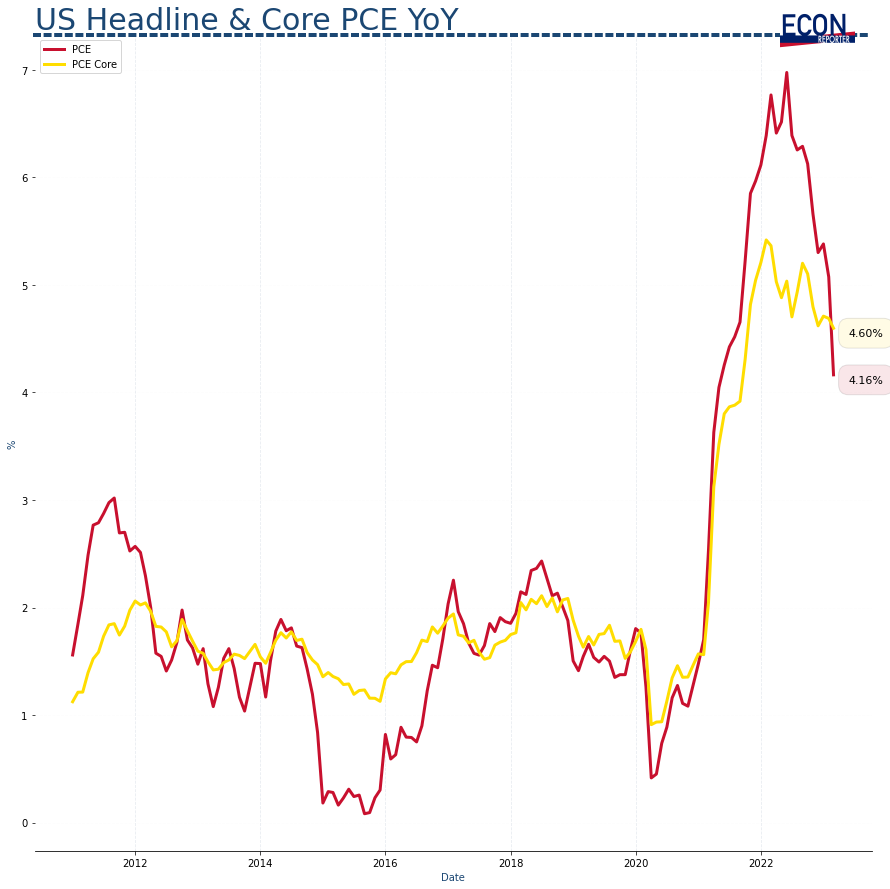

The so-called core rate, which excludes the more volatile food and energy prices and is preferred by the Fed to use as a gauge of underlying inflation, however, didn’t shows a similar fall, only took a step down to 4.6% from 4.7% in February.

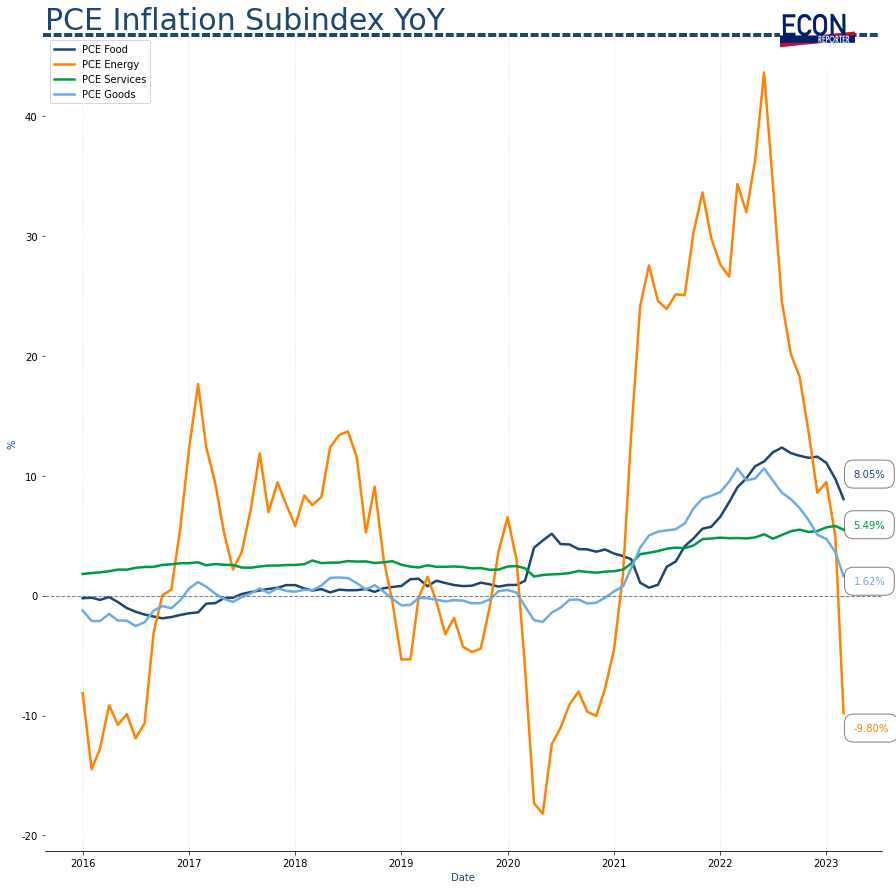

The sharp fall in headline number is mostly driven by the nosedive of energy prices, which booked a 9.8% YoY decrease in the last month of Q1, the largest decrease since Nov 2020.

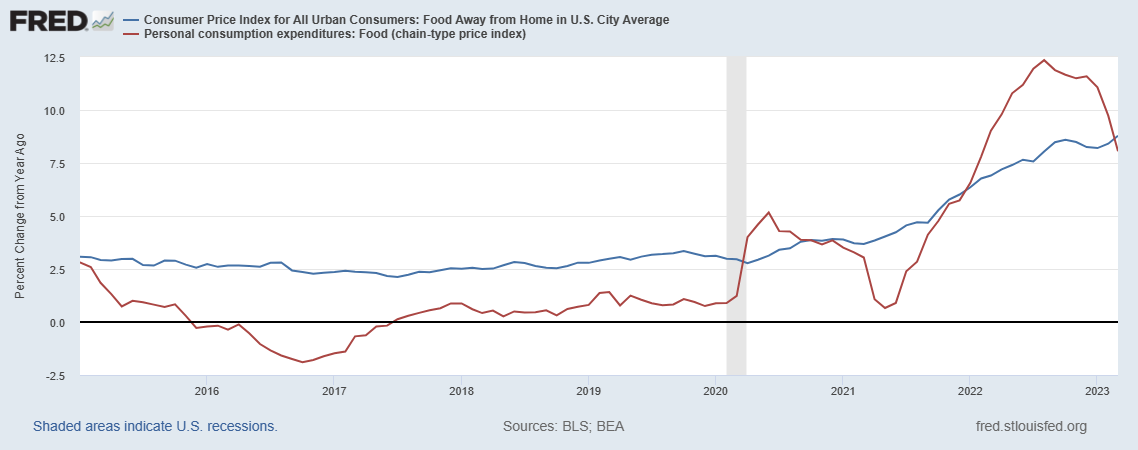

Food inflation in PCE price index, which only “consists of food and beverages purchased for off-premises consumption” but excluding food services such as purchased meals and beverages, also shows a clear decelerating trend.

It is interesting to see that, comparatively, the food index in CPI, even if we only focus on the food away from home index, still failed to show such a clear down trend as of March (though the YoY growth are in very similar rate in March now).

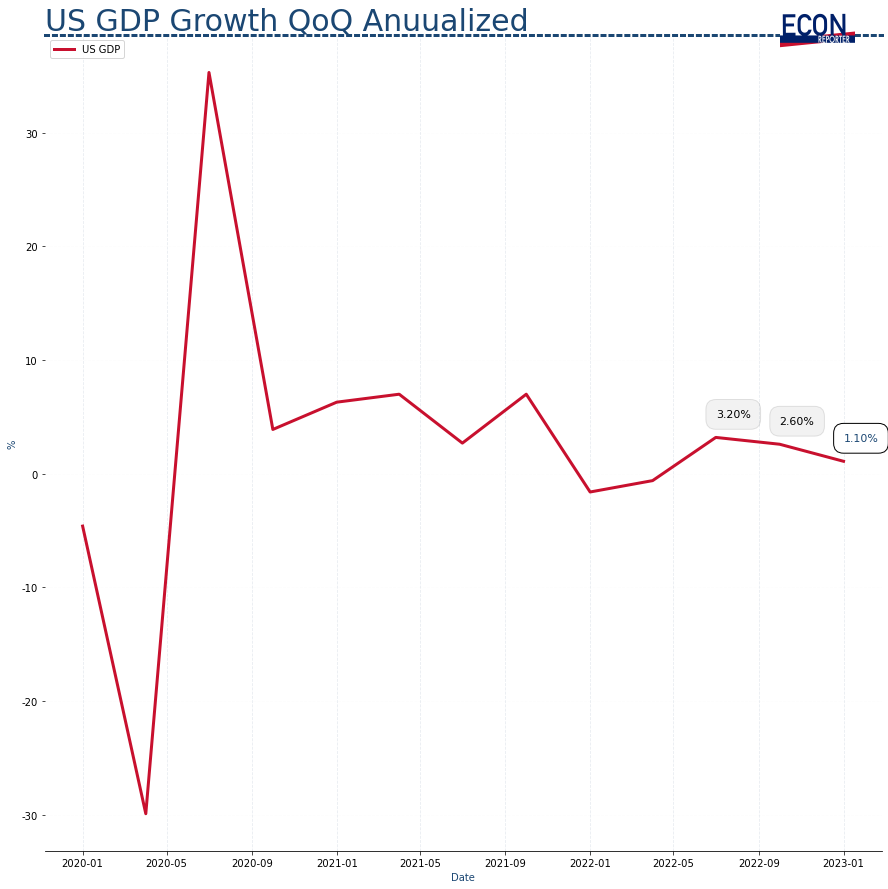

The PCE price index relelase followed the advance estimate of Q1 GDP for the US, which shows a 1.1% annualized growth rate from the previous quarter. That is a slow down from Q4’s 2.6% and missed market expectation of 2%.

These two reports generated concerns that the US economy is facing a mild stagnation — that the economy is entering a period of slowdown while the Fed failed to timely send inflation back down to below its 2% traget.

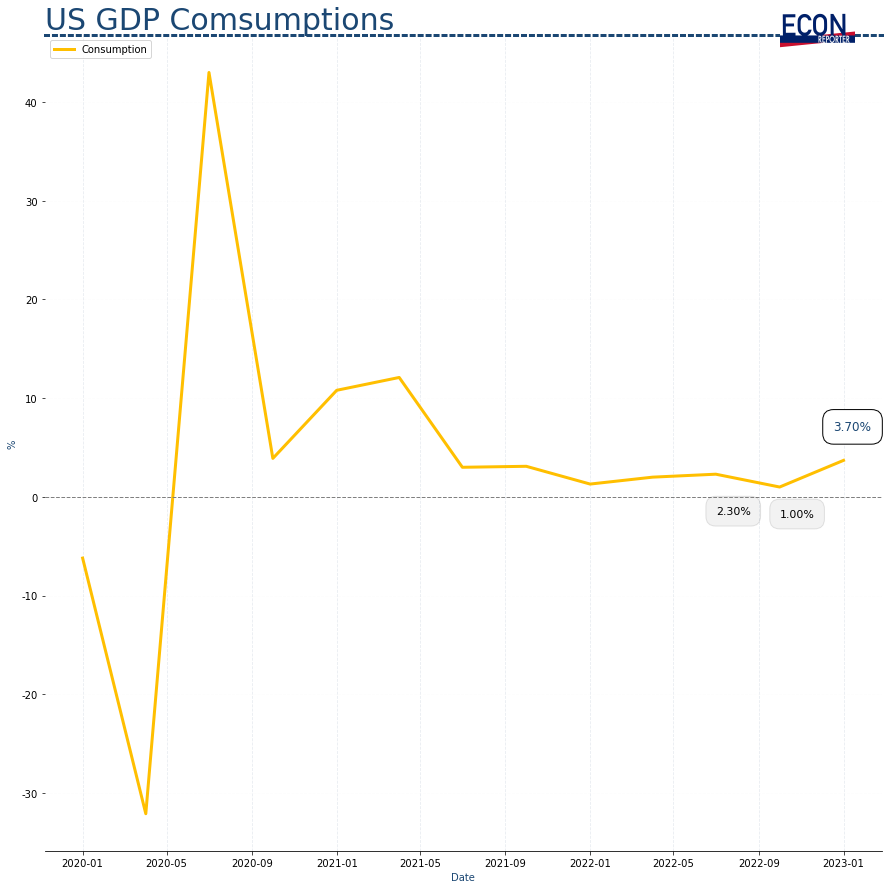

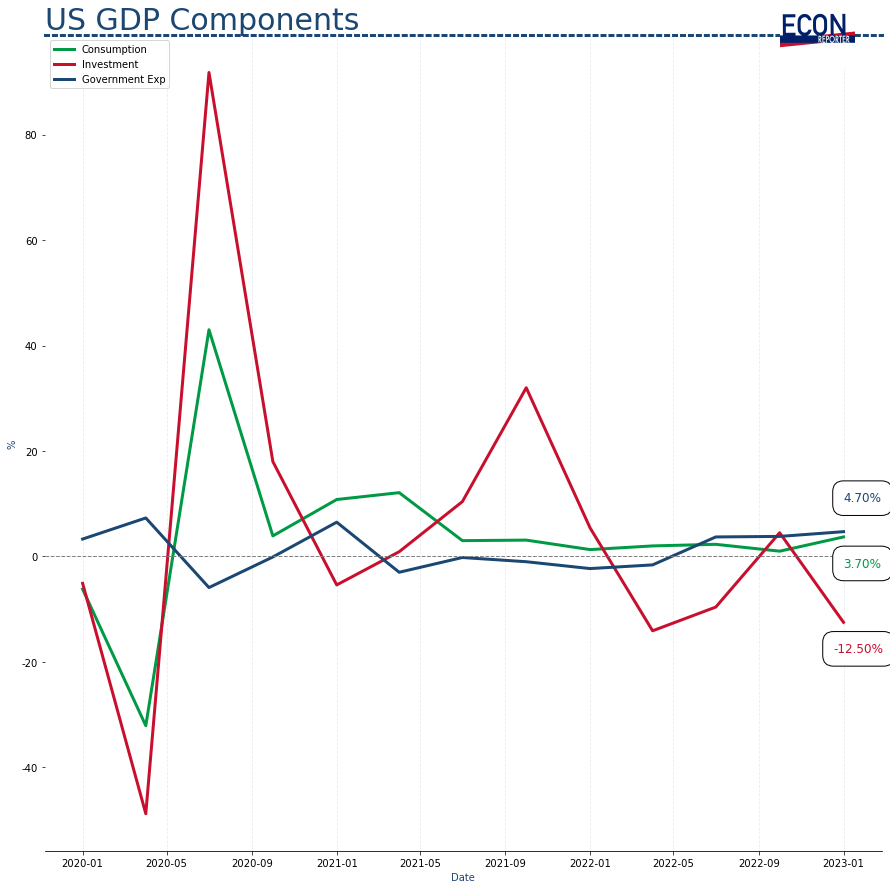

Digging in the GDP figures, they show that, on one hand, consumption expenditure is still expanding at a 3.7% rate, fastest since 2021 Q2, showing consumer demand has yet been subdued.

On the other hand, private investment suffered a sharp contraction in the quarter, falling at a 12.5% annualized rate. The freefall in investment was mostly a result of companies drawing down inventory, which contributed 2.26 percentage point reduction in the headline GDP figure.

Companies clearing their inventory may reflect a pessimistic sentiment among business owners, as they worry an economic downturn can hurt their bottom-line in a near future.

So the US economy is currently in a delicate position: the business sector is seemingly feeling wary about an upcoming recession as the Fed’s rate hike started to squeeze their operations, but the statistics still shows booming consumer demand at the moment.

The pressing question right now is therefore — when will the consumption boom ends and whether inflation will die down faster than demand?

>>> You can follow EconReporter via Bluesky or Google News