“Where is the General Theory of the 21st Century?” is an interview series which ask top economists a very important question: “Why haven’t economists come up with a new General Theory that can explain the Great Recession?” This is an inquiry into how the macroeconomics academia changed since the Great Recession, and why the responses from macroeconomists since 2008 are different from their counterpart in the 1930s.

In this installment, we talked to Olivier Blanchard, the C. Fred Bergsten Senior Fellow of Peterson Institute for International Economics and formerly the economic counselor and director of the Research Department at the International Monetary Fund. He was also the chair of the economics department at MIT from 1998 to 2003 and remains as Robert M. Solow Professor of Economics Emeritus.

Introduction

Blanchard is one of the pioneers in the developments of New Keynesian economic models.

He has written two influential textbooks on macroeconomics, one is the “Lectures on Macroeconomics” coauthored with Stanley Fischer, an essential reading for many graduated level macroeconomics courses. Another one is “Macroeconomics” , an insightful macro textbook for undergraduates.

(The transcript below has been edited for clarity. All mistakes are ours.)

Keynesian Revolution of the 21st Century?

Q: EconReporter B: Olivier Blanchard

Q: Do you think there is another “Keynesian Revolution” happening in the macroeconomics academia since the Great Recession?

B: I think so. If you think of Keynesian Economics as the theory insisting that the demand side is the most important determinant of activities in the short run, then the answer is yes.

To understand what has happened to the world economy since 2008, one needs to look at what has happened to the demand . I think this is probably a generally accepted notion now.

Q: Yet, most of the “new ideas” emerged after the Great Recession are actually the resurgence of old ideas.

In this sense, do you think macroeconomics is, in fact, moving forward in recent years?

B: I think we now have a much better understanding of the short-run and the long-run effect of the financial shocks.

For example, what some people called financial cycle, or I should just call it financial shocks as I am not sure if in fact there is a financial cycle, clearly has some major macroeconomic effect. This is one example of what we understand much better than in 2007.

Q: Do you think that progress like these are “game changers” to the development of macroeconomics?

B: Two parts for the answer. Is it a game changer? No.

But it has added something that was missing to the basic model, that is the financial sector. Once we have done this, we have a different type of model and a different view of how the economy works.

So, is it a game changer? I am not sure. But it is an important development.

Another thing is that as the crisis has been so complex in so many ways, I think economists are much more willing to explore new mechanisms, new distortions, and new facts now. Much more so than they were in 2007. I think the facts that we did poorly in predicting the crisis and explaining what was going on have led to more open-minded research in macroeconomics.

Do DSGE Models have a Future?

Q: In your paper “Do DSGE Models Have a Future?”, you have mentioned one of the problems of DSGE models is that it is difficult to be used for communication with the public.

Why can’t we have some simple and stylized DSGE model and use it for the discussions with non-economist?

B: As I have said in the note, you can’t have one model for everything.

If you want to have a model for the Fed or the IMF to make policy advice, then it has to fit the data and explain the data well. Otherwise, you can’t pretend to be able to explain the world.

If you want to conduct a counterfactual simulation to see what happens if the Fed increases the interest rate by a 100 bp, then the model has to have enough structure to be useful for that.

This is the first type of macroeconomics models. I think this kind of model has to be close to reality and has a clear analytical structure so that you can work on the counterfactuals.

Then you have a second type of models, and DSGE model (Dynamic Stochastic General Equilibrium Model) should be in this category. It is the more theory-based models so that researchers can use them as a common basis to add and discuss distortions, or any other mechanisms they want to explore. This kind of model is not for policy advice directly so they don’t need to be as close to the data as the first type of models.

I think DSGE models should be theoretically based, which means that to a large extent they should be micro-founded. This should be generally accepted as a starting point. When you want to look at the effect of some new mechanism, that is what you will have in mind.

The third category of models is what I would call pedagogical or “toy” models. This kind of models should be simpler. For example, ISLM or three-equation New Keynesian Model is in this category.

The idea is to capture what are in the big ones but to be explained in a simple way. When we want to introduce a new mechanism, we can explore first in an ISLM model and see what happens. We may then put it in the DSGE model.

In the same way, if I do a DSGE simulation and I found an interesting result, I might want to translate it into the ISLM and say it in terms of how the IS or LM curve shift.

The fourth type is the pure statistical models like VARs (Vector Autoregression Model). They are useful to describe the data and for assessing the correlations. We can try to see whether more structural models fit the data or not. That is a very different exercise.

They don’t need to be microfounded. They are used to characterize the data in a way which we can potentially understand.

Q: Do you agree that policymakers should focus on using the structural model for policy making and the “toy” model for better communication with laymen? Or they should use both of them?

B: Yes, policymakers should use both the first (policy models) and the third type (toy models).

The staff of the central bank should be working with the complicated models that they understand. When they go and report to the board, for example to the FOMC, they should present the result of these models.

Yet, they should also give a simpler explanation based on toy models, like the ISLM model. When the central bankers have to explain to the public what they are doing, they should use some kind of toy model formally or in words only.

Still, the hard work has to be done using the first type of models, right?

More empirical integrations into DSGE?

Q: What is the role of empirical work in the development of DSGE models? Is it possible to have a bigger role for empirical models to be in the DSGE model?

B: The current approach is to use calibration rather than estimation for most of the coefficients. Then we do Bayesian estimation to estimate the remaining parameters and the system as a whole.

I think the evidence from the vast body of econometric work should be used much more. For example, in order to specify the consumption function, we should do it by using all kinds of information — single equation estimation, natural experiments, case studies, or anything else. Then, use all these pieces to characterize a consumption function which can then be put in the DSGE model.

Once this is done, we want to make sure that the DSGE replicates the VAR representation of the data. If the dynamics of the DSGE are close to those of the VAR, the job is done.

If not, one has to go back to the drawing board and see why the DSGE model is not replicating the VAR dynamics.

But this is a completely different exercise, which involves building on the work of hundreds of people who do partial equilibrium estimation.

This is not done at this point and DSGEs are largely operating within an intellectual silo with less than enough interaction with the rest of the empirical work going on in macro.

Q: Is the way to build a model which you have just mentioned too ideal to be possible?

Or is it just macroeconomists not working fast enough to make significant progress in macroeconomics?

B: I think there is a lot of progress. If, say, we look at the NBER working papers, there are five or six macroeconomics papers coming out every week and They are all extremely interesting.

What happens is that these new research have not been fed into the DSGE models. The DSGE models live in their own universe. They do not build on the very good works that are happening in macroeconomics in the recent years.So, it is not that we don’t have enough good research. It is that there are not enough coordination and integration of the results.

Q: Is there any other ways to speed up the progress in coordinating and integrating the research?

Maybe the IMF Annual Research Conference “Macroeconomics after the Great Recession” you co-hosted this year is one of those efforts to further the coordination?

B: Yes. There is another project by David Vines, professor at Oxford University.

He, together with other researchers, is trying to build an alternative DSGE. It will be microfounded, but will also be based on more realistic consumption functions, investment behavior, asset demand. It is building on the works that are done by others. And there are other projects at work also. I hope some of them will be successful.

“I would use this model to explain Macroeconomics to my Mum”

Q: In another one of your note “How to teach intermediate Marco after the crisis”, you have mentioned a IS-LM-Phillips Curve model. Is this a kind of toy model you have just mentioned? Are you confident that more students will learn about this?

B: Actually, I have done just that in my own textbook. If I have to teach undergraduate students, I don’t want to teach them 200 models, right?

The students are not ready to use Matlab or any complicated programming, so we cannot teach the DSGEs yet. We must teach them with the toy models.

If I have to teach undergrads or to explain something to my mother or to my friends, I think using an ISLM with two interest rates plus a Phillips Curve is the best way to talk about most of the issues that are relevant today.

B: Yes, it’s different. As you may know, the 5th edition was published before the crisis and the 7th edition is published this year, so there are several major changes.

The first change is that I have introduced a financial sector in the basic model.

Traditionally, the ISLM only has one interest rate, which is the rate set by the central bank. It is the same rate in the LM and the IS curve. That’s clearly not right.

A lot of what happened in the financial crisis is that even if the central bank lowered the policy rate, the rate relevant to investment decisions turned out to be a very different and much higher rate.

So, I think it is very important to have two rates, one determined by the central bank, and another which is relevant for people and firms when they borrow. This is a way to introduce the financial system.

If the financial system is in good shape, the two rates tend to be close; if it is not, the two rates can be quite different.

The second change is in the LM curve. The old LM curve was derived on the assumption that the central bank chooses the money supply, and then the interest rate is determined by the market.

It is clearly not true. Nowadays, the central banks choose the rate. So, that’s how we should think about the LM curve, which is at the rate chosen by the central bank.

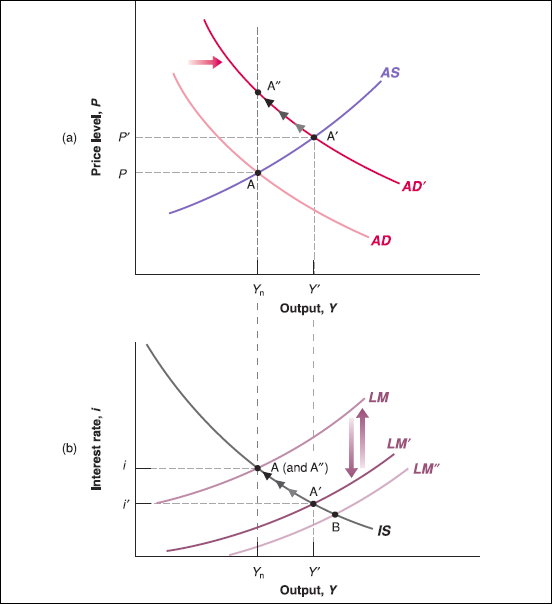

The third change is that I have given up on Aggregate Supply and Demand model (ASAD). It is because ASAD was quite complicated. It is not great from the point of view of being a toy model. Also, ASAD is misleading as it has the very strong message that even if no economic policy is implemented, the economy will return to the equilibrium all by itself.

As I have written in the 5th edition, if there was an adverse shock in the ASAD model, the price level would decrease, then real money supply would increase, this lowered the interest rate, which would have pushed the economy right back to its potential output level.

This mechanism is more or less irrelevant now. Economies do not return to health all by themselves, central banks do not keep the nominal money supply constant.

(The figure is an illustration of a reserved example which starts with a positive shock on demand. The figure is from “Macroeconomics:A European perspective” by Olivier Blanchard, Alessia Amighini, Francesco Giavazzi.)

So I gave up on AS, instead, I use the Phillips Curve as a description of the supply side. It gives a much more realistic description of what happens.

What do you think about FTPL?

Q: In my previous interview, Professor John Cochrane mentioned that he thought that Fiscal Theory of Price Level (FTPL) may be the missing link of New Keynesian model. What do you think about the FTPL’s prospect in incorporating in mainstream models?

B: I don’t believe it. It would take a long time to explain, but I don’t find FTPL to be an attractive theory of determination of the price level.

I believe however that the issue of the fiscal dominance of monetary policy is an important one. There are many countries where fiscal policy determines monetary policy. If the ministry of finance is very powerful, it can force the central bank to monetize their bonds. But this is a very different story from John’s fiscal theory of the price level.

The Problem of Hysteresis and Where to find it

Q: Federal Reserve Chair Janet Yellen, in her recent speech “Macroeconomic Research After the Crisis” , suggested four research topics macro researchers should work on. One of which, the problem of hysteresis, is a research topic you have been working on in recent years.

Explainer: What is Hysteresis?

Hysteresis is referred to the hypothesis that recessions may have permanent effects on the level of output relative to trend.

In a recent research “Inflation and Activity – Two Explorations and their Monetary Policy Implications”, Blanchard, Larry Summers and Eugenio Cerutti presented a strong case for the existence of hysteresis. Based on the data from 1960 in 23 advanced economies, the authors found that two-thirds of the recessions in the dataset are followed by lower output relative to the pre-recession trend, and almost one-half of those are followed not only by lower out but also by lower output growth relative to the pre-recession trend. The authors suggested this result could have important implications for monetary policy.

In her speech “Macroeconomic Research After the Crisis”, Janet Yellen said that if we assume that hysteresis is, in fact, present, it may imply there are possibilities that policymakers can temporarily run a “high-pressure economy” to reserve the adverse supply-side effects caused by hysteresis. For example, Yellen postulated that running a “high-pressure economy” may result in a tight labor market and draw in potential workers who would otherwise sit on the sidelines to the labor force, and lead to a more efficient job market.

B: For the moment, it is just a hypothesis. Therefore, I think the way policymaker should deal with it is to assume it’s true, say, with a probability of 20%, but not with 100% probability, and then decide what should the policy be. For the moment, that’s what they should do.

In terms of academic research, I am actually doing more research on this topic. I think when we look at topics like this, we should look at the micro evidence.

There are interesting works on how, for example, long-term unemployed people drop out of the labor force. There is also some very interesting research on what happens to research and developments during the recessions. But I don’t think we will ever be sure.

I hope that I can convince few more people that it is important. Maybe, I can get the 20% to become 50%, in a few years’ time.

Q: Why economists are so hard to convince that there is hysteresis? I think it is very intuitive to laymen to believe that unemployment has long-term effect on the economy.

B: Let’s say, for example, people commit suicide as the result of being unemployed, that’s hysteresis, right? We know in fact some people commit suicide, so it clearly is the case, right?

But the important question for macroeconomists is how quantitatively important that is. One suicide is one big individual tragedy. Yet if it is just one, it doesn’t matter from the macroeconomics point of view, right?

So, the important thing is to show how big the effect is. How reliable is it? What type is it? Is it the case that they only exist in recessions? Or they also exist in booms? Is it asymmetrical? All these are the things that we don’t know.

>>> You can follow EconReporter via Bluesky or Google News