Hysteresis is referred to the hypothesis that recessions may have permanent effects on the level of output relative to trend.

In a 2015 IMF working paper “Inflation and Activity – Two Explorations and their Monetary Policy Implications”, Olivier Blanchard, Larry Summers, and Eugenio Cerutti presented a strong case for the existence of hysteresis.

Based on the data in 23 advanced economies from 1960 to 2010, the authors found that two-thirds of the recessions in the dataset are followed by lower output relative to the pre-recession trend, and almost one-half of those are followed not only by lower output but also by subdued output growth relative to the pre-recession trend.

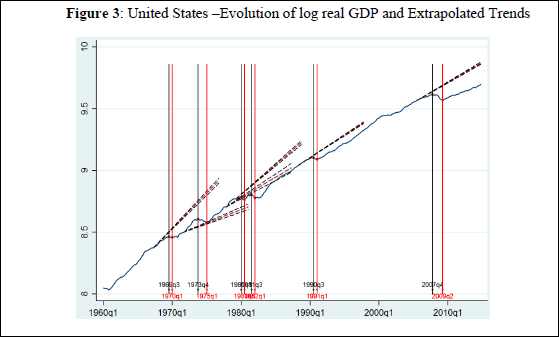

Here is the growth of the US economy, the black dashed lines are the growth trend before the recession hit, and the blue line is the realized real GDP growth. We can see that it is quite often the dashed line is above the blue line, an indication of a longer-term impact of the recessions.

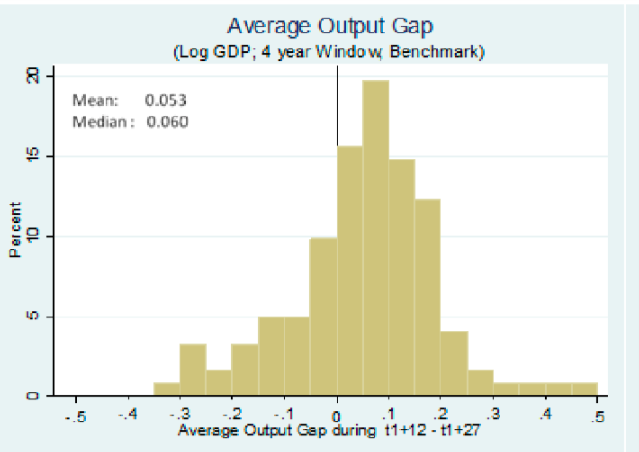

They also try to use the output gap, defined as the difference between the estimated trend growth rate and the realized growth rate, to measure the impact of hysteresis. Below are the distributions of the post-recession output gaps, i.e., the average output gaps from three to seven years after the recession. We can see that the mean and median of the distribution are positive, which means, on average, the output is lower than the pre-recession trend.

In sum, the three economists found that in only 31% of cases, the recession was not followed by a sustained output gap. Equivalently, in 69% of the cases, the recession was followed by a sustained gap. And, in 47% of these sustained-gap cases (33% of all the cases), the recession was followed by an increasing gap, which might indicate a worsening effect of the recession.

But are all output gaps the result of hysteresis? There is an alternative explanation for the output gaps. First, supply shocks may be behind both the recession and the lower output later. For example, if real wages are sticky in the short run, an increase in oil prices may lead to a sharp initial recession and, unless long-run labor supply is entirely inelastic, lower employment and lower output later.

Thus, the three researchers separate those recessions associated with an increase in inflation and those associated with a decrease in inflation. The reason is straightforward – recessions associated with supply shocks are more likely to experience an increase in inflation after the downturn, vice versa.

The results are that recessions associated with increasing inflation are more likely to show a sustained gap, with a frequency of 72%, compared with 63% for those associated with decreasing inflation. Meanwhile, for those recessions associated with decreasing inflation, and thus more likely to be due to demand shocks, the proportion of recessions followed by lower output is still 63%.

The fact that almost two-thirds of the recessions associated with decreasing inflation (and thus with demand shocks) are associated with a sustained output gap suggests a hysteresis effect.

But in an interview with EconReporter, Blanchard cautioned that policymakers, when approaching hysteresis, should assume that “it’s true, say, with a probability of 20%, but not with 100% probability, and then decide what should the policy be. For the moment, that’s what they should do.”

Why would he encourages such a conservative approach, even though in laymen’s view it is intuitive to think that recessions have a long-term negative effect on the economy and the workers?

“Let’s say, for example, people commit suicide as the result of being unemployed, that’s hysteresis, right? We know in fact some people commit suicide, so it clearly is the case, right But the important question for macroeconomists is how quantitatively important that is. One suicide is one big individual tragedy. Yet if it is just one, it doesn’t matter from the macroeconomics point of view, right?” Blanchard explained.

“So, the important thing is to show how big the effect is. How reliable is it? What type is it? Is it the case that they only exist in recessions? Or they also exist in booms? Is it asymmetrical? All these are the things that we don’t know.”

[Traditional Chinese version of the article can be found here]

>>> You can follow EconReporter via Bluesky or Google News